Browsing: decentralized finance

In the evolving landscape of digital currencies, the native stablecoin is garnering significant attention as a driving force behind cryptocurrency adoption.CZ, on platform X, revealed that their team is actively collaborating with multiple countries to launch this innovative financial asset.

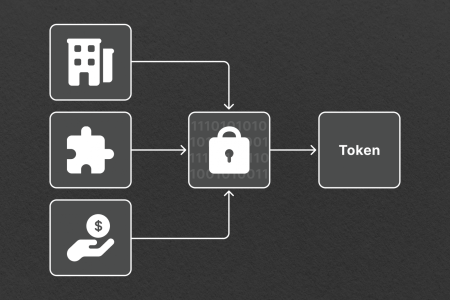

Tokenization is rapidly emerging as a revolutionary force in the financial landscape, especially in the context of digital currencies and decentralized finance.At the 2026 World Economic Forum, the topic sparked vibrant discussions, highlighting how tokenization can enhance financial inclusion by democratizing investment opportunities for a broader audience.

DeFi governance is at the forefront of discussions surrounding the future of decentralized finance, especially as U.S.lawmakers grapple with the implications of proposed cryptocurrency regulations.

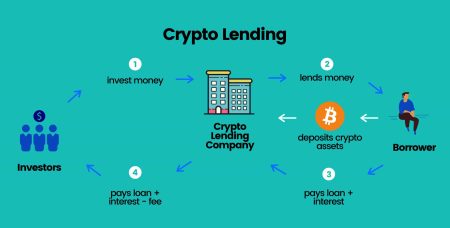

Crypto lending is revolutionizing the way individuals and businesses approach borrowing and lending in the ever-evolving landscape of decentralized finance (DeFi).This innovative model allows users to leverage their digital assets, such as Bitcoin and stablecoins, to unlock liquidity without selling their holdings.

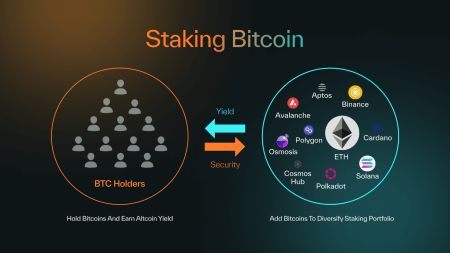

Bitcoin staking is rapidly gaining traction as a formidable way to maximize the potential of one of the most influential cryptocurrencies.This innovative approach allows users to actively engage in decentralized finance (DeFi) by utilizing their Bitcoin as collateral for lending, thus unlocking new financial opportunities within the blockchain ecosystem.

Crypto DAO is at the forefront of a revolutionary shift in the financial landscape, poised to officially launch global node subscriptions on December 10.This innovative organization embodies the principles of decentralized finance by transitioning trust from individual entities to mechanisms built on blockchain technology.

Tokenized equities are revolutionizing the landscape of traditional finance by allowing digital representations of shares to trade on blockchain platforms.Recent developments highlight the growing tension between traditional entities, like Citadel, and decentralized finance (DeFi) platforms, particularly in light of DeFi regulations and compliance standards.

The newly launched Chainlink ETF is making waves in the financial landscape, debuting with an impressive $64 million valuation courtesy of Grayscale.This exchange-traded fund represents a pivotal shift, giving institutional investors direct exposure to the Chainlink ecosystem via the LINK token, amidst the rise of tokenized finance and decentralized finance (DeFi).

VTB Bank cryptocurrency trading is set to transform the landscape of digital finance in Russia as the country prepares for evolving regulations.As the second-largest bank in Russia, VTB is on track to launch cryptocurrency trading services by 2026, which will allow clients to engage in direct cryptocurrency investment.

DeFi regulations are increasingly becoming a focal point in the ongoing conversation about the future of decentralized finance.Prominent figures like Uniswap founder Hayden Adams express concern over how traditional financial institutions are urging the U.S.