Browsing: Bitcoin market volatility

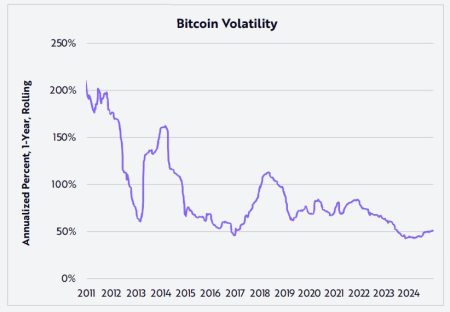

Bitcoin ETFs have emerged as a revolutionary financial instrument, bringing the world of cryptocurrency closer to traditional investing.As Eric Balchunas, a senior ETF analyst at Bloomberg, analyzes the Bitcoin market volatility, his insights suggest that investor structures within Bitcoin ETFs may be more robust than previously anticipated.

As the cryptocurrency market evolves, Bitcoin price prediction has become a focal point for investors and analysts alike.With the recent volatility and significant fluctuations impacting its value, understanding where Bitcoin might head next is crucial for those involved in digital currencies.

Bitcoin market volatility has become a focal point for investors observing its price fluctuations in tandem with economic shifts, particularly as the US dollar experiences a sharp decline.Recent market movements have spotlighted Bitcoin’s potential as a hedge against fiat currencies, drawing parallels with the rises of traditional assets like gold and silver amid geopolitical tensions.

Bitcoin manipulation has become a hot topic among crypto enthusiasts and investors alike, especially in light of the recent drastic price shifts in the Bitcoin market.Just days ago, Bitcoin soared past $90,000 before plummeting in a matter of hours, prompting widespread speculation about underlying forces at play.

Bitcoin market volatility has become a significant focal point for investors as global economic conditions shift.Recently, as expectations of a rate hike by the Bank of Japan intensified, Bitcoin suffered a steep one-day price drop of over 6%.

Bitcoin market volatility Bitcoin’s recent rally has reversed as gold prices have seen an 8% pullback, prompting speculation about the…