Browsing: index

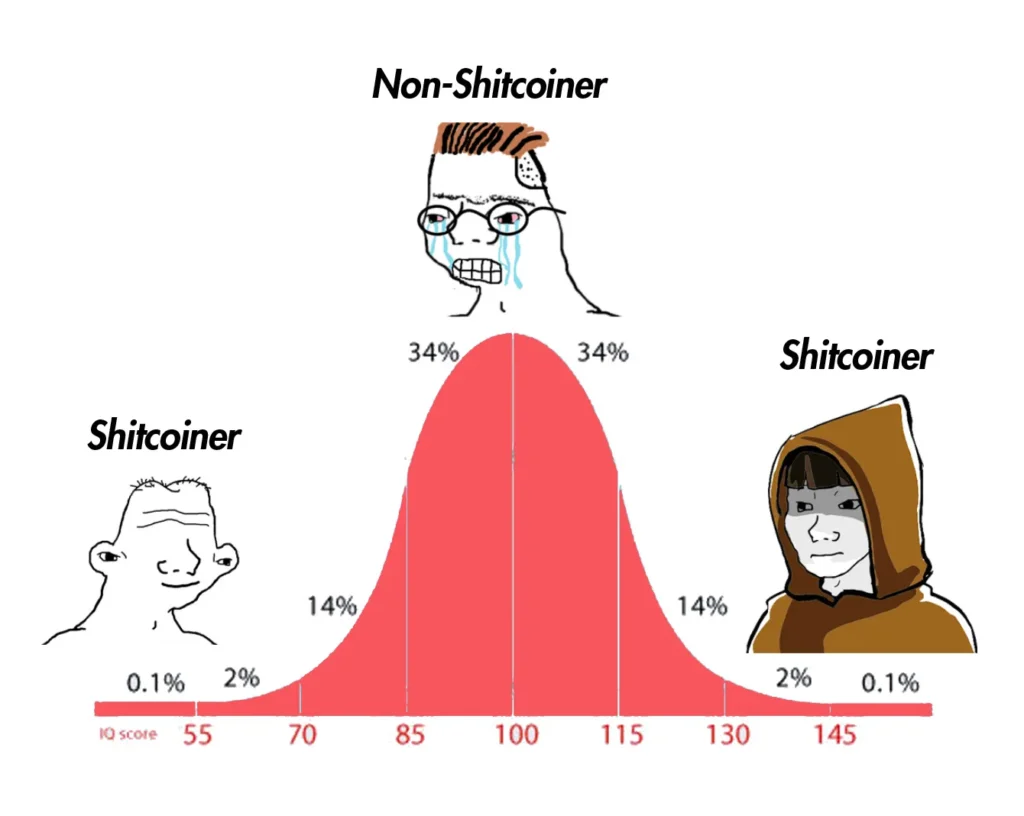

The Shitcoin Season Index has risen to 30, indicating a notable trend in the cryptocurrency market. This rise suggests increased speculation surrounding lesser-known digital currencies. Investors and analysts may interpret this uptick as an opportunity…

Crypto Fear Index Hits 15, Analysts Call for Patience: Navigating the Volatile Landscape of Cryptocurrency Markets In the latest downturn of the cryptocurrency market, the Crypto Fear and Greed Index has plummeted to a dismal…

Bitcoin Cash (BCH) experienced a gain of 4.1%, contributing to an overall increase in the CoinDesk 20 index. This performance reflects the cryptocurrency’s positive momentum in the market. The CoinDesk 20 index tracks the performance… (via Bpaynews real-time desk)

The Bitcoin Investor Confidence Index has reportedly fallen into a low range, indicating a decrease in investor sentiment towards the cryptocurrency. Analysts suggest that this decline reflects growing concerns among investors regarding market stability and… (via Bpaynews real-time desk)

UBS forecasts that the S&P 500 Index will rise to 7500 in the coming year. This projection reflects the firm’s outlook on market trends and economic conditions. Analysts at UBS believe that various factors will…

The Shitcoin Season Index has increased, now standing at 28. This rise indicates a noticeable shift in the market’s sentiment toward lesser-known cryptocurrencies. Analysts often use the Shitcoin Season Index to gauge the performance of…

Aave has decreased by 3.5% as the CoinDesk 20 Index experiences a decline. The performance of Aave is reflective of broader market trends impacting the cryptocurrency sector. The CoinDesk 20 Index, which tracks the top…

The CoinDesk 20 index experienced an increase, primarily driven by SUI’s notable gain of 9.6%. This performance reflects a positive trend within the cryptocurrency market. SUI’s rise contributed significantly to the overall index movement, showcasing…

The Shitcoin Season Index has risen to 32, indicating a potential shift in market dynamics. This index reflects the growing…

An option trader predicts that the S&P 500 Index will remain around 7000 by the end of the year. The…