Browsing: Bitcoin price drop

The recent Bitcoin crash has left investors reeling, with the Bitcoin price dropping dramatically over the past month.This sell-off, attributed primarily to leveraged bets made by Hong Kong hedge funds, has seen Bitcoin plummet over 40%, dipping below the $60,000 mark.

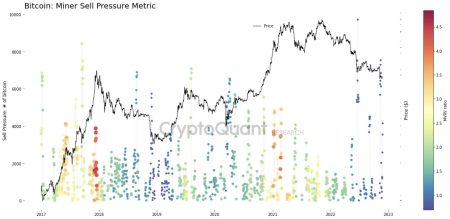

Bitcoin selling pressure has become a pivotal theme in discussions surrounding the cryptocurrency market, revealing the potential for significant price adjustments.Recent reports indicate that hefty sales from Bitcoin spot ETFs, coupled with forced liquidations due to abrupt price drops, are contributing to heightened market volatility.

Bitcoin market analysis remains crucial as the cryptocurrency continues to experience fluctuations in value, with recent events highlighting significant volatility.Following a notable Bitcoin price drop to $60,000, market observers are closely examining the underlying factors contributing to this decline.

The recent Bitcoin price drop has sent shockwaves through the cryptocurrency market as traders try to decipher the catalysts behind this dramatic shift.In just 24 hours, Bitcoin’s value plummeted to around $60,000, resembling the chaos of the 2022 FTX market collapse.

The crypto market volatility is an ever-present factor that shapes both investor sentiment and financial strategies within the ever-expanding digital asset landscape.Recently, we’ve observed significant fluctuations, with the Bitcoin price drop impacting countless investors and institutions alike, leaving them grappling with new challenges.

The recent Bitcoin price drop has sent shockwaves through the cryptocurrency market, as it plummeted below the critical 200-day moving average—a level not seen in recent history.Analysts are closely monitoring Bitcoin market trends to forecast potential recoveries, with many speculating on the possibility of a mean reversion in the coming weeks.

The recent Bitcoin price drop has sent shockwaves through the cryptocurrency community, marking the largest single-day decline in history with a staggering loss of over $10,000.This unprecedented fall reflects the current state of the Bitcoin market analysis, where selling pressure has ramped up significantly, leading to over $2.6 billion in liquidations.

Bitcoin treasury losses have become a headline concern as the cryptocurrency’s value plummeted, hitting an alarming low of $60,233 before recovering to $65,443.This drop has significantly affected Bitcoin treasury companies, leading to unrealized losses topping nearly $10 billion across several major players holding more than 850,000 BTC.

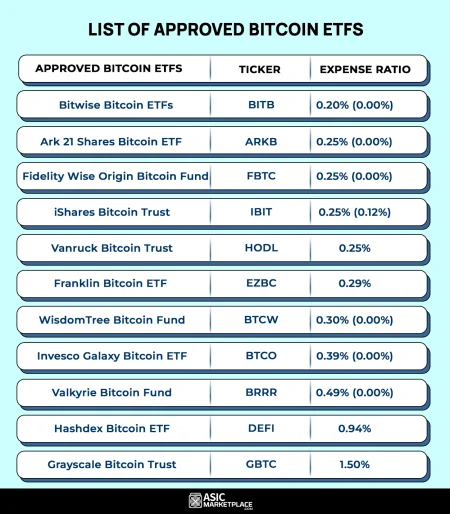

Bitcoin ETFs are currently at the forefront of financial discussions, especially as they face substantial outflows—totaling nearly $1 billion in just two days.This surge in withdrawals has raised concerns among investors about the impact of ETFs on Bitcoin’s volatility and its price trends, particularly as the price of Bitcoin recently dipped following high inflows earlier in the week.

Bitcoin mining stocks have been under significant pressure recently, with major players like IREN and CleanSpark seeing substantial declines amid a broader downturn in the crypto market.Following a drastic 9% drop in total market value, these crypto mining companies reported earnings that fell short of Wall Street’s expectations, exacerbating the situation.