Strategy Bitcoin lending is shaping up to be a pivotal development in the evolving cryptocurrency market, as major players adapt to the increasing demand for yield. With the allure of lending platforms rising, institutions are looking beyond traditional methods to maximize profits from their Bitcoin reserves. This shift not only signals a transformation for companies like Strategy but also introduces new dynamics that could affect hedge funds and short selling Bitcoin strategies. As more firms pivot towards crypto lending, understanding the implications on market pricing and institutional investments becomes critical. By leveraging their Bitcoin treasury in innovative ways, such strategies could potentially transform how assets are managed within this digital landscape.

The concept of cryptocurrency lending has gained momentum, with firms exploring alternative avenues to leverage their digital assets for financial growth. Known as Strategy Bitcoin lending, this approach allows companies to utilize their cryptocurrency holdings, like Bitcoin, to generate interest and facilitate borrowing for various institutional needs. As the crypto lending space heats up, it becomes essential for investors to grasp the risks tied to shorting Bitcoin and how blockchain assets fit into the broader financial ecosystem. This evolution not only highlights the changing paradigm within digital finance but also addresses the growing appetite for structured credit products in the realm of blockchain technology. By turning their Bitcoin reserves into working capital, firms aim to maintain competitiveness while navigating a complex and volatile market.

The Evolution of Strategy: From Bitcoin Holder to Lender

Strategy’s recent shift from a passive Bitcoin holder to considering lending out its substantial crypto reserves marks a significant evolution in its business model. This transformation is crucial as the firm, previously known for its ‘digital vault’ concept, is now exploring potential opportunities in the crypto lending market, which is evolving rapidly. By doing so, Strategy could leverage its impressive Bitcoin treasury to generate additional revenue streams, potentially enhancing its position amidst a commoditized cryptocurrency market.

However, entering the crypto lending space does not come without its challenges. The current demand for borrowing Bitcoin largely stems from hedge funds and market makers who typically short-sell Bitcoin to hedge against price volatility. This presents a double-edged sword for Strategy, as it could inadvertently support short-selling activities that diminish the value of its own holdings. Therefore, while the strategy aims to capitalize on its extensive Bitcoin reserve, it also risks introducing complexities and counterparty risks previously avoided in its custodial model.

Understanding Bitcoin Lending Risks and Opportunities

The foray into Bitcoin lending exposes Strategy to various risks, particularly those associated with counterparty exposure and market volatility. The tumultuous history of crypto credit markets serves as a cautionary tale; previous collapses, such as those involving BlockFi and Celsius, underline the importance of prudent risk assessment when engaging with potential borrowers. Strategy’s pivot necessitates meticulous evaluation of bank partnerships and borrower profiles to mitigate these risks and avoid repeating past mistakes in the crypto lending arena.

