Browsing: Bitcoin bear market

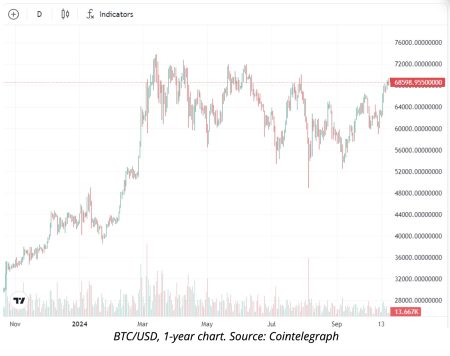

Bitcoin below $70K has captured the attention of both seasoned investors and newcomers alike, especially in light of the recent Bitcoin price analysis.As the leading cryptocurrency continues to navigate a bear market, opinions diverge on its future trajectory, reflecting a mix of uncertainty and opportunity among market participants.

The recent Bitcoin price drop has sent shockwaves through the cryptocurrency market, as it plummeted below the critical 200-day moving average—a level not seen in recent history.Analysts are closely monitoring Bitcoin market trends to forecast potential recoveries, with many speculating on the possibility of a mean reversion in the coming weeks.

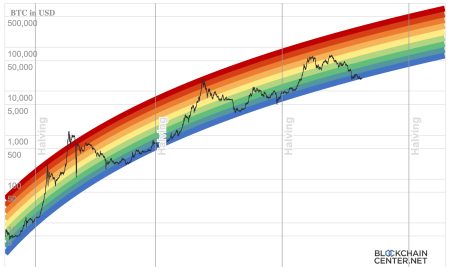

As the cryptocurrency landscape evolves, the significance of Bitcoin prediction becomes increasingly crucial for investors and enthusiasts alike.With Bitcoin’s price forecast indicating potential shifts, understanding the finer points of BTC market analysis can provide clarity in turbulent times.

The current Bitcoin bear market has raised eyebrows as the cryptocurrency has fallen below the crucial 200-week moving average, signaling a potential prolonged downturn.Bitcoin price analysis reveals that this decline, exacerbated by a turbulent U.S.

The recent BTC correction has sparked significant interest amongst traders and investors alike, as it reflects broader patterns emerging in the cryptocurrency market trends.Notably, as Bitcoin approaches key price levels, the implications for the future remain uncertain, particularly in the context of a Bitcoin bear market.

Bitcoin price analysis has become increasingly crucial as the cryptocurrency market continues to display extreme volatility.Recently, BTC experienced a staggering drop of 13%, falling below the significant support level of $69,000, marking a notable shift in Bitcoin market trends.

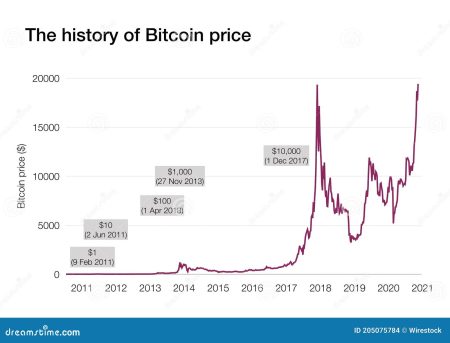

The Bitcoin bear market has captured the attention of investors and analysts alike, especially following insights from renowned investor Michael Burry.Burry points to the current downtrend in Bitcoin, likening it to the bear market phase experienced in 2022.

The Bitcoin bear market has become a hot topic among crypto enthusiasts and investors, as analysts debate the implications of current market conditions.With the Bitcoin price trend showing a significant decline from its peak, many industry experts suggest that we may be in for a prolonged bearish phase that could last well into 2026.

The Bitcoin bear market has captured the attention of traders and enthusiasts alike, as recent data suggests a significant decline began in November.With many eyes focused on crypto market trends, analysts are closely monitoring Bitcoin’s price prediction, which indicates a potential dip to between $56,000 and $60,000 by 2026.

The recent Bitcoin bear market has sent shockwaves through the cryptocurrency community, leaving investors and analysts scrambling to make sense of the downturn.With prices fluctuating unpredictably, Bitcoin price prediction models are becoming increasingly conservative, as many expect further losses in the months to come.