Browsing: Ethereum ETFs

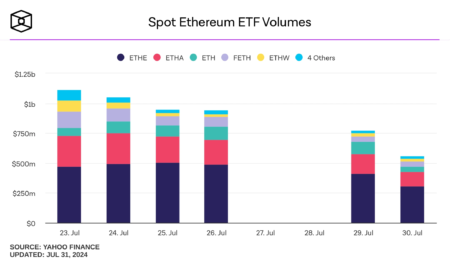

The Ethereum spot ETF has been making waves in the financial markets, particularly with significant net inflows and outflows reported recently.As of February 5, data indicates that while the Grayscale Ethereum Trust ETF experienced an impressive inflow of $7.0526 million, the Fidelity ETF FETH faced a substantial net outflow of $55.7826 million.

In a significant turn of events, the Ethereum spot ETF net outflow reached $79.4773 million yesterday, sparking discussions in the crypto investment community.BlackRock’s ETHA led the charge, experiencing an outflow of $58.948 million, a notable shift for one of the leading Ethereum ETFs.

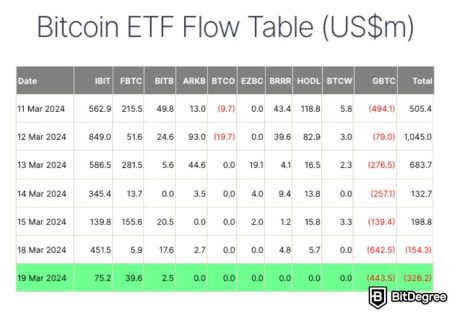

Bitcoin ETF outflows have surfaced, marking a notable shift following an explosive start to 2026.After drawing in more than $1.16 billion in net inflows during the first two trading days of the year, the latest data reveals a sudden exit of $243 million from Bitcoin exchange-traded funds.

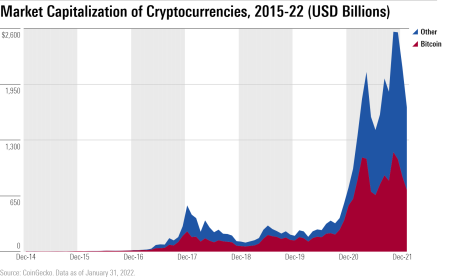

In the ever-evolving landscape of blockchain technology and innovation, understanding crypto market trends is crucial for investors and enthusiasts alike.As we dive into 2026, significant fluctuations are observed, particularly in Bitcoin analysis, where key moving averages signal potential turbulence ahead.

Ethereum spot ETFs are making headlines as the crypto market experiences significant fluctuations.Recently, these financial products saw a staggering net outflow of $72.0586 million, emphasizing the volatility within the Ethereum market.

Ethereum spot ETFs have emerged as a significant player in the cryptocurrency investment landscape, but recent trends indicate a troubling pattern of net outflows.Just yesterday, these investment vehicles saw a striking net outflow of $9.6308 million, marking the fourth consecutive day of losses.

Cryptocurrency ETFs represent a pioneering financial instrument that allows investors to gain exposure to the dynamic world of digital currencies without directly owning the underlying assets.As this innovative category of exchange-traded funds gains traction, we are witnessing a surge in interest particularly in Bitcoin ETFs and Ethereum ETFs, which are driving institutional cryptocurrency investment.

The analysis of Ethereum spot ETFs reveals some striking trends in the cryptocurrency market, notably a staggering net outflow of $75.2065 million reported yesterday.With none of the nine Ethereum ETFs experiencing any net inflows, this raises critical questions about the future of Ethereum investments and market sentiment.

Vanguard crypto ETFs are making headlines today as the investment giant signals a significant shift in financial landscape by allowing its brokerage clients to invest in cryptocurrencies.Traditionally known for its skepticism towards digital currencies, Vanguard’s decision to offer ETFs linked to Bitcoin, Ethereum, and XRP marks a pivotal moment for mainstream crypto adoption.

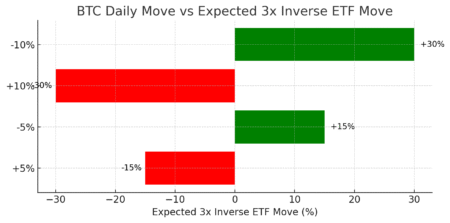

The launch of 3x leveraged Bitcoin and Ethereum ETFs marks a significant development in the world of exchange-traded products, particularly as Europe gears up for increased participation in the crypto market.These newly introduced leveraged crypto ETFs by LeverageShares are set to offer investors an opportunity to exponentially amplify their exposure to the volatile landscapes of Bitcoin and Ethereum.