Browsing: Bitcoin price prediction

The concept of a **Bitcoin super cycle** has been gaining significant traction in the cryptocurrency community, largely due to predictions made by prominent figures.Recently, CZ, the founder of Binance, hinted that Bitcoin could be on the brink of such a cycle in an interview at Davos.

Bitcoin price prediction remains a hot topic among traders and investors, especially as it navigates a turbulent market.Currently, Bitcoin has dipped below the $90,000 mark, a stark contrast to the soaring prices of gold and silver, which are nearing historical highs.

The Bitcoin price forecast remains a focal point for investors in the rapidly evolving cryptocurrency landscape.As BTC trades below the $90k mark, signs of recovery have begun to show but the momentum remains sluggish.

Bitcoin has emerged as a revolutionary digital currency, captivating the interest of investors and analysts alike with its potential for high returns.However, recent analysis suggests that the widening U.S.

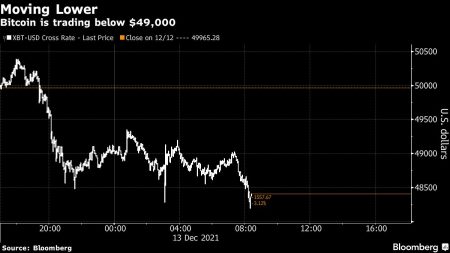

The recent BTC price drop has sent ripples through the cryptocurrency market, as Bitcoin tumbles below the critical threshold of 89,000 USDT.Fresh insights from OKX market data reveal that Bitcoin is now trading at approximately 88,960 USDT, reflecting a 24-hour decline of 1.24%.

Institutional Investors Bitcoin have become a focal point for many analysts and enthusiasts alike, especially with discussions surrounding their potential impact on the cryptocurrency market.As the Bitcoin price prediction adjusts amidst varying market dynamics, the role of institutional investment in Bitcoin is under scrutiny.

In today’s ever-evolving financial landscape, Bitcoin price prediction has become a topic of immense interest for investors and analysts alike.As the cryptocurrency market exhibits significant volatility, knowing the potential future price movements can assist both seasoned investors and newcomers in making informed choices.

Bitcoin price prediction has become a hot topic as enthusiasts and investors closely follow market trends and forecasts.ARK Invest’s recent analysis suggests that the leading cryptocurrency could skyrocket to nearly $1 million by 2030, primarily driven by heightened adoption efforts.

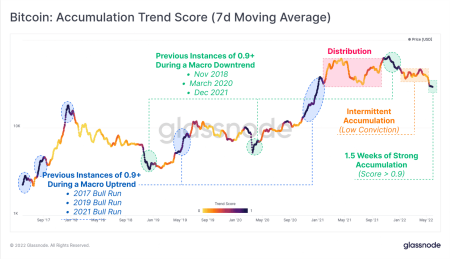

Bitcoin accumulation has emerged as a significant trend among large investors in early 2024, particularly during the ongoing market fluctuations.With Bitcoin’s price recently experiencing a notable drawdown from its all-time highs, many institutional players have seized the opportunity to increase their holdings.

Key Points

Details

Market Reaction

US markets are responding negatively to trade war concerns with the EU, impacting BTC.Critical Support

$90,000 is the critical support level for Bitcoin amidst market volatility.