Browsing: Bitcoin price prediction

CME gaps are an intriguing phenomenon in the cryptocurrency market, specifically concerning Bitcoin price movements.These gaps arise from the disparity between trading hours of the CME Group Bitcoin futures and the continuous trading of Bitcoin, creating empty spaces on charts that traders closely monitor.

Bitcoin support level around $60,000 has been a focal point for traders navigating the uncertainties of the current crypto market trends.As discussed by trader Eugene, this level may provide some resilience amidst the bearish sentiment that dominates the landscape.

Bitcoin price analysis is an essential tool for investors seeking to navigate the complex landscape of cryptocurrency trading.Recently, Bitcoin surged an impressive 15%, pushing its price above the $70,000 mark, yet the Bitcoin options market hints at a potentially precarious new floor beneath this level.

In recent news, the BTC price drop has captured the attention of investors and analysts alike as Bitcoin falls below the key threshold of 70,000 USDT.This decline has led to speculation regarding the future of cryptocurrency trends, particularly as the current price sits at 69,990.8 USDT, displaying a modest 24-hour increase of just 7.53%.

The recent Bitcoin crash has sent shockwaves through the cryptocurrency market, leaving many investors anxious about the future.After months of relentless downturn, the question on everyone’s lips is whether this decline signals a long-term bearish trend or merely a temporary setback.

The recent Bitcoin price surge has captured the attention of both seasoned investors and newcomers alike, as BTC has eclipsed the 69,000 USDT mark, currently trading at 69,000.1 USDT.This impressive leap, highlighted in the latest cryptocurrency market news, represents a significant 24-hour increase of 2.92%.

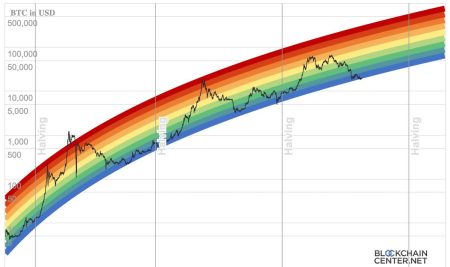

Bitcoin price prediction has become a hot topic among investors and enthusiasts alike, particularly following its recent fluctuations in the crypto marketplace.As the world’s leading digital currency faced significant declines, many are analyzing Bitcoin market sentiment to gauge future movements.

As the cryptocurrency market evolves, Bitcoin price prediction has become a focal point for investors and analysts alike.With the recent volatility and significant fluctuations impacting its value, understanding where Bitcoin might head next is crucial for those involved in digital currencies.

Bitcoin’s recent plunge below $63,000 has ignited intense speculation about whether the cryptocurrency can rebound to $90K by March.As traders sip hot coffee and analyze the market’s movements, many are turning to Bitcoin price predictions and options data to gauge its future trajectory.

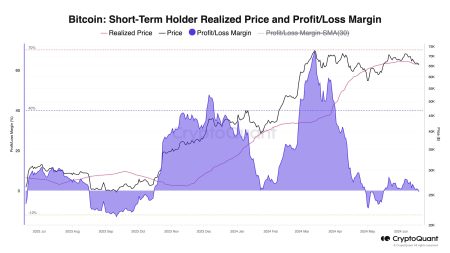

As interest in the cryptocurrency landscape ebbs and flows, understanding BTC price analysis has never been more critical for investors.Recent insights showcase a market performance that is undeniably weaker than that of the early 2022 bear market, with Bitcoin potentially heading towards a troubling price point of $60,000.