Browsing: interest rates

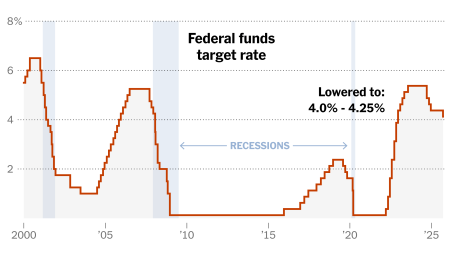

The anticipation surrounding a potential Federal Reserve rate cut has captured the attention of investors and economists alike.As the nation braces for the upcoming Federal Reserve meeting, discussions about the implications of an interest rate decision remain at the forefront of economic policy debates.

Federal Reserve Meeting Minutes play a crucial role in understanding the central bank’s approach to interest rates and monetary policy.These minutes reveal insights into the discussions among Federal Reserve officials, providing a glimpse into their thoughts on potential rate cuts and the economic landscape.

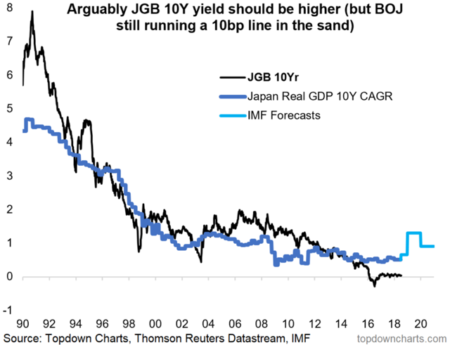

The Japan 10-year government bond yield has recently climbed to an impressive 1.94%, marking its highest point since July 2007.This notable increase in Japanese bond yields signals a pivotal change within the national economy, prompting a reaction from global investors who are keenly observing these developments.

In the world of finance, the recent buzz surrounding the Hassett Federal Reserve has captured the attention of both investors and policymakers alike.As speculation mounts about potential interest rate cuts, bond market analysts are increasingly concerned that economic decisions may veer into politically motivated territory.

Federal Reserve rate cuts are a pivotal topic in today’s economic climate, as the central bank grapples with conflicting voices among its policymakers.Amid fluctuating economic indicators, the Federal Reserve’s decisions on interest rates are paramount for shaping monetary policy, yet they could generate dissent within the Federal Open Market Committee (FOMC).

Federal Reserve official Lael Brainard indicated that a further interest rate cut in December is improbable. She emphasized the importance of evaluating economic conditions before making such decisions. Brainard noted that the central bank remains…

Federal Reserve official Collins indicated that maintaining the current interest rates is the appropriate course of action. She emphasized the importance of assessing economic conditions before making any alterations. Collins noted that stability in interest…

Bitunix analysts report that recent Non-Farm Payrolls data presents mixed signals, contributing to a pause in interest rate decisions and a subsequent decline in Bitcoin prices. The Non-Farm Payrolls data has shown varied results, indicating… (via Bpaynews real-time desk)

JPMorgan Chase has adjusted its outlook, stating that it no longer anticipates the Federal Reserve will lower interest rates in December. This change reflects a shift in the bank’s economic predictions regarding the central bank’s…

interest rate cuts An analyst anticipates that next year, following the appointment of the new Federal Reserve Chair, there will be four cuts to interest rates. This forecast suggests a shift in monetary policy as…