Browsing: Bitcoin market analysis

The Bitcoin bear market has captured the attention of investors and analysts alike, especially following insights from renowned investor Michael Burry.Burry points to the current downtrend in Bitcoin, likening it to the bear market phase experienced in 2022.

The recent Bitcoin price drop has sent shockwaves through the cryptocurrency market, as the digital asset falls below $71,000, marking a significant decline not seen since October 2024.This drop has raised eyebrows and generated extensive Bitcoin market analysis, with analysts scrambling to decipher the potential implications for investors and the broader financial landscape.

The recent cryptocurrency market decline has sent ripple effects through various sectors, raising concerns among investors and enthusiasts alike.In the last 24 hours, the market witnessed a significant downturn, with major players like Ethereum experiencing a price drop that saw it briefly dip below the $2100 mark.

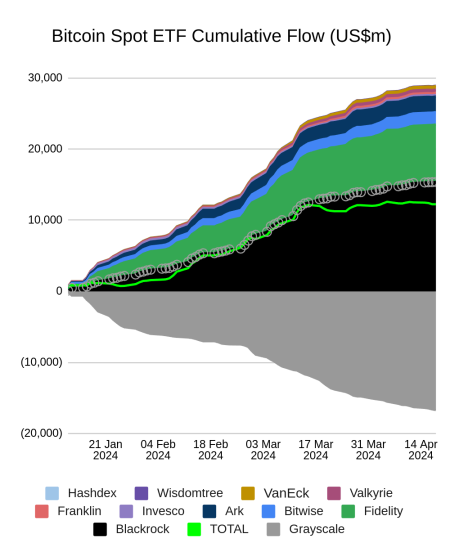

Recent activity in the Bitcoin market has raised eyebrows, particularly concerning the rising Bitcoin ETF outflow which has seen over $2.9 billion exit these exchange-traded funds in just 12 days.This significant withdrawal highlights a bearish sentiment emerging as traders react to broader cryptocurrency trends and pressures from the futures market.

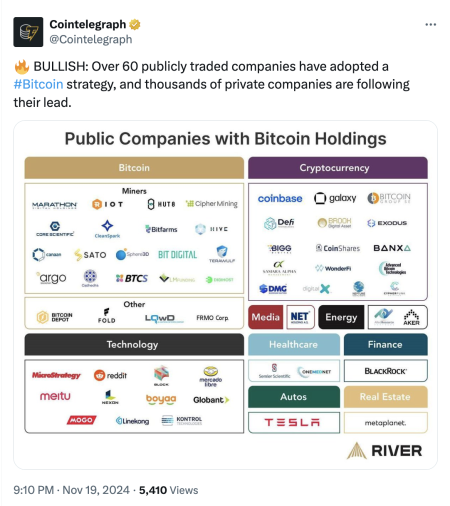

Bitcoin purchases by public companies have become a significant trend in the financial landscape, capturing the attention of investors and analysts alike.As of January 26, 2025, publicly listed companies around the world have made notable investments in Bitcoin, totaling $290 million in just one week.

Bitcoin holders are experiencing a challenging time as recent trends show a significant shift in market dynamics.For the first time since October 2023, these long-term investors are selling their digital assets at a loss, a startling change that emphasizes the current risk-averse sentiment prevailing in the cryptocurrency landscape.

Bitcoin market analysis is essential for investors looking to navigate the volatile cryptocurrency landscape effectively.Recent trends indicate that the Bitcoin price movements are closely tied to key indicators such as the 21-week moving average.

The Bitcoin correction phase is a critical moment for investors and market analysts alike, as it signifies a period of heightened volatility and price adjustments in the cryptocurrency’s journey.According to a recent Bitcoin market analysis by Matrixport, the cryptocurrency has broken key technical levels, indicating that it remains ensnared in a correction phase.

The recent Bitcoin price drop has left investors feeling anxious as BTC now trades at 86,956.9 USDT, marking a notable decline of 2.75% over the last 24 hours.This sudden dip has sparked widespread discussions within the Bitcoin market analysis community, as enthusiasts scramble to comprehend the underlying factors driving these fluctuations.

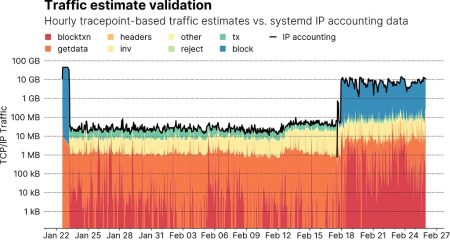

Bitcoin internal traffic has recently seen a significant decline, dropping to approximately 14,000 BTC, which is its lowest level since 2022.This decrease in internal exchange activity signals a broader trend of reduced cryptocurrency liquidity, affecting how traders interact within the market.