Browsing: Bitcoin market analysis

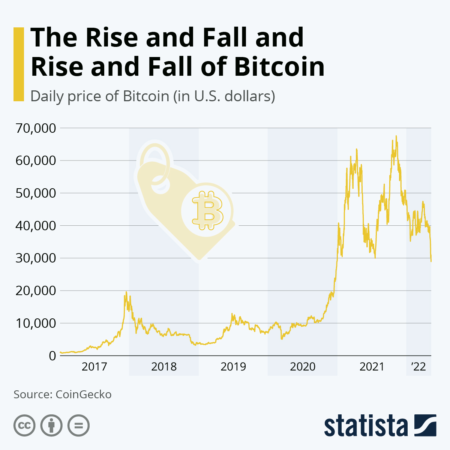

Bitcoin ETF support is becoming increasingly crucial as the cryptocurrency experiences significant market fluctuations.Recently, Bitcoin prices have dipped 28% from their October peak, drawing attention to the essential cost basis level for ETF investors.

As the cryptocurrency market evolves, BTC price prediction remains a hot topic among traders and investors alike.Recently, Bitcoin reached an impressive milestone, breaking through 91,000 USDT, marking a significant moment for the digital currency.

Bitcoin ETFs have become a hot topic in the investment world, particularly as recent data reveals a staggering outflow of $194.6 million, marking the highest returns in two weeks.This sharp decline raises questions about the behavior of institutional investors as they navigate the complexities of the Bitcoin market analysis.

The recent Bitcoin price drop has left many investors on edge as BTC falls below the crucial threshold of 92,000 USDT, currently sitting at 91,999.9 USDT with a 24-hour decrease of 1.63%.This sudden decline raises questions about the future of cryptocurrency trends and the overall stability of the Bitcoin market.

Bitcoin short positions are generating significant buzz as traders brace for the potential effects of a Federal Reserve rate cut.With over $6 billion in leveraged positions hanging in the balance, the cryptocurrency market is rife with speculation and tension.

Bitcoin Price Target has become a hot topic among investors and analysts, particularly as market conditions shift and predictions evolve.Recently, major players, including MicroStrategy, are re-evaluating their strategies in response to the fluctuations in the crypto landscape.

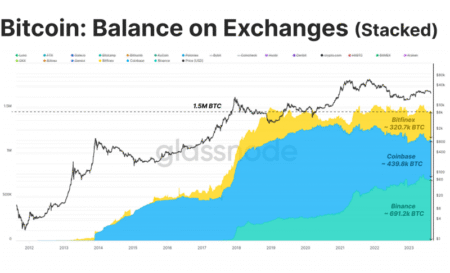

Bitcoin exchange balances have become a significant topic of discussion as they reveal key insights into market dynamics and investor behavior.Recent data from Matrixport indicates a persistent decline in the Bitcoin held on exchanges, a trend that often signals bullish price movements.

In the ever-evolving realm of cryptocurrency, Bitcoin market analysis has become a vital tool for traders and investors alike.As fluctuations in Bitcoin’s value continue to capture global attention, understanding Bitcoin price prediction trends is essential for navigating the turbulent landscape.

The recent Bitcoin price decline has raised eyebrows among investors and analysts alike, as external economic factors continue to exert their influence.Notably, the Bank of Japan’s potential move to raise interest rates in December has sparked significant concern within the cryptocurrency community.

Arthur Hayes Bitcoin prediction continues to stir excitement in the cryptocurrency community as he asserts that Bitcoin could reach an astonishing $250,000 by the end of the year.Known for his role as co-founder of BitMEX, Hayes bases his prediction on a comprehensive Bitcoin market analysis that suggests the cryptocurrency has hit rock bottom after dipping to $80,600.