Browsing: Market Volatility

Real-time analysis of crypto market volatility and price swings. Stay informed with AI-driven market insights on BPayNews.

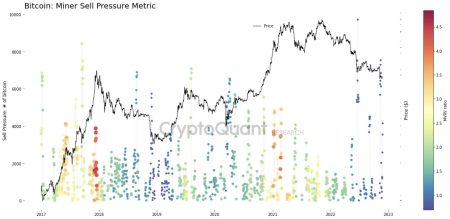

Bitcoin selling pressure has become a pivotal theme in discussions surrounding the cryptocurrency market, revealing the potential for significant price adjustments.Recent reports indicate that hefty sales from Bitcoin spot ETFs, coupled with forced liquidations due to abrupt price drops, are contributing to heightened market volatility.

Bitcoin price analysis is an essential tool for investors seeking to navigate the complex landscape of cryptocurrency trading.Recently, Bitcoin surged an impressive 15%, pushing its price above the $70,000 mark, yet the Bitcoin options market hints at a potentially precarious new floor beneath this level.

The recent decline in the OP token price has raised eyebrows among investors, especially after the approval of Optimism’s buyback plan.Despite this seemingly positive development, the token’s value has plummeted by approximately 8.8% in just 24 hours, reflecting a broader trend of risk-off sentiment affecting high-beta altcoins within the volatile crypto market.

Cryptocurrency trading has emerged as an exciting yet challenging arena for investors aiming to capitalize on market volatility and fluctuating prices.Understanding the intricacies of digital currencies, such as Bitcoin and Ethereum, is crucial for devising effective investment strategies.

As the markets hold their breath in anticipation of the Fed’s rate cut decision, all eyes are on Chairman Jerome Powell’s forthcoming guidance.The impact of this pivotal monetary policy move on the cryptocurrency market is significant, especially as Bitcoin price hovers near $90,000.

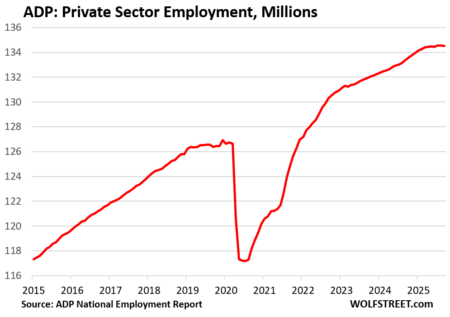

The ADP employment numbers, set to be released tonight, play a crucial role in assessing the health of the job market amid the absence of this week’s non-farm payroll report.As we approach the Federal Reserve’s interest rate meeting next week, these figures may provide invaluable job market insights that could impact monetary policy decisions.

The Bitcoin Lending Business is carving out a niche in the financial landscape, particularly as companies like Strategy explore innovative ways to leverage their digital assets.With a reserve fund of $1.4 billion, Strategy CEO Phong Le has highlighted the potential of BTC lending as a strategic move to alleviate the pressures of market volatility.

Information asymmetry in digital assets is an increasingly critical concern as the market matures.As highlighted by Shane Molidor, the founder of blockchain consulting firm Forgd, this issue is becoming prevalent not only in traditional token markets but also within institutional products like Digital Asset Trusts (DAT).

Stablecoins minting has emerged as a crucial process in the cryptocurrency market, particularly in times of volatility.This process allows entities like Tether USDT and Circle USDC to provide a stable financial instrument that investors can rely on during turbulent market conditions.

Arthur Hayes, the co-founder of BitMEX, recently made headlines with a bold statement on X, exclaiming, “I’m out.Send this dogshit to ZERO!