Browsing: Bitcoin investment

Hyperscale Data Bitcoin holdings are quickly becoming a focal point for investors looking to diversify their cryptocurrency portfolios.With the company’s total assets soaring to approximately $323 million as of January 31, 2026, the significant portion allocated to Bitcoin, totaling $97 million, highlights the growing influence of digital currencies on company financial performance.

Bitcoin treasury losses have become a headline concern as the cryptocurrency’s value plummeted, hitting an alarming low of $60,233 before recovering to $65,443.This drop has significantly affected Bitcoin treasury companies, leading to unrealized losses topping nearly $10 billion across several major players holding more than 850,000 BTC.

Bitcoin price prediction has become a hot topic among investors and enthusiasts alike, particularly following its recent fluctuations in the crypto marketplace.As the world’s leading digital currency faced significant declines, many are analyzing Bitcoin market sentiment to gauge future movements.

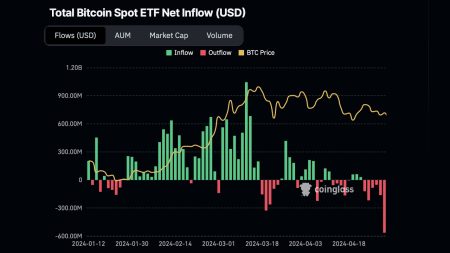

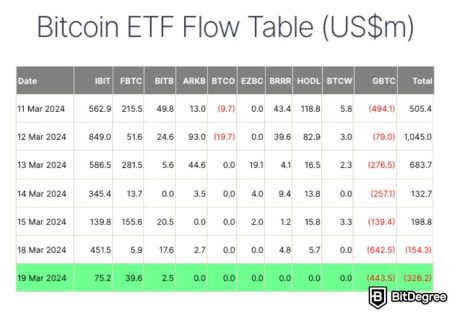

Bitcoin ETF outflow is making headlines today as the United States reports a significant net outflow of 7,925 BTC from Bitcoin exchange-traded funds.This surge in outflow is closely mirrored by trends in other prominent cryptocurrencies, with 37,809 ETH exiting Ethereum ETFs and 21,223 SOL leaving Solana ETFs.

Michael Saylor Bitcoin Tracker has become a vital resource for crypto enthusiasts eager to keep up with the latest in their Bitcoin investments.As the founder of Strategy, Saylor is at the forefront of providing significant updates about Bitcoin holdings, and his latest announcement has sparked widespread interest.

Key Point

Details

Grant Cardone’s Investment

CEO of Cardone Capital, a real estate investment company.Investment Amount

Adding approximately $10 million in Bitcoin.

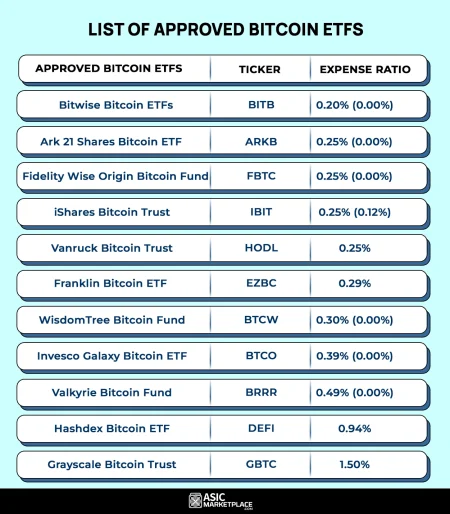

Bitcoin ETFs have become a pivotal development in the cryptocurrency landscape, revolutionizing the way investors engage with Bitcoin.As more people look to diversify their portfolios with Bitcoin investments, these exchange-traded funds offer a seamless gateway into the world of cryptocurrencies.

Bitcoin ETF outflows have surfaced, marking a notable shift following an explosive start to 2026.After drawing in more than $1.16 billion in net inflows during the first two trading days of the year, the latest data reveals a sudden exit of $243 million from Bitcoin exchange-traded funds.

Bitcoin investment has captured the attention of both seasoned and novice investors, becoming a prominent topic in the financial landscape.With major financial institutions weighing in, such as The Benchmark Company reiterating their buy rating on the Bitcoin asset holder MSTR, the allure of cryptocurrency continues to grow.

Publicly traded companies Bitcoin purchases have surged recently, reflecting a growing trend among corporations to integrate cryptocurrency into their financial strategies.Last week alone, these firms collectively acquired a staggering $968.89 million in Bitcoin, with MicroStrategy leading the charge by investing $962.70 million to add 10,624 bitcoins to their portfolio.