Browsing: crypto investments

In a shocking turn of events today, Arthur Hayes liquidates DeFi tokens, leading to a staggering loss of $3.48 million.As reported by Yu Jin Monitoring, the former BitMEX CEO sold off four types of decentralized finance tokens he had initially purchased for a total of $9.35 million last December.

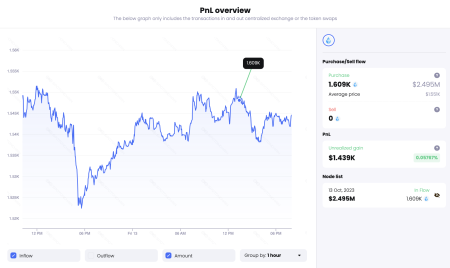

The 1inch team investment fund has recently made headlines as it withdrew a staggering 58.66 million 1INCH tokens from Binance over the past three months, totaling an impressive $5.53 million.On-chain analyst Yu Jin uncovered that just two hours ago, the fund executed another significant withdrawal of 20 million 1INCH, worth around $1.86 million.

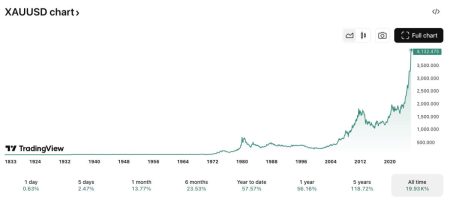

In recent XAUT purchase news, seven addresses tied to a particular entity made headlines after acquiring a staggering 4,300 XAUT at an impressive price of $5,049 each.This collective investment totaled a remarkable $21.71 million, showcasing the increasing interest in cryptocurrency trading among high-profile investors.

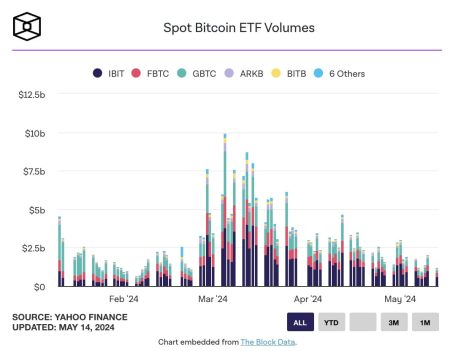

The Bitcoin Spot ETF has recently made headlines with a staggering net inflow of $471 million in just one day, showcasing its rising prominence within the cryptocurrency landscape.Leading this surge is BlackRock’s IBIT, which captured a remarkable $287 million, further solidifying its status in Bitcoin investments.

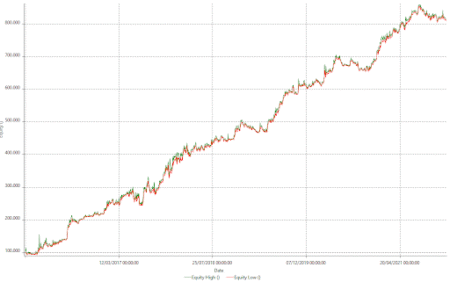

Brother Maji’s ETH long position has captured the attention of crypto investors as it currently stands valued at an astonishing 25 million USD.With an impressive leveraged trading strategy, Maji is utilizing 25x leverage to amplify his potential returns in the volatile world of Ethereum.

Ethereum purchase activity continues to capture the attention of the crypto community, particularly with recent happenings that underscore the vibrant nature of the blockchain ecosystem.In a notable transaction, an address acquired 2,226 ETH worth a staggering 6.95 million dollars, showcasing the robust demand for this digital currency.

Cryptocurrency stocks are becoming a pivotal segment in the U.S.stock market, reflecting a remarkable shift in investor focus toward digital assets.

The recent disclosure by Cantor Fitzgerald regarding its stake in the Solana ETF has marked a pivotal moment in the evolution of cryptocurrency investments.As the firm has officially reported its involvement with the Volatility Shares Solana ETF, we see institutions beginning to embrace exchange-traded funds linked to digital assets.

Altcoin portfolio losses have become a pressing concern for many crypto investors, as evidenced by a staggering unrealized loss of $4.06 million from a particular wallet address.This significant decline highlights the volatile nature of altcoin investments, where fluctuations can lead to substantial financial setbacks.

HYPE whale trading has taken the crypto community by storm, particularly as significant transactions have captured the attention of investors and analysts alike.Recently, a notable whale with profits exceeding $25.7 million made headlines by acquiring $6.9 million worth of HYPE tokens.