Browsing: Bitcoin market analysis

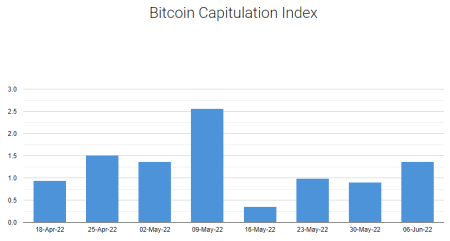

Bitcoin capitulation has sparked intense discussions among traders and analysts alike, especially following recent market turmoil.As Bitcoin’s price teetered below $65,000 and approached the critical $60,000 mark, panic selling became evident among short-term holders, raising questions about the sustainability of the cryptocurrency’s current trajectory.

BTC price prediction has become a hot topic among crypto enthusiasts, especially as Bitcoin recently broke through the 70,000 USDT mark.With a notable 24-hour increase of 2.21%, the outlook for BTC suggests budding optimism in the cryptocurrency market.

Bitcoin market analysis has become increasingly vital in understanding the fluctuations and emerging trends in the cryptocurrency landscape.On February 5, the market witnessed notable volatility amidst rising concerns about risk unwinding within traditional financial structures, as articulated in Jeff Park’s latest evaluation.

The recent Bitcoin crash has left investors reeling, with the Bitcoin price dropping dramatically over the past month.This sell-off, attributed primarily to leveraged bets made by Hong Kong hedge funds, has seen Bitcoin plummet over 40%, dipping below the $60,000 mark.

Bitcoin market analysis remains crucial as the cryptocurrency continues to experience fluctuations in value, with recent events highlighting significant volatility.Following a notable Bitcoin price drop to $60,000, market observers are closely examining the underlying factors contributing to this decline.

The recent Bitcoin price dip has stirred significant attention in the cryptocurrency market, marking a crucial moment for traders and investors alike.As Bitcoin’s value fell toward $60,000, a staggering $2.56 billion was lost in liquidity across crypto derivatives markets, highlighting the severity of this sell-off.

The recent Bitcoin crash has sent shockwaves through the cryptocurrency market, leaving many investors anxious about the future.After months of relentless downturn, the question on everyone’s lips is whether this decline signals a long-term bearish trend or merely a temporary setback.

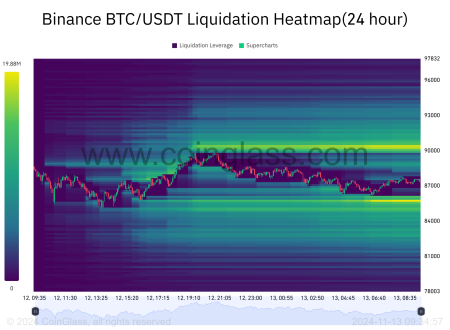

In a dramatic turn of events in the Bitcoin market analysis, BTC liquidations soared to an astonishing 79.85 million dollars within just four hours.This surge contributes to a staggering total of 167 million dollars in crypto liquidations across the network.

Amid the recent volatility in cryptocurrency markets, the Bitcoin price rebound has captured the attention of traders and investors alike.As Bitcoin surged back above $65,000, up 11% from lows under $60,000, many are eager to understand the driving forces behind this resurgence.

In a significant development in the finance sector, BlackRock cryptocurrency deposits have made waves by transferring 3,948 BTC and 5,734 ETH into Coinbase, totaling a staggering $272 million.This bold move is gaining attention amidst the latest BlackRock Bitcoin news, as investors seek insights into the potential impact on the Bitcoin market analysis.