Browsing: CEX

A specific Whale Address has withdrawn 20,726 $ETH from a centralized exchange within the last two hours. This significant movement of Ethereum highlights ongoing activity in the cryptocurrency market. Whale addresses, which typically hold large… (via Bpaynews real-time desk)

The current funding rates for both centralized exchanges (CEX) and decentralized exchanges (DEX) suggest that the market has largely stabilized after a period of being oversold. This shift indicates a change in market sentiment, as… (via Bpaynews real-time desk)

The current funding rate of mainstream centralized exchanges (CEX) and decentralized exchanges (DEX) suggests a minor decrease in the bearish sentiment prevailing in the market. Market participants are closely monitoring these funding rates as indicators…

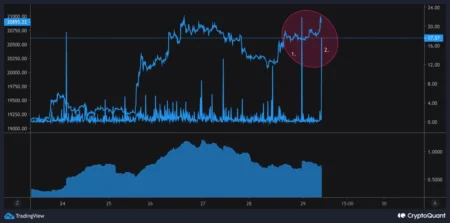

Bitcoin flow In the past 72 hours, more than 10,000 Bitcoin ($BTC) have been transferred into centralized exchanges (CEX). This significant influx indicates a notable movement within the cryptocurrency market. The recent activity may suggest… (via Bpaynews real-time desk)

Current funding rate indicators from both centralized exchanges (CEX) and decentralized exchanges (DEX) suggest that the market has slightly stabilized after a notable decline. Recent trends indicate a shift back toward neutrality in the funding…

ETH Whale A notable Ethereum whale has staked 4,037 ETH with a centralized exchange, resulting in earnings of $5.08 million. The move reflects the ongoing trend of large investors engaging with decentralized finance. By staking… (via Bpaynews real-time desk)

If Bitcoin surpasses $98,000, the cumulative short liquidation pressure on mainstream centralized exchanges will total $155 million. This potential rebound highlights the volatility and trading dynamics within the cryptocurrency market. Traders and investors are closely… (via Bpaynews real-time desk)

Bitcoin drop A drop in Bitcoin’s value below $100,000 may lead to a total long liquidation volume of $922 million across mainstream centralized exchanges. This potential scenario highlights the significant impact that Bitcoin’s price fluctuations… (via Bpaynews real-time desk)

OKX Launches CeDeFi Trading Platform, Bridging Centralized and Decentralized Exchanges In a significant move that blurs the boundaries between centralized (CEX) and decentralized (DEX) crypto exchanges, OKX, a leading player in the cryptocurrency space, has…

Ethereum Withdrawal Syndrome persists, with centralized exchanges experiencing a net outflow of 119,700 $ETH over the past 24 hours. This trend highlights ongoing concerns within the Ethereum ecosystem. Investors appear to be withdrawing significant amounts… (via Bpaynews real-time desk)