Browsing: Bitcoin investment strategy

Bitcoin allocation has become a hot topic among investors as they navigate the complexities of the cryptocurrency landscape.In a world where financial strategies are rapidly evolving, understanding how to optimally allocate Bitcoin in your portfolio can significantly impact financial outcomes.

Bitcoin has emerged as a revolutionary digital currency, captivating the interest of investors and analysts alike with its potential for high returns.However, recent analysis suggests that the widening U.S.

Key Points

Details

Bitcoin’s Unique Role

Bitcoin serves as an ‘escape valve’ during potential volatility caused by the ECB’s monetary policy.ECB’s Warning

Philip Lane warns that political strife could destabilize the dollar, affecting global markets.

The recent Strategy Bitcoin purchase marks a pivotal move in the evolving landscape of cryptocurrency investment.In a bold step, Strategy acquired 1,283 Bitcoin for $116 million, elevating its corporate Bitcoin holdings to an impressive 673,783 BTC despite experiencing a staggering paper loss of $17.4 billion in Q4.

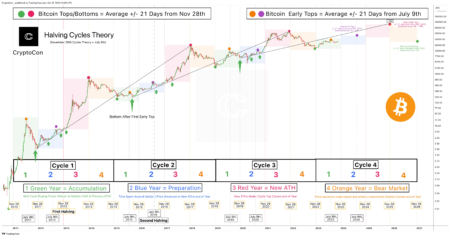

As we delve into the Bitcoin forecast, market analysts are closely monitoring Bitcoin’s recent performance, particularly as it stabilizes around the $90,000 mark ahead of the upcoming Federal Open Market Committee (FOMC) meeting.With Bitcoin price predictions suggesting possible fluctuations in the wake of the Fed’s decisions, investors are keen on understanding how these economic factors may influence future Bitcoin stability.

MicroStrategy Bitcoin strategy has garnered attention as the company embarks on a bold journey in cryptocurrency investment.With a commitment to hold Bitcoin at least until 2065, MicroStrategy sets a long-term vision that showcases their focus on Bitcoin accumulation as a primary asset.

Bitcoin Tracker has become a crucial resource for investors and enthusiasts alike, keeping a pulse on the cryptocurrency landscape.Industry heavyweight Michael Saylor has recently shared exciting updates concerning his own Bitcoin investment strategy, hinting at possible expansions in his holdings.

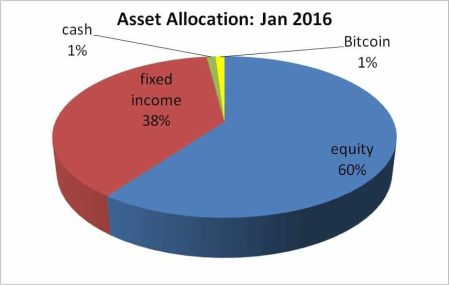

Massimo Bitcoin Treasury marks a pivotal shift in corporate finance strategies, as the Nasdaq-listed company embraces cryptocurrency as a key component of its long-term treasury reserves.In a bold move aimed at enhancing its financial portfolio, Massimo has approved an innovative Bitcoin investment strategy, allocating up to 10% of its total assets for future crypto purchases.