Browsing: Bitcoin price prediction

Key Point

Details

BTC Futures Premium

Remained around 5%, indicating stable leverage demand despite unsuccessful attempts to break $98,000.ETF Outflows

ETFs saw $395 million in outflows, reducing Bitcoin’s appeal as a hedge against inflation as gold rises.

Bitcoin traders are currently navigating a tumultuous landscape as the market reacts to the evolving dynamics of monetary policy and political tension.The ongoing conflict between President Trump and Federal Reserve Chair Jerome Powell has sparked significant discussions about the potential implications for Bitcoin price predictions and the overall crypto market analysis.

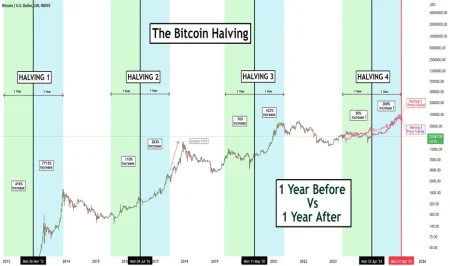

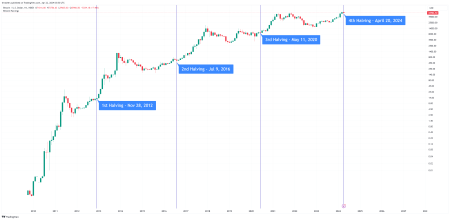

The Bitcoin halving cycle is a pivotal event in the cryptocurrency ecosystem, occurring approximately every four years and fundamentally impacting Bitcoin’s supply and market dynamics.Historically, these halvings have led to significant price increases, capturing the attention of both retail and institutional investors, who recognize their potential to shape Bitcoin market trends.

The recent Bitcoin price surge has captivated both investors and analysts as the cryptocurrency shows signs of a revival in early 2026.Following a tumultuous December, a range of structural indicators, as detailed in a thorough Bitcoin price prediction, suggests that we may see Bitcoin soar past $125,000.

Bitcoin price prediction has become a hot topic among traders and investors alike, particularly with recent bullish indicators emerging from the crypto space.Analysts are highlighting that Bitcoin (BTC) could potentially reach a staggering price target of $105,000 in the coming weeks, thanks to favorable signals from the Relative Strength Index (RSI).

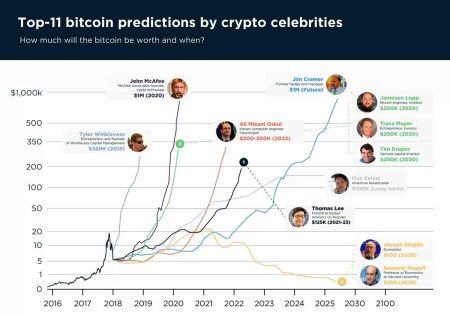

Bitcoin price prediction continues to capture the interest of investors and analysts alike, especially with forecasts suggesting it could soar to $2.9 million by 2050.According to the asset management firm VanEck, this impressive milestone hinges on Bitcoin becoming a settlement currency for international and domestic trade, while gaining traction in the central bank reserves.

Bitcoin price prediction has become a critical topic as traders seek to navigate the tumultuous waters of the cryptocurrency market in 2026.With recent bearish trends resurfacing, analysts are adjusting their BTC forecast to reflect the challenges in overcoming the established resistance level of $95,000.

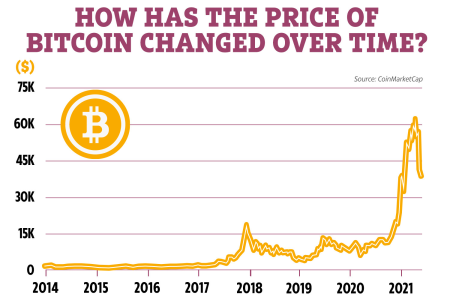

Bitcoin price prediction has become a hot topic among investors and cryptocurrency enthusiasts alike.With the price of Bitcoin often subject to rapid fluctuations, many are eager to understand its potential trajectory in 2023.

Bitcoin price prediction is a hot topic among crypto enthusiasts as analysts scrutinize market trends and future movements.Recently, insights from seasoned traders suggest that Bitcoin may bottom out at $88,000 in the upcoming cycle if the last CME gap remains unfilled.

As investors and analysts look toward the future of cryptocurrency, Bitcoin price prediction remains a hot topic amongst enthusiasts.Recent insights from Glassnode co-founder Negentropic highlight a crucial price point of $94,700 that Bitcoin must surpass to enhance the chances of revisiting its historical all-time high.