Browsing: digital assets

News and insights on digital assets, tokenized markets, and blockchain innovation. Stay updated with BPayNews AI reports.

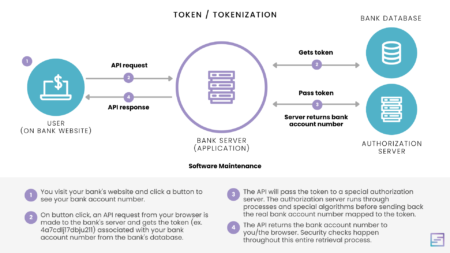

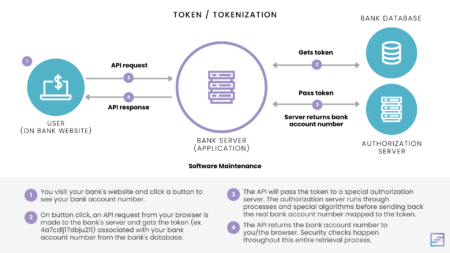

Tokenization, the process of creating digital representations of real-world assets, is gaining significant traction in the U.S.financial landscape.

In a significant move for blockchain security, Upbit has recently frozen approximately $1.77 million in damaged assets to safeguard digital assets and maintain trust within the crypto community.The asset freeze, reported by Odaily Planet Daily, follows the detection of suspicious fund movements, prompting the platform’s operator, Dunamu, to employ a sophisticated on-chain tracking system for further investigation.

Tokenization is revolutionizing the landscape of digital assets as it paves the way for innovative investment opportunities.By transforming physical assets into digital tokens on blockchain technology, tokenization enhances liquidity solutions for investors seeking diversification.

Harvard Bitcoin ETF investments are making headlines in the financial world, showcasing the prestigious university’s strategic pivot towards digital assets.With more Bitcoin ETFs in its portfolio than shares of tech giants like Google, Harvard is setting a remarkable precedent in the realm of cryptocurrency investments.

The Western Union stablecoin card represents a groundbreaking evolution in the realm of digital financial solutions.Designed specifically for remittance services, this innovative payment card supports stablecoin prepayments, ensuring users can maintain purchasing power in volatile economies.

Blockchain bank N3XT has emerged as a pivotal player in the fintech landscape, securing an impressive $72 million through three recent rounds of funding.This innovative institution, backed by notable investors including Paradigm, is set to redefine the way we approach blockchain investment and digital assets.

Tokenization is rapidly emerging as a transformative force in the realm of financial technology, with companies like BlackRock advocating for its potential to revolutionize market efficiency.By utilizing digital assets and blockchain technology, tokenization promises to streamline processes and widen access to various investment opportunities.

Tokenization in finance is revolutionizing the way we interact with assets and financial transactions, marking a significant transformation fueled by blockchain technology.With major players like BlackRock leading the charge, the ability to digitize assets opens new avenues for innovation in financial infrastructure.

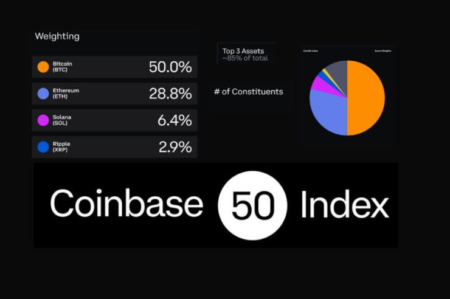

The Coinbase 50 Index (COIN50) is a pivotal tool for investors looking to navigate the rapidly evolving world of digital assets.Set to undergo adjustments in the fourth quarter of 2025, the index will introduce six new cryptocurrencies: Hedera Hashgraph (HBAR), Mantle (MANTLE), VeChain (VET), Flare (FLR), Sei (SEI), and Immutable X (IMX).

Sony stablecoin is making waves in the digital finance world as part of Sony Bank’s bold move to integrate Web3 payments into its ecosystem.This innovative US dollar stablecoin aims to create seamless transactions within Sony’s vast entertainment services, enhancing the user experience for gaming, anime, and more.