Browsing: financial markets

Tokenized money market funds, such as Circle’s USYC, combine blockchain-based liquidity with institutional yield, providing new opportunities for capital management in today’s financial markets. These funds are designed to offer investors a way to access…

Hong Kong’s Securities and Futures Commission is advising licensed institutions to enhance their monitoring systems to detect and prevent potential layering transactions related to anti-money laundering. The Commission emphasizes the importance of robust measures to…

Tom Lee stated that market makers may need six to eight weeks to address existing liquidity gaps. This timeframe is essential for stabilizing market conditions. Lee emphasized the importance of liquidity in the financial markets,…

The issuance of global exchange-traded funds (ETFs) has seen significant growth, highlighted by the listing of 15 new cryptocurrency ETFs in October. This surge reflects an increasing interest in cryptocurrency investment options among traders and…

The founder of Real Vision suggests that the U.S. government’s restart will initiate a series of liquidity tailwinds in the financial markets. This perspective highlights the potential impact of government actions on market dynamics. The… (via Bpaynews real-time desk)

The competition for the Federal Reserve chair position is intensifying, with ‘Wall Street Waterfall’ emerging as a key theme in discussions. This phrase reflects the current sentiment in financial markets, highlighting concerns over economic stability.…

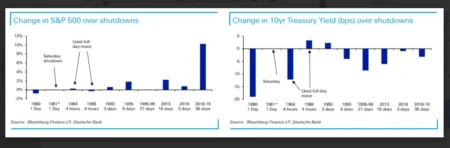

The recent government shutdown has concluded, coinciding with a period of data downtime and an increase in U.S. Treasury yields. The shutdown, which affected various government operations, has now been resolved, allowing federal agencies to… (via Bpaynews real-time desk)

The end of the government shutdown has not resolved uncertainties in financial markets, with the US Debt Volatility Index climbing to a one-month peak. This surge indicates persistent concerns among investors regarding debt stability and… (via Bpaynews real-time desk)

The US stock market’s three major indexes opened higher today, reflecting positive momentum in the financial markets. Investors are responding favorably to various economic indicators and trends. In addition to the stock market’s gains, crypto…

Federal Reserve official John Williams indicated that bond purchases are anticipated to commence shortly. This announcement comes as the Fed continues to navigate economic challenges. Williams emphasized the importance of these purchases in supporting the…