Browsing: digital assets

News and insights on digital assets, tokenized markets, and blockchain innovation. Stay updated with BPayNews AI reports.

The recent Bitcoin price decline has sent shockwaves through the cryptocurrency market, with the digital asset falling below $70,000 for the first time since late 2021.This steep drop echoes broader trends in the Bitcoin market, where volatility has become a familiar companion.

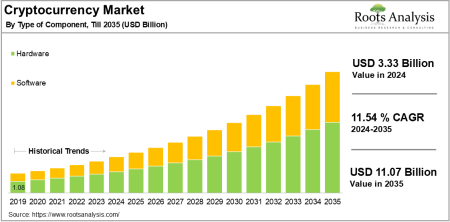

The crypto market 2026 is poised to be a watershed moment for the digital finance landscape, as industry leaders emphasize the need for robust financial infrastructure.Experts like André Casterman predict that the focus will move beyond just the adoption of cryptocurrency, shifting towards tangible frameworks that support the growth of digital assets.

In recent XAUT purchase news, seven addresses tied to a particular entity made headlines after acquiring a staggering 4,300 XAUT at an impressive price of $5,049 each.This collective investment totaled a remarkable $21.71 million, showcasing the increasing interest in cryptocurrency trading among high-profile investors.

The cryptocurrency market structure bill is at the forefront of legislative discussions, as U.S.lawmakers push for significant updates to how digital assets are regulated.

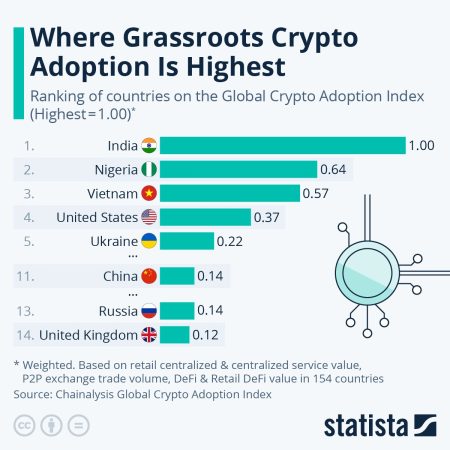

Cryptocurrency adoption is rapidly gaining momentum, demonstrating a significant shift in how institutions view and utilize digital assets.As highlighted in PwC’s “2026 Global Cryptocurrency Regulatory Report,” the moment has arrived when institutions are no longer debating the merits of cryptocurrency assets but are instead focused on the practicalities of their integration into the financial system.

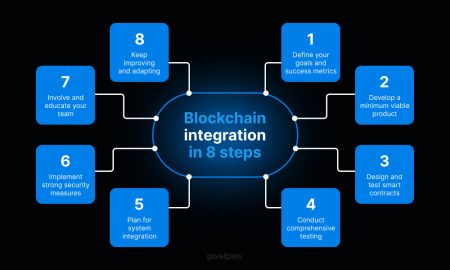

Blockchain integration is set to revolutionize the financial landscape as it becomes the foundational layer for modern finance.Ripple’s president, Monica Long, foresees a future where global balance sheets will hold over $1 trillion in digital assets, with many Fortune 500 companies embracing this shift.

Key Point

Details

Grant Cardone’s Investment

CEO of Cardone Capital, a real estate investment company.Investment Amount

Adding approximately $10 million in Bitcoin.

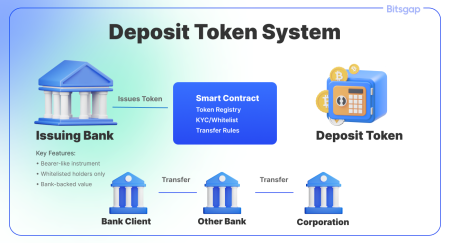

Tokenized deposits are emerging as a revolutionary development in the realm of blockchain finance, particularly for institutional clients.This innovative solution allows banks to issue digital assets that represent cash deposits on an in-house permissioned blockchain, enhancing liquidity and efficiency in capital markets.

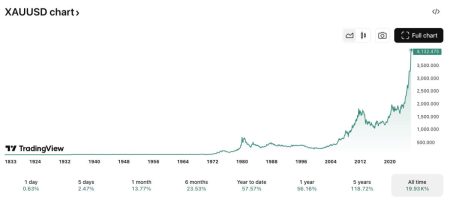

Tokenized Gold is emerging as a groundbreaking financial innovation that bridges traditional asset management with modern digital solutions.Standard Chartered is pioneering this space by introducing the revolutionary MG 999 fund in Singapore, aimed specifically at institutional investors seeking exposure to gold.

Crypto custody is becoming an essential focus within the evolving landscape of digital assets, as regulators and banking institutions grapple with its implications for innovation and stability.Recently, the Office of the Comptroller of the Currency (OCC) has emphasized that restricting national trust banks from engaging in crypto custody presents a “recipe for irrelevance.” This statement comes amidst a surge in interest regarding banking regulation and the role of stablecoins in the financial ecosystem.