Browsing: Ethereum Price Prediction

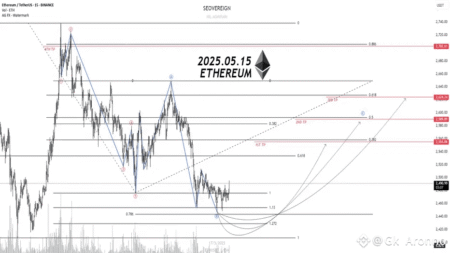

As of February 6, 2026, Ethereum price is currently hovering above $1,960, but recent market turbulence has sparked major concerns among investors.Just yesterday, ETH experienced a sharp decline, crashing to lows of $1,700, which reminds many of the volatile nature of cryptocurrency price trends.

In a notable turn of events, an Ethereum whale sells ETH, parting with a staggering 27,800 ETH to curb potential losses amid the current market fluctuations.This strategic move comes as the price of ETH reached $2050, prompting the whale to take decisive action to protect its assets.

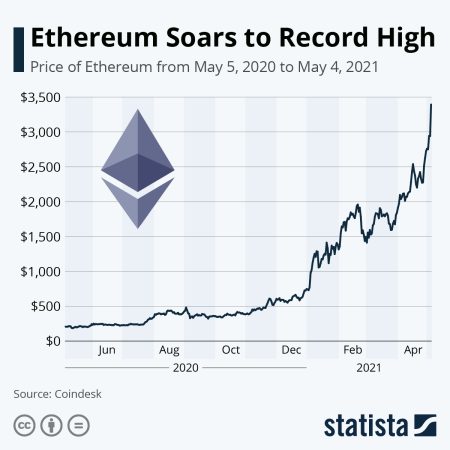

The recent Ethereum price drop has left many investors questioning the stability of the crypto market, especially as the price fell below the crucial $3,000 mark.Despite this downturn, significant ETH accumulation has been noted among crypto whales and institutional investors, who are seizing the opportunity to buy at lower prices.

When discussing Ethereum price prediction, the recent insights from financial experts are hard to ignore.Notably, Tom Lee has projected that Ethereum could soar to an astonishing $250,000, bringing considerable attention to the cryptocurrency market.

In the world of cryptocurrency, Ethereum price analysis remains a topic of great interest, especially among traders and investors keen to navigate its complexities.Over recent years, Ethereum has established itself not just as a digital currency but as a leading smart contract platform, driving the narrative of “Programmable Money” in the blockchain ecosystem.

Ethereum price prediction is a hot topic among cryptocurrency enthusiasts, especially as the digital asset recently surpassed the $3300 mark.Investors like Yi Li Hua have demonstrated that understanding ETH market analysis is crucial for navigating the highly volatile landscape of cryptocurrency investment.

An Ethereum long position, such as the one opened by Bitcoin OG with approximately 54,300 ETH at an average price of $3,048.31, reflects a bullish outlook on the cryptocurrency.With the potential for significant returns, savvy investors are increasingly turning to Ethereum, leveraging their investments to maximize profits through strategies that include 5x leverage trading.

Ethereum long positions are becoming increasingly popular among traders looking to capitalize on fluctuations in the ETH market.With varying strategies emerging, an effective Ethereum trading strategy is crucial for investors aiming to maximize their returns.

Ethereum options traders are demonstrating a more optimistic outlook compared to their Bitcoin counterparts, as recent data reveals a significant difference in market sentiment.This trend is supported by a decrease in bearish sentiment toward Ethereum, particularly after the successful launch of the Fusaka upgrade, which has bolstered Ethereum bullish sentiment in the crypto options market.

Brother Maji ETH Long Positions have recently captured the attention of the crypto trading community as this well-known investor dives deeper into Ethereum.With an impressive commitment of approximately 7.54 million USD in long positions, Brother Maji continues to navigate the challenges presented by the current market conditions.