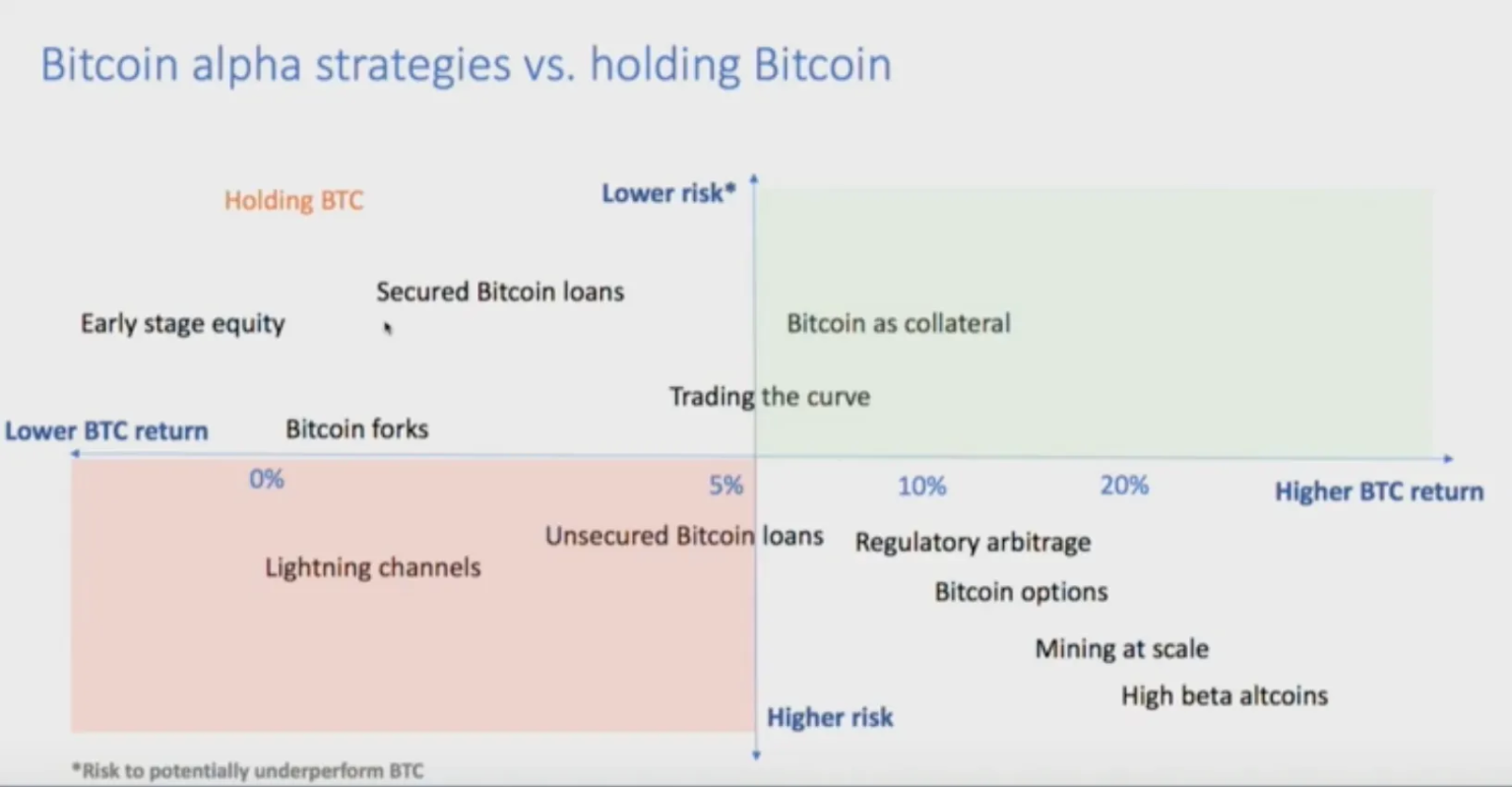

On the flip side, embracing Bitcoin lending could present notable opportunities for Strategy to bolster its financial health. By offering its vast reserves as collateral for loans, Strategy can generate yields to support its cash flows without the need to sell its Bitcoin, preserving shareholder value. Moreover, as the cryptocurrency market matures, strategic lending partnerships with established financial institutions could provide the necessary framework to navigate the potential pitfalls inherent in lending, ultimately enhancing Strategy’s operational resilience in a competitive landscape.

Frequently Asked Questions

What is the Strategy Bitcoin lending approach and how does it work?

Strategy Bitcoin lending refers to the initiative by companies like Strategy (formerly MicroStrategy) to lend out their Bitcoin reserves, particularly leveraging the institutional demand for Bitcoin loans. This approach aims to generate revenue from Bitcoin holdings by entering the crypto lending market, where firms can earn interest by lending Bitcoin to borrowers, often market makers and hedge funds.

What risks are associated with Strategy Bitcoin lending?

Strategy Bitcoin lending introduces several risks, including counterparty risk and re-hypothecation risks. Lending out Bitcoin means that instead of securely holding the asset, the company would act as an unsecured creditor if a lender fails. The practice could contradict the original ethos of holding Bitcoin as a secure asset, exposing the firm to financial vulnerabilities.

How does Strategy Bitcoin lending impact the cryptocurrency market?

