Browsing: market sentiment

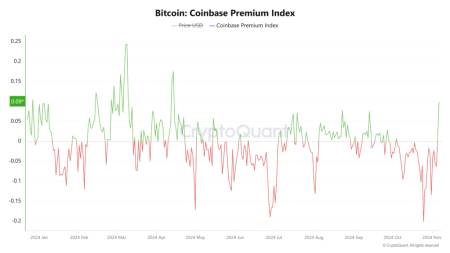

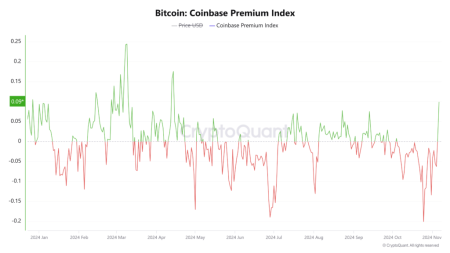

The Coinbase Bitcoin Premium Index serves as a significant barometer of Bitcoin pricing trends, reflecting the disparity between Bitcoin rates on Coinbase and the global market average.Recently, this index has been notably negative for 25 consecutive days, highlighting a concerning trend in market sentiment.

The Coinbase Bitcoin Premium Index has recently garnered attention as it enters its 23rd consecutive day in negative premium, currently recorded at -0.0878%.This notable drop indicates fluctuating Bitcoin prices and highlights a significant shift in market sentiment affecting crypto trading dynamics.

Crypto sentiment has recently shifted, moving away from the oppressive ‘extreme fear’ zone that has characterized market perceptions for far too long.As Bitcoin hovers near $88,738, the prevailing crypto market sentiment shows signs of improvement, transitioning to a ‘fear’ score of 29—a notable high not seen in 21 days.

The Bitcoin Greed and Fear Index indicates a state of extreme pessimism, suggesting that a tactical bottom may be found in the cryptocurrency market. Analysts are closely monitoring this index as it often signals market… (via Bpaynews real-time desk)

US stocks opened slightly higher, reflecting a modest increase in market sentiment. Investors are observing the performance of various sectors as trading begins. Crypto-related stocks showed mixed results, indicating varying investor confidence in the digital…

Market sentiment has fallen to levels not seen in nearly a decade, according to Matrixport, reflecting significant concerns among investors. The current sell-off is attributed to persistent macroeconomic pressures that continue to impact market dynamics.…

The “30-Time Longing Whale” has successfully ended its losing streak with an opening trade that generated approximately $400,000 in profits. This positive turn comes after a challenging period for the investment. The recent trade marks…

Bitcoin support Market sentiment among traders remains bearish, with particular attention on Bitcoin’s critical support level at $90,000. Analysts are closely monitoring this threshold as it could indicate future price movements. The prevailing sentiment suggests… (via Bpaynews real-time desk)

Market sentiment has declined once more, with the Fear and Greed Index dropping to a low of 11. This decline reflects growing concerns among investors regarding market conditions. The Fear and Greed Index is a… (via Bpaynews real-time desk)

ZEC has surpassed the $685 mark, experiencing a rebound of about 24% from its recent local low. This significant recovery comes after a period of decline. The rise in value indicates a potential shift in…