Browsing: Bitcoin market analysis

The Bitcoin spot ETF has quickly become a focal point in the world of cryptocurrency, particularly after a notable net outflow of $399 million was reported recently.This trend reflects changing Bitcoin investment trends, as investors navigate the complexities of the market.

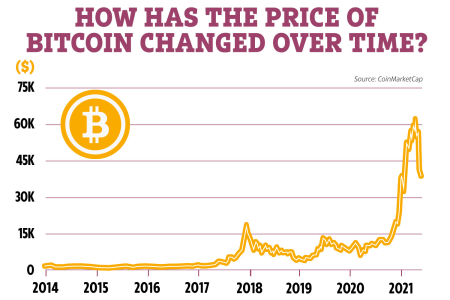

Bitcoin price predictions are currently the focus of traders as the cryptocurrency shows signs of volatility and potential resurgence.As we enter a new quarter, the Bitcoin market analysis highlights the critical resistance levels around $93,000 that have frustrated bullish traders.

Bitcoin price prediction has become a critical topic as traders seek to navigate the tumultuous waters of the cryptocurrency market in 2026.With recent bearish trends resurfacing, analysts are adjusting their BTC forecast to reflect the challenges in overcoming the established resistance level of $95,000.

The recent Bitcoin price surge has captured the attention of investors and analysts alike, as the cryptocurrency breaks through the $94,000 mark for the first time in a month.This remarkable upward momentum not only signals renewed confidence in the digital asset space but also coincides with significant inflows into Bitcoin ETFs, reflective of a broader positive sentiment in the cryptocurrency market analysis.

As discussions around Bitcoin price forecasts heat up, traders are eyeing significant fluctuations driven by geopolitical tensions, particularly the volatility from Venezuela.Recent market analysis shows that Bitcoin has surged to $93,000 for the first time in nearly a month, a 6.6% increase in just five days.

Bitcoin price has surged back to $90,000, raising questions about whether the bear market has truly come to an end.Despite this remarkable rebound, market sentiment remains cautious, as many traders exhibit skepticism regarding the sustainability of these gains.

Bitcoin price predictions for the coming years are creating buzz in the financial markets, with expectations fluctuating amidst recent trading activities.Currently, Polymarket traders assign only a 21% chance of Bitcoin reaching an impressive $150,000 this year despite optimistic forecasts from various analysts.

The recent Bitcoin price drop has captured the attention of investors worldwide, as the cryptocurrency plunged below $90,000 after a brief surge over the weekend.Contributing factors include rising crude oil prices and a notable decline in gold values, creating an environment that threatens to tighten financial conditions across markets.

As investors keenly watch Bitcoin price forecasts, the cryptocurrency continues to capture significant attention in the financial markets.Recent Bitcoin fluctuations have led analysts to project that the price may stabilize around $90,000 in the near term, reflecting a market response to anticipated rate cuts.

In recent years, the ownership of Bitcoin supply has garnered significant attention within the financial sector.Data from CoinGecko reveals that publicly listed companies now control over 5% of the total Bitcoin supply, with the Strategy Company alone responsible for an impressive 3%.