Browsing: Bitcoin investment

In a bold move that underscores the burgeoning intersection of traditional finance and the cryptocurrency realm, BlackRock Bitcoin deposits have made headlines with the transfer of 1,197 BTC, valued at approximately $110.15 million, into Coinbase Prime.This strategic leap not only signifies BlackRock’s increasing interest in Bitcoin investment but also enhances its profile in the rapidly evolving landscape of digital assets.

The future growth of BTC appears increasingly promising as recent bullish signals suggest a new wave of interest and investment within the cryptocurrency landscape.Notably, factors such as enhanced BTC regulation, rising institutional adoption of Bitcoin, and innovative trends like tokenization in crypto are reshaping the market.

Harvard University Bitcoin investment has made waves in the financial world, signaling a bold shift in how elite institutions view cryptocurrency assets.Recently, reports revealed that the prestigious university has elevated its Bitcoin holdings from $117 million to an impressive $443 million, showcasing a significant institutional Bitcoin allocation.

Metaplanet Bitcoin Holdings, a prominent Japanese Bitcoin company, has made headlines recently for halting its Bitcoin purchases since September 30.This pause in activity raises intriguing questions about the company’s strategy and its future Bitcoin investments.

The Bitcoin liveliness indicator has emerged as a crucial metric in understanding the ongoing dynamics of the cryptocurrency landscape.As market analysts continue to scrutinize Bitcoin price analysis, this innovative indicator highlights the health of on-chain activity, suggesting fascinating trends within the crypto market.

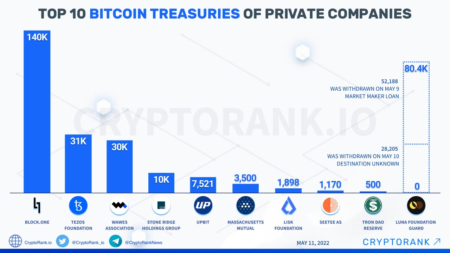

In the evolving landscape of cryptocurrency, Bitcoin treasury companies are gaining recognition as pivotal players in the financial markets.These firms, like Strive, are now advocating for transparent practices that allow the market to determine the fate of companies with Bitcoin assets.

The recent adjustments to the price target for Strategy (MSTR) shares have stirred considerable interest within the investment community.Cantor Fitzgerald analysts have significantly lowered their expectations from $560 to $229, reflecting a 59% decrease.

In the realm of cryptocurrency investment, XRP ETFs are capturing significant attention as they approach the staggering mark of $1 billion in assets.With the growing enthusiasm around digital assets, the approval of such Exchange-Traded Funds (ETFs) is shaping the future of crypto investments.

CANGO Bitcoin holdings have recently made headlines in the cryptocurrency community, as the company continues to expand its presence in the digital asset space.This week, they announced a significant achievement: mining 130.7 BTC, which boosts their total Bitcoin holdings to an impressive 7,033.1 BTC.

Bitcoin treasury management is entering a new era as Twenty One Capital prepares to make its debut on the New York Stock Exchange (NYSE) this December 9.With a staggering $4 billion in Bitcoin assets backing its operations, Twenty One is poised to redefine how corporate entities utilize cryptocurrency for investment and growth.