Browsing: crypto market sentiment

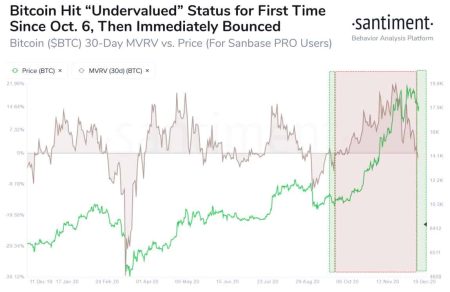

Bitcoin has been identified as undervalued by a significant majority of institutional investors, presenting a compelling opportunity for savvy traders and long-term holders alike.Despite its current valuation at approximately $87,600—over 30% down from its all-time high of $126,080—many analysts are confident that Bitcoin could rebound to a price range of $85,000 to $95,000.

Bitcoin undervaluation is a hot topic among institutional investors, especially as recent reports suggest that a vast majority perceive its current market price as significantly lower than its true worth.According to Coinbase’s latest survey, approximately 70% of institutional investors believe Bitcoin is undervalued, with optimal pricing estimated between $85,000 and $95,000.

Ethereum options trading has emerged as a pivotal strategy in the realm of cryptocurrency investing, particularly amidst the current Ethereum bearish trend.As traders analyze Ethereum price movements, the dynamics of options trading strategies become essential for navigating the crypto market sentiment.

As we navigate the complex landscape of cryptocurrency, the Bitcoin price forecast remains a hot topic for investors and enthusiasts alike.Recent analysis indicates that Bitcoin may experience a period of stagnation, described as a ‘boring sideways movement’, particularly in the early months of 2026.

As the FOMC meeting impact on Bitcoin looms on December 10, the cryptocurrency market’s sentiment is sharp and watchful.Matrixport reports that while Bitcoin’s price has found a temporary footing, an upward trend remains uncertain.

Bitcoin ETF inflows are making headlines as the cryptocurrency market experiences a remarkable turnaround, with inflows reported for five consecutive days as Bitcoin rises back above $93,000.This resurgence follows a disappointing period marked by significant outflows of $3.48 billion throughout November, highlighting a critical shift in market dynamics.