Browsing: on-chain analysis

The **1011 Insider Whale** has recently made headlines by transferring a staggering 10,000 ETH to the Binance deposit address linked to Yi Lihua, reigniting conversations within the crypto community.On-chain analysis, conducted by the keen analyst Ai Yi, reveals that this significant transaction was quickly followed by an Aave withdrawal of 55,000 ETH, indicating a strategic movement of assets.

Binance whale activity has recently captured the attention of the cryptocurrency community as significant transactions unfold on the platform.An on-chain analysis by expert Ai Yi reveals that a massive deposit of 69.08 million USDT was made into Binance from a wallet linked to Yilihua.

In recent developments, Multicoin transfers have been making waves in the cryptocurrency space.In just the past 24 hours, addresses linked to Multicoin have sent a staggering 440,000 JITOSOL to prominent platforms like FalconX and Galaxy Digital.

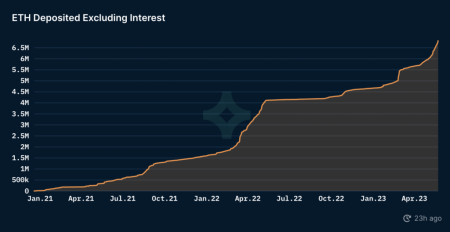

The recent ETH deposit made by Trend Research, guided by Yili Hua, has captured the attention of the crypto community.With an impressive 30,000 ETH added to Binance, valued at an astounding 58.18 million USD, this transaction highlights significant movements within the Ethereum ecosystem.

The 1inch team investment fund has recently made headlines as it withdrew a staggering 58.66 million 1INCH tokens from Binance over the past three months, totaling an impressive $5.53 million.On-chain analyst Yu Jin uncovered that just two hours ago, the fund executed another significant withdrawal of 20 million 1INCH, worth around $1.86 million.

Trend Research ETH liquidation has emerged as a focal point in the cryptocurrency market, especially following the sale of 47,000 ETH worth nearly $89.29 million in a frantic attempt to avert potential liquidation.Recent insights from on-chain analysis indicate that this strategic move was prompted by the evolving ETH price analysis, with the critical liquidation range currently pegged between $1509 and $1800.

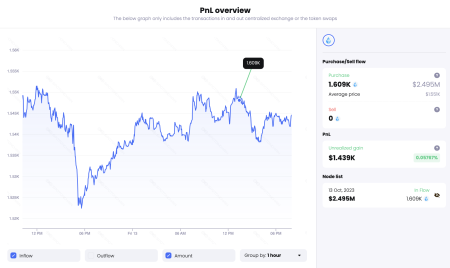

In the latest ETH investment news, significant movements in the Ethereum market have been highlighted by Lookonchain monitoring.Recently, a collective known as the “7 Siblings” made headlines by acquiring 1,994.98 ETH at an average price of $2,070.31, amounting to an impressive total of $4.13 million.

HYPE price analysis is critical for investors navigating the volatile landscape of cryptocurrency markets.Recent developments indicate a significant accumulation of HYPE cryptocurrency, as a particular address amassed 7 million USD worth within just 12 hours.

SOL short positions have recently captured the attention of traders and analysts alike, especially with the notable price drop of SOL to $90.This remarkable market shift has allowed a prominent whale investor to amass substantial paper profits exceeding $30 million through strategic shorting.

Whale liquidation has recently taken center stage in the crypto community, as a massive sell-off shook the market.In just four days, a well-known whale liquidated 96,585 ETH and 334,000 SOL, incurring a staggering loss of $141 million.