Browsing: Bitcoin ETFs

Bitcoin ETFs have emerged as a revolutionary financial instrument, bringing the world of cryptocurrency closer to traditional investing.As Eric Balchunas, a senior ETF analyst at Bloomberg, analyzes the Bitcoin market volatility, his insights suggest that investor structures within Bitcoin ETFs may be more robust than previously anticipated.

Bitcoin ETFs are currently at the forefront of financial discussions, especially as they face substantial outflows—totaling nearly $1 billion in just two days.This surge in withdrawals has raised concerns among investors about the impact of ETFs on Bitcoin’s volatility and its price trends, particularly as the price of Bitcoin recently dipped following high inflows earlier in the week.

Bitcoin ETFs have been making headlines recently, particularly as the price of Bitcoin approaches the prestigious $70,000 mark.Despite market fluctuations, these exchange-traded funds are experiencing significant losses, with reports showing $545 million in outflows this past Wednesday.

Bitcoin ETFs have become a pivotal development in the cryptocurrency landscape, revolutionizing the way investors engage with Bitcoin.As more people look to diversify their portfolios with Bitcoin investments, these exchange-traded funds offer a seamless gateway into the world of cryptocurrencies.

Bitcoin ETFs have become a focal point of discussion in the financial world, especially following the latest reports of a net outflow of 3,826 BTC.As investors continue to navigate the complexities of cryptocurrency markets, the performance of Bitcoin ETFs is closely monitored for trends that could impact broader investment strategies.

Bitcoin ETFs have been making headlines recently, particularly for their astonishing $1.1 billion in losses within just 72 hours.As the landscape of the cryptocurrency market shifts, these exchange-traded funds are grappling with unprecedented outflows that reflect the changing dynamics of Bitcoin investment strategies.

Bitcoin ETFs have captured significant attention in the financial world, especially with the recent surge in ETF inflows marking a new era for cryptocurrency investments.On the very first trading day of 2026, US-based spot Bitcoin exchange-traded funds experienced an impressive $471.3 million in net inflows, signaling a robust start despite fluctuating crypto market sentiment.

Bitcoin whales play a critical role in shaping the cryptocurrency market landscape, yet recent speculation about their massive accumulation efforts has been largely exaggerated.On-chain data reveals that the substantial presence of these large holders does not equate to a definitive reaccumulation phase.

