Browsing: institutional investors Bitcoin

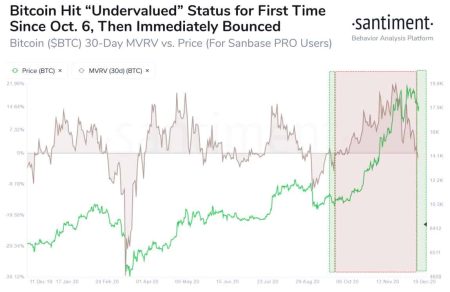

Bitcoin has been identified as undervalued by a significant majority of institutional investors, presenting a compelling opportunity for savvy traders and long-term holders alike.Despite its current valuation at approximately $87,600—over 30% down from its all-time high of $126,080—many analysts are confident that Bitcoin could rebound to a price range of $85,000 to $95,000.

Bitcoin undervaluation is a hot topic among institutional investors, especially as recent reports suggest that a vast majority perceive its current market price as significantly lower than its true worth.According to Coinbase’s latest survey, approximately 70% of institutional investors believe Bitcoin is undervalued, with optimal pricing estimated between $85,000 and $95,000.

Institutional Investors Bitcoin have become a focal point for many analysts and enthusiasts alike, especially with discussions surrounding their potential impact on the cryptocurrency market.As the Bitcoin price prediction adjusts amidst varying market dynamics, the role of institutional investment in Bitcoin is under scrutiny.

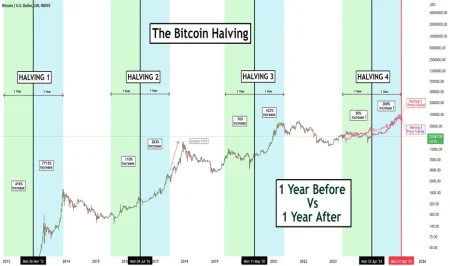

The Bitcoin halving cycle is a pivotal event in the cryptocurrency ecosystem, occurring approximately every four years and fundamentally impacting Bitcoin’s supply and market dynamics.Historically, these halvings have led to significant price increases, capturing the attention of both retail and institutional investors, who recognize their potential to shape Bitcoin market trends.

Bitcoin ETFs have become a hot topic in the investment world, particularly as recent data reveals a staggering outflow of $194.6 million, marking the highest returns in two weeks.This sharp decline raises questions about the behavior of institutional investors as they navigate the complexities of the Bitcoin market analysis.