Browsing: Bitcoin price prediction

Bitcoin price prediction is at the forefront of the cryptocurrency market as traders and investors closely monitor recent price movements and trends.Currently, Bitcoin (BTC) is demonstrating a tight trading range between $86,400 and $90,600, setting the stage for a potential breakout.

The Bitcoin bear market has captured the attention of traders and enthusiasts alike, as recent data suggests a significant decline began in November.With many eyes focused on crypto market trends, analysts are closely monitoring Bitcoin’s price prediction, which indicates a potential dip to between $56,000 and $60,000 by 2026.

The recent Bitcoin bear market has sent shockwaves through the cryptocurrency community, leaving investors and analysts scrambling to make sense of the downturn.With prices fluctuating unpredictably, Bitcoin price prediction models are becoming increasingly conservative, as many expect further losses in the months to come.

As the cryptocurrency landscape evolves, Bitcoin price prediction stands at the forefront of discussions among investors and analysts alike.With increasing interest in Bitcoin long-term investment and notable Bitcoin institutional investment, understanding market trends is critical for potential gains.

Understanding Bitcoin price correlation is crucial for investors navigating the volatile cryptocurrency market.Recent analysis highlights a striking disconnection in the relationship between Bitcoin (BTC), traditional stocks, and gold, suggesting intriguing developments ahead for Bitcoin price prediction.

As we delve into the Bitcoin forecast, market analysts are closely monitoring Bitcoin’s recent performance, particularly as it stabilizes around the $90,000 mark ahead of the upcoming Federal Open Market Committee (FOMC) meeting.With Bitcoin price predictions suggesting possible fluctuations in the wake of the Fed’s decisions, investors are keen on understanding how these economic factors may influence future Bitcoin stability.

The Bitcoin price forecast has taken a significant turn as Standard Chartered revises its projections for the cryptocurrency.Initially predicting a robust end-of-2025 price of $200,000, the bank has now slashed this figure to $100,000, reflecting shifting dynamics in the cryptocurrency market.

As the FOMC meeting impact on Bitcoin looms on December 10, the cryptocurrency market’s sentiment is sharp and watchful.Matrixport reports that while Bitcoin’s price has found a temporary footing, an upward trend remains uncertain.

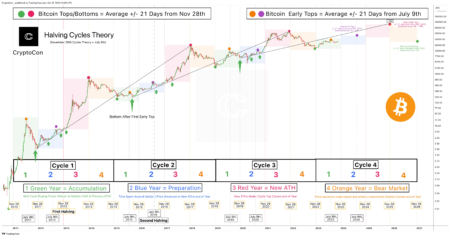

Bitcoin price prediction is at the forefront of discussions in the cryptocurrency investment community, especially as analysts evaluate the latest trends and market shifts.Recent reports suggest that the Bitcoin cycle has broken its traditional 4-year model, signaling a potential peak of $200,000 in the coming years.

As the cryptocurrency market trends continue to evolve, the Bitcoin price forecast is drawing significant attention ahead of an important Federal Reserve decision.With the current trading price hovering around $92,200, many analysts are offering Bitcoin price predictions that hint at a potential bullish outlook.