Browsing: decentralized finance

AI Smart Contract Security is rapidly transforming the landscape of decentralized finance (DeFi), offering innovative solutions to combat the escalating threat of smart contract vulnerabilities.As the adoption of cryptocurrency continues to rise, so does the prevalence of DeFi exploits, exposing critical weaknesses in blockchain technology.

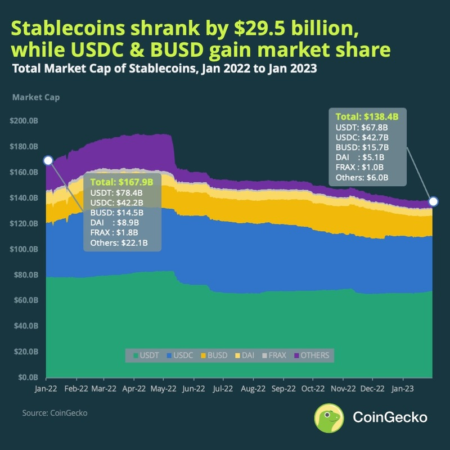

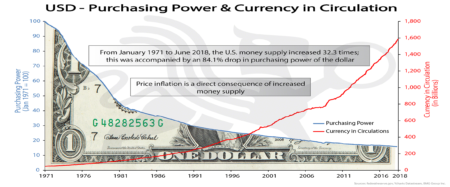

Stablecoins represent an innovative evolution in the cryptocurrency landscape, designed to provide stability in an otherwise volatile market.These digital assets are pegged to traditional currencies or commodities, enabling them to maintain a stable value, which makes them an attractive option for both peer-to-peer payments and decentralized finance (DeFi).

Trust Wallet prediction market is revolutionizing how users engage with decentralized finance, offering a dynamic platform for crypto enthusiasts to make informed bets on future events.With the rise of self-custodied wallets, Trust Wallet stands out by providing a secure and seamless experience for users looking to explore the thrilling world of crypto prediction markets.

The decentralized settlement platform is transforming the landscape of stablecoin trading, offering an innovative solution for users looking to engage in cryptocurrency transactions without traditional fees.Launched by the fintech innovator Unlimit, this platform, Stable.com, enables seamless trading of major stablecoins without incurring GAS commissions, making it a cost-effective choice for crypto traders.

The stablecoin market growth is capturing significant attention as its size skyrockets from a mere $4 billion in early 2020 to an astonishing $272 billion projected by October 2025.This rapid expansion highlights the shift of stablecoins from their initial role as crypto trading instruments to pivotal players in decentralized finance and cross-border payments, demonstrating their versatility in modern finance.

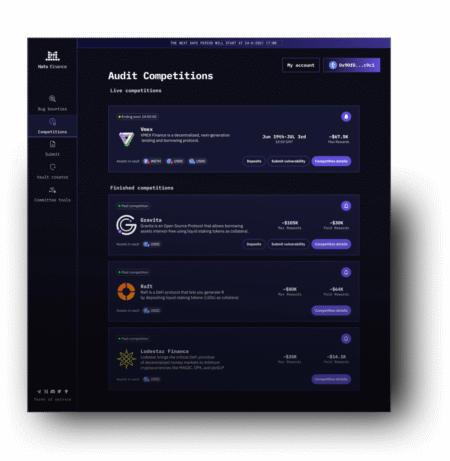

Hats Finance is making a significant shift in its operations as it prepares to cease its centralized custody front-end and server functions by December 31, 2025.This decision stems from the growing demand for decentralized finance solutions, making it clear that the traditional custody structure is no longer viable.

USDD circulation has officially exceeded $600 million, marking a historic milestone in the stablecoin market.This remarkable achievement highlights the growing trust and recognition of USDD as a leader in decentralized finance, contributing significantly to its ecological impact.

Aave’s founder has announced plans to relaunch ETHLend in 2026. This decision marks a significant step for the decentralized finance platform. ETHLend originally aimed to connect borrowers and lenders using cryptocurrency. The relaunch is intended… (via Bpaynews real-time desk)

DEX Protocol Revenue Mainstream decentralized exchange protocols have experienced a revenue surge, with Hyperliquid reporting $4.24 million in revenue over a 24-hour period. This marks a significant performance within the sector. The increased activity highlights…

R25 has launched rcUSD+, a yield-bearing token on Polygon, which aims to bridge traditional finance with decentralized finance through a collection of real-world assets. This innovative token represents a significant step in merging established financial…