Browsing: crypto market downturn

Recent developments in Bitcoin mining have seen a notable drop in mining difficulty, decreasing by approximately 11.16%.This substantial decline marks the sharpest adjustment since the significant mining challenges triggered by the China crypto mining ban in 2021.

Bitcoin treasury losses have become a headline concern as the cryptocurrency’s value plummeted, hitting an alarming low of $60,233 before recovering to $65,443.This drop has significantly affected Bitcoin treasury companies, leading to unrealized losses topping nearly $10 billion across several major players holding more than 850,000 BTC.

The Bitcoin accumulation strategy has become increasingly prominent as investors seek stability amidst the volatile crypto market downturn.Even in these turbulent times, Metaplanet CEO Simon Gerovich remains unwavering in the company’s commitment to this strategy, emphasizing its importance for long-term growth.

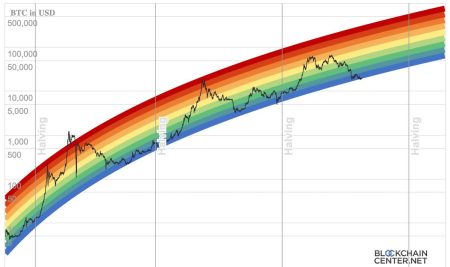

As interest in the cryptocurrency landscape ebbs and flows, understanding BTC price analysis has never been more critical for investors.Recent insights showcase a market performance that is undeniably weaker than that of the early 2022 bear market, with Bitcoin potentially heading towards a troubling price point of $60,000.

BitMine ETH losses have come to the forefront as the institution grapples with its staggering financial situation.Holding a colossal 4.28 million Ethereum, valued at over $8 billion at peak prices, BitMine now faces an alarming loss exceeding $7 billion amid a significant Ethereum price drop.

The recent crypto market downturn has sent shockwaves through the digital currency landscape, resulting in a staggering loss of approximately $100 billion.As Senate Democrats threaten a government shutdown over funding disputes, traders are reacting to the uncertainty with panic selling, which has been further exacerbated by declining Bitcoin prices.

In recent discussions about digital asset treasury (DAT) companies, Matt Hougan, the chief investment officer at Bitwise, emphasized that these firms are likely to struggle in maintaining any premiums over their underlying cryptocurrency holdings.This challenge is largely attributed to the operational costs and liquidity restrictions that impose significant pressure on their market valuations, especially in the midst of a crypto market downturn.

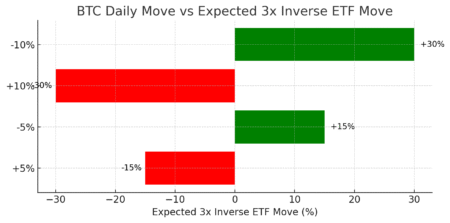

The launch of 3x leveraged Bitcoin and Ethereum ETFs marks a significant development in the world of exchange-traded products, particularly as Europe gears up for increased participation in the crypto market.These newly introduced leveraged crypto ETFs by LeverageShares are set to offer investors an opportunity to exponentially amplify their exposure to the volatile landscapes of Bitcoin and Ethereum.

crypto market downturn The crypto market is experiencing a notable downturn, with Bitcoin falling to $111,000 following the Federal Reserve’s…