Browsing: Bitcoin volatility

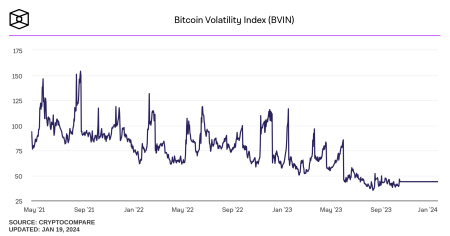

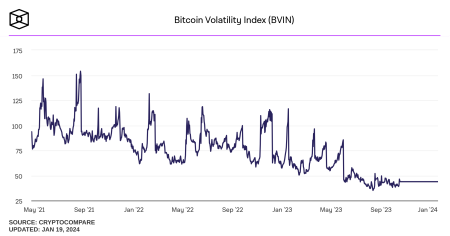

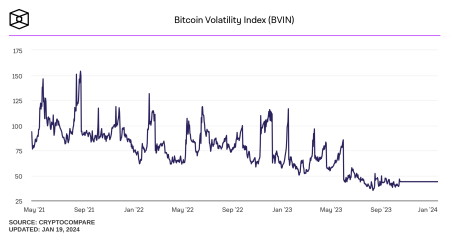

Bitcoin price has recently experienced dramatic fluctuations, drawing attention to its volatility within the cryptocurrency market.Following a significant downturn that saw Bitcoin plunge to around $60,000, the market witnessed a swift recovery, with prices rebounding to approximately $67,000.

The Bitcoin bear market has captured the attention of investors and analysts alike, especially following insights from renowned investor Michael Burry.Burry points to the current downtrend in Bitcoin, likening it to the bear market phase experienced in 2022.

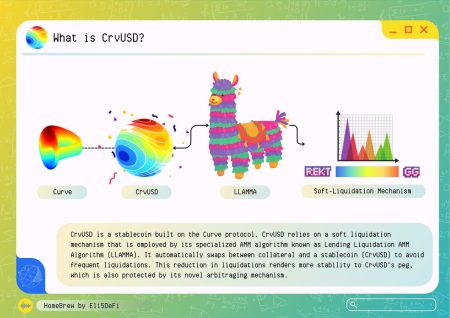

crvUSD stability is a critical component in the evolving landscape of the stablecoin market, particularly in relation to mainstream crypto assets such as Bitcoin.As highlighted by Michael Egorov, the founder of Curve, the substantial liquidity of crvUSD offers both opportunities and challenges, especially during periods of Bitcoin volatility.

Bitcoin price has been the focal point of market discussions lately, especially as it encounters significant volatility ahead of pivotal macroeconomic events.Recently, Bitcoin (BTC) faced a decline, trading near multi-day lows as investors braced for potential turmoil driven by looming economic uncertainties.

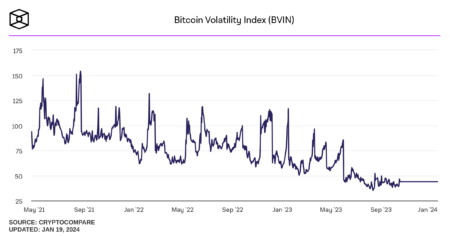

Bitcoin volatility has become a defining characteristic of the cryptocurrency landscape, particularly as it responds to shifting macroeconomic signals and regulatory pressures.Recent developments, such as comments from Federal Reserve Chair Jerome Powell regarding the influence of political forces on central bank decisions, highlight the profound uncertainties now shaping the Bitcoin market.

Bitcoin volatility is at the forefront of traders’ minds today as pivotal economic events unfold, sending shockwaves through the cryptocurrency market.Amid a perfect storm of macroeconomic indicators, including the latest jobs report and Supreme Court deliberations, fluctuations in Bitcoin’s value are likely to be pronounced.

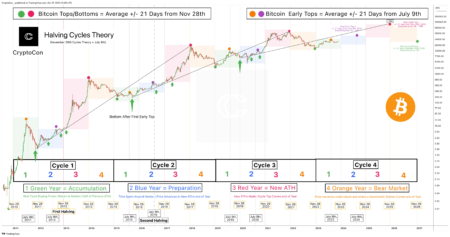

Bitcoin volatility has been a significant topic within the cryptocurrency landscape, marked by intriguing price fluctuations and shifts in market stability.Over the past few years, institutional investment in Bitcoin has surged, particularly with the introduction of Bitcoin ETFs, which allow traditional investors to engage more seamlessly within the crypto market trends.

Bitcoin speculation has captivated the financial world, often evoking passionate discussions about the viability of this digital asset.As major investment firms like Vanguard have begun to offer crypto ETFs, the prospect of Bitcoin trading represents both exciting opportunities and substantial Bitcoin investment risks.

As we delve into the Bitcoin short-term forecast, it becomes evident that the leading cryptocurrency is currently experiencing a phase of stabilization, though market sentiment remains notably cautious.The December 10 FOMC meeting looms large on the horizon, creating significant anticipation around potential policy signals that could influence Bitcoin price analysis.

Bitcoin volatility has become a focal point for traders and investors alike, especially amid the shifting dynamics in the cryptocurrency market.While the price of Bitcoin appears range-bound, the derivatives market is buzzing with anticipation of dramatic fluctuations.