Browsing: market sentiment

Nvidia earnings Nvidia’s strong earnings have positively influenced market sentiment, while recent Federal Reserve minutes reveal increasing divisions that raise questions about a potential rate cut in December. Investors reacted favorably to Nvidia’s performance, which… (via Bpaynews real-time desk)

The US economy is currently in a phase closer to late cycle than to a recession, according to QCP. This assessment highlights the importance of upcoming economic data. The data released this week will play… (via Bpaynews real-time desk)

coin price The price of a cryptocurrency continues to decline despite significant anticipation and ongoing positive news surrounding it. This puzzling trend raises questions among investors and market observers alike. Many enthusiasts expected that the…

The Crypto Fear & Greed Index has increased to 15, indicating a persistent state of “Extreme Fear” in the market. Despite this rise, investor sentiment remains low. The index is a gauge used to assess…

HBAR has declined by 6% to a value of $0.144, driven by a significant technical breakdown. Market analysts are observing this downward trend closely. The recent price movement indicates a potential shift in market sentiment.…

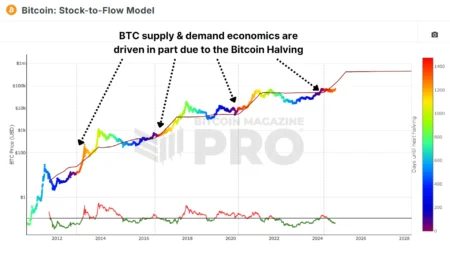

A shift in Bitcoin’s demand structure is influencing its cycle behavior. This change is altering how participants interact with the cryptocurrency market. Analysts suggest that the current dynamics are significantly different from previous cycles, impacting… (via Bpaynews real-time desk)

The Fear and Greed Index today stands at 11, reflecting a situation categorized as “Extreme Fear.” This level suggests a significant downturn in market sentiment. Investors often interpret such a low reading as a sign…

Bitcoin crash Bitcoin has fallen below $90,000, prompting a wave of extreme fear among investors, driven by the emergence of a death cross pattern. This technical indicator typically signals a potential downward trend in the… (via Bpaynews real-time desk)

The nominal trading volume on a mainstream prediction platform has nearly reached $3 billion over the past week. This significant trading activity indicates a robust engagement from users. The platform has seen increased participation, reflecting…

Market sentiment continues to indicate “Extreme Fear,” as reflected in the latest Fear and Greed Index, which stands at 14. This rating suggests pervasive anxiety among investors and participants in the market. The Fear and…