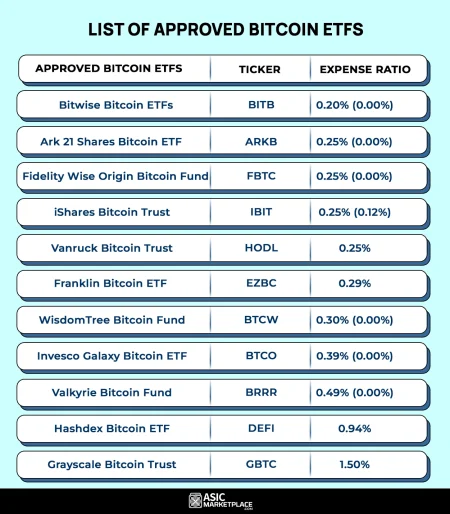

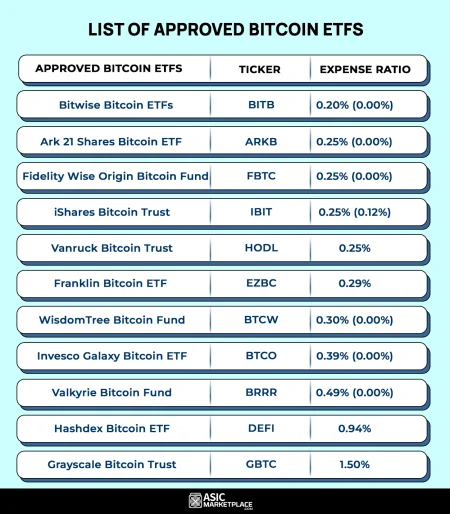

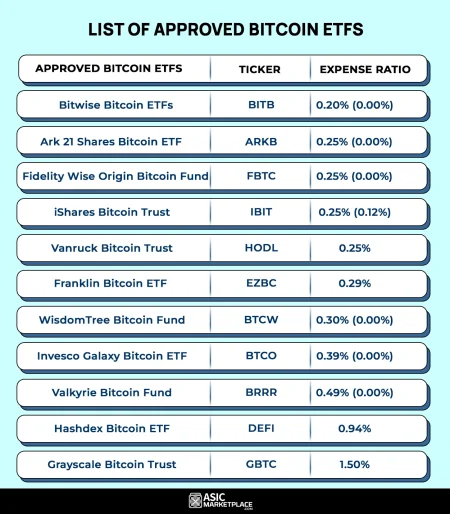

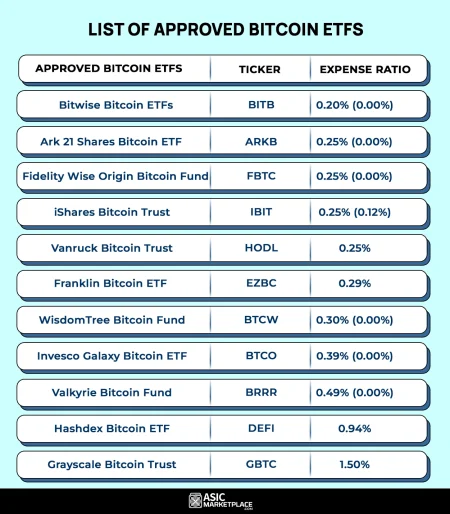

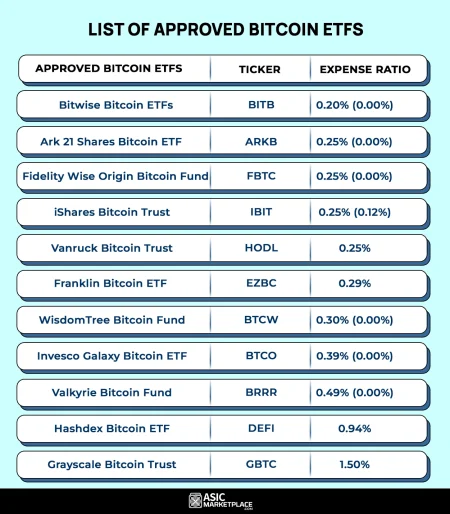

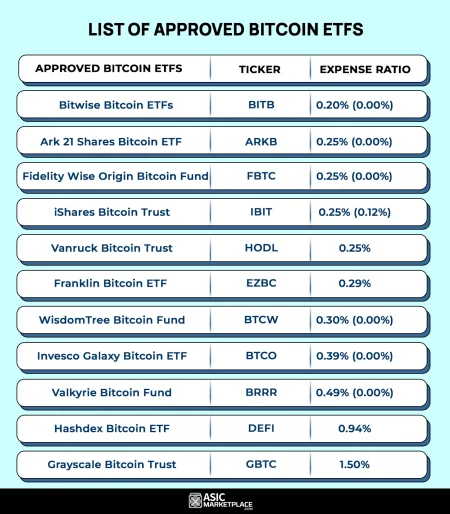

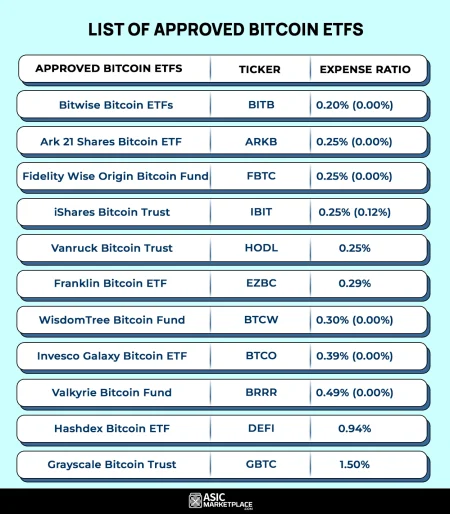

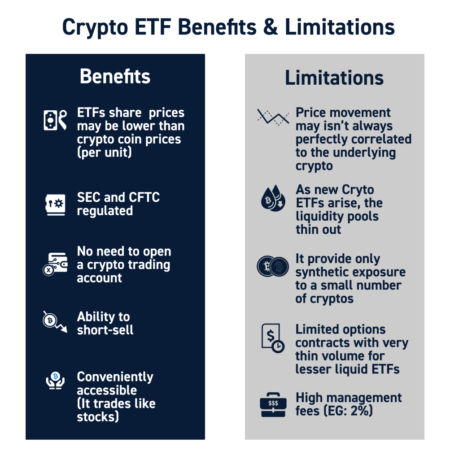

Cryptocurrency ETFs represent a pioneering financial instrument that allows investors to gain exposure to the dynamic world of digital currencies without directly owning the underlying assets.As this innovative category of exchange-traded funds gains traction, we are witnessing a surge in interest particularly in Bitcoin ETFs and Ethereum ETFs, which are driving institutional cryptocurrency investment.

Crypto ETFs are reshaping the landscape of digital asset investment, providing investors with opportunities to engage with blockchain assets without directly purchasing cryptocurrencies.Recently, the market has witnessed significant fluctuations, with Bitcoin ETFs experiencing notable $60M outflows while Ethereum funds rallied with $35.49M in inflows.