Browsing: CEX

CEX net outflow In the past 24 hours, centralized exchanges (CEX) experienced a net outflow of 1,502.14 Bitcoin ($BTC). This significant movement indicates a withdrawal trend among users. Such outflows can reflect various market dynamics,… (via Bpaynews real-time desk)

The current funding rates for mainstream centralized exchanges (CEX) and decentralized exchanges (DEX) suggest a prevailing market sentiment leaning towards bearishness. This trend indicates that traders are generally anticipating a decline in asset prices. The…

Bitcoin long liquidation pressure If Bitcoin’s price falls below $84,000, long liquidation pressure from mainstream centralized exchanges (CEX) could amount to $1.185 billion. This scenario suggests a significant impact on market sentiment and trading dynamics.… (via Bpaynews real-time desk)

Movement is in the process of transferring 50 million MOVE tokens back to a centralized exchange (CEX) after repurchasing them. The decision to return the tokens to a CEX indicates a strategic move by the…

Ethereum Deposit Synchronization Ethereum is experiencing a synchronization delay for deposits, while centralized exchanges (CEX) registered a net inflow of 60,200 ETH in the past 24 hours. This ongoing delay may affect user transactions and… (via Bpaynews real-time desk)

Two new addresses have received 70,000 $SOL from a centralized exchange, valued at approximately $9.8 million. This transfer highlights the ongoing activity in the cryptocurrency market. The movement of such a significant amount of $SOL… (via Bpaynews real-time desk)

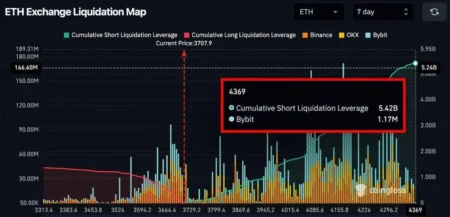

If Ethereum surpasses the $3200 mark, the cumulative short liquidation pressure across mainstream centralized exchanges (CEX) is projected to reach $8.9 billion. This significant threshold indicates a potential shift in market dynamics, as traders may… (via Bpaynews real-time desk)

In the past 24 hours, CEX Net Inflow has recorded a total of 8130.20 $ETH. This figure indicates the amount of Ethereum entering centralized exchanges during this timeframe. The inflow is a significant metric that… (via Bpaynews real-time desk)

CEX net inflow In the past 24 hours, the centralized exchange (CEX) has recorded a net inflow of 3,943.14 Bitcoin ($BTC). This significant inflow reflects the movement of Bitcoin into centralized exchanges, which can be… (via Bpaynews real-time desk)

Ethereum’s price could trigger significant short liquidations if it surpasses $3150, potentially affecting the cumulative short liquidation pressure on centralized exchanges (CEX). Should Ethereum break this key price level, the cumulative short liquidation pressure across… (via Bpaynews real-time desk)