Browsing: gold price

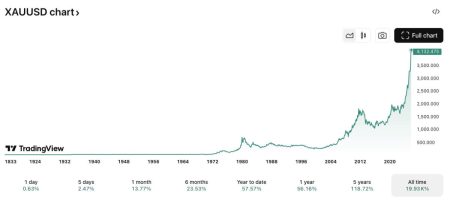

In a remarkable turn of events, the recent XAUT purchase on January 24, 2026, has caught the attention of cryptocurrency enthusiasts worldwide.With the gold price soaring above $5,000, an address recorded by Lookonchain made headlines by acquiring 843 XAUT, amounting to a substantial $4.17 million.

As of today, the gold price has reached an astonishing $4980 per ounce, marking a historic high in the precious metals market.Investors are keenly observing gold market trends as they reflect broader economic fluctuations, making the current gold price a focal point for financial discussions.

In recent market developments, the gold price has surged past $4,230 per ounce, reflecting an increase of 0.61% for the day.Investors and analysts are keeping a keen eye on the current gold price as it influences various financial decisions.

Following the Federal Reserve’s announcement regarding interest rates, the spot gold price experienced a brief decline, reaching $3979.9 per ounce.…

The spot gold price has risen to $3980 per ounce, reflecting a 0.69% increase during the trading session. This uptick…

Morgan Stanley forecasts that the average price of gold will surpass $5,000 in 2026, with a long-term outlook suggesting it…

JP Morgan has expressed optimism regarding the price of gold, predicting it could reach $6,000 per ounce by the year…

JPMorgan has expressed optimism regarding gold prices, predicting they could reach $6,000 by the year 2028. The investment bank’s analysts…

A market analyst has noted that the US government shutdown and rising geopolitical tensions have pushed gold prices back above…

Bitcoin market volatility Bitcoin’s recent rally has reversed as gold prices have seen an 8% pullback, prompting speculation about the…