The entry of Strategy into Bitcoin lending has the potential to significantly influence the cryptocurrency market by increasing the supply of borrowable Bitcoin. This could lower the cost to borrow Bitcoin, making it easier for hedge funds to short the asset, which may exert downward pressure on Bitcoin prices in the market.

How can Strategy maintain its valuation premium through Bitcoin lending?

Strategy aims to defend its valuation premium through Bitcoin lending by generating yield from its massive Bitcoin reserves. Given that its stock valuation depends on trading at a premium to its Net Asset Value (NAV), lending might serve as a crucial method to maintain cash flow obligations and avoid liquidating Bitcoin to cover expenses.

What challenges does Strategy face in the Bitcoin lending space?

Strategy faces challenges in the Bitcoin lending space, including a crowded competitive environment with existing players like Nexo and Galaxy Digital. Additionally, the market dynamics have changed since the 2021 lending boom, requiring Strategy to navigate potential yield compression due to an influx in supply caused by their significant Bitcoin reserves.

What measures is Strategy taking to mitigate risks in Bitcoin lending?

Strategy’s approach to mitigating risks in Bitcoin lending includes partnering only with reputable banks and institutions to minimize counterparty risk. They are also closely monitoring market conditions to ensure that the lending practices do not undermine the firm’s core strategy of holding Bitcoin as a safe asset.

Why is there institutional demand for borrowing Bitcoin in the lending market?

Institutional demand for borrowing Bitcoin is primarily driven by market makers and hedge funds looking to hedge derivative exposure or short-sell Bitcoin. By borrowing Bitcoin, these entities can profit from anticipated price declines, thereby creating a robust source of demand for lenders like Strategy.

What is the potential impact of Strategy entering the Bitcoin lending market on retail investors?

The potential entry of Strategy into Bitcoin lending could affect retail investors by altering the supply and demand dynamics of Bitcoin in the market. If lending increases the availability of Bitcoin for borrowing, it could drive prices down, impacting the investments of retail clients who view Bitcoin as a long-term store of value.

How does Strategy’s Bitcoin reserve play a role in its lending strategy?

Strategy’s Bitcoin reserve, currently holding 650,000 BTC, is central to its lending strategy. By utilizing this reserve, Strategy can effectively generate revenue through interest on loans while also serving the broader market needs of borrowers, notably hedge funds looking to short-sell Bitcoin.

What does the future hold for Strategy Bitcoin lending?

The future of Strategy Bitcoin lending is uncertain and will heavily depend on market conditions, institutional engagements, and the company’s ability to balance yield generation with risk management. As the firm continues to explore partnerships and the lending landscape, its strategic direction will significantly influence its success in this evolving financial space.

| Key Point | Details |

|---|---|

| Company Overview | Strategy (formerly MicroStrategy) is exploring moving into the crypto lending market. |

| Current Strategy | Strategy has historically held a vast reserve of Bitcoin (650,000 BTC) as a digital vault. |

| New Developments | CEO Phong Le announced talks with banks to start lending Bitcoin, changing the firm’s risk profile. |

| Risks Involved | Lending Bitcoin exposes Strategy to re-hypothecation risks and counterparty risk. |

| Market Demand | Institutional demand for borrowing Bitcoin is primarily from those looking to short it, which can undermine Strategy’s position. |

| Valuation Issues | Strategy’s stock is under pressure, and to defend its valuation, it needs to offer yields that ETFs cannot. |

| Competitive Landscape | If Strategy enters lending, it could disrupt the market due to its size compared to competitors like Nexo. |

| Future Outlook | The pivot from passive holding to active lending could change the essence of Strategy as a holder of Bitcoin. |

Summary

The Strategy Bitcoin lending initiative marks a significant transformation in how the company engages with the cryptocurrency ecosystem. By venturing into the lending market, Strategy aims to maintain its valuation premium in a competitive environment while addressing the increasing demand for yield among investors. However, this strategy must carefully navigate the heightened risks associated with lending, particularly the potential for re-hypothecation and counterparty risks. As Strategy balances these opportunities and challenges, its evolution in the Bitcoin space could redefine its operational identity and influence market dynamics.