| Key Points | Details |

|---|---|

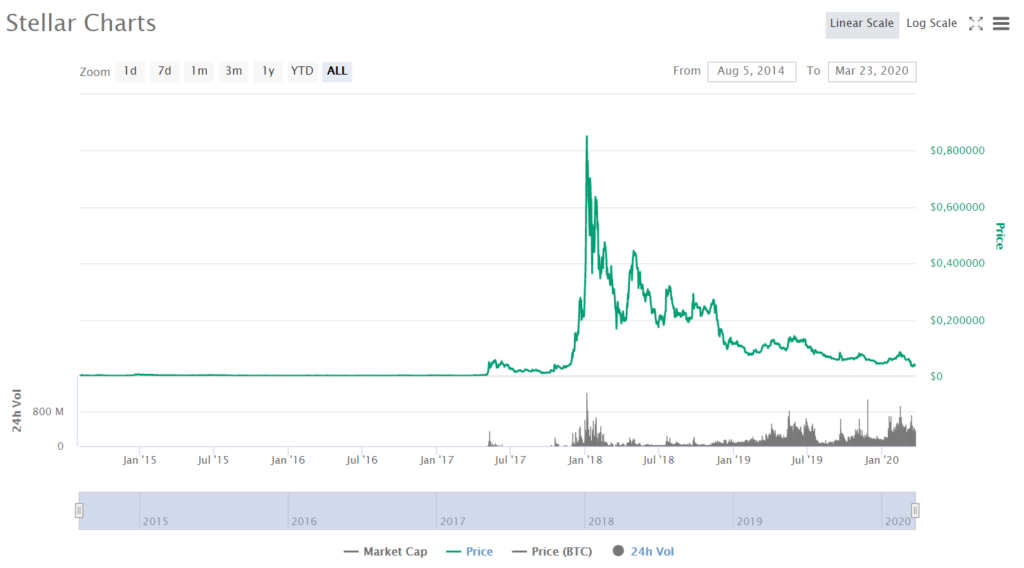

| Current Price Situation | Stellar’s price dropped, approaching the $0.20 support level as the market mimics Bitcoin‘s trend. |

| Technical Levels | Breaking below $0.22 could lead to further declines, while $0.20 acts as a key support level. |

| Market Sentiment | Bearish sentiment prevails due to recent price declines and weakening on-chain confidence. |

| Open Interest | Derivatives show a decrease in open interest, favoring bearish positions. |

| Resistance Levels | $0.22 and $0.25 are now significant resistance levels for bulls trying to regain control. |

| Potential for Recovery | A daily close above $0.23 could attract buying interest up to $0.32 and $0.41. |

Summary

The Stellar price forecast indicates a crucial moment as the XLM price risks dipping below $0.22, which could push it toward the significant support level of $0.20. The current bearish market sentiment, exacerbated by Bitcoin’s performance, suggests that XLM may continue to experience challenges ahead. Keeping an eye on these critical price points and overall market trends will be essential for investors looking to navigate Stellar’s future movements.

The Stellar price forecast reveals critical insight into the current market dynamics surrounding XLM as it faces considerable challenges below $0.22. Recent trends indicate the volatility of altcoins, especially as the influence of Bitcoin on altcoin performance remains pronounced. With support levels for XLM teetering dangerously close to the significant $0.20 mark, traders are closely watching the implications of these price movements. Stellar price analysis suggests that if bearish pressure continues, we could see a substantial decline, reinforcing the need for astute monitoring of cryptocurrency trends. Understanding the XLM price prediction amidst these shifts is vital for investors looking to navigate the current landscape cautiously.

In contemplating the future of Stellar, or XLM, many investors are eager to dissect the various elements influencing its trajectory. As the altcoin struggles in the aftermath of Bitcoin’s latest fluctuations, alternative metrics are emerging to guide potential buyers. Examining support zones and resistance levels becomes crucial as traders strategize their moves in this fluctuating environment. The interplay of market sentiment and technical analysis will be instrumental in shaping XLM’s potential recovery or further decline. Ultimately, by delving into the myriad factors at play, stakeholders can better position themselves within the unpredictable world of cryptocurrencies.

Stellar Price Forecast: Risks Below $0.22

The recent decline in Stellar’s price is a critical concern for traders and investors. With XLM now trading below $0.22, analysts are closely monitoring the potential repercussions of this downward trend. The support level at $0.20 represents a significant threshold; falling below this point could lead to a cascade of selling, as traders may panic and cut their losses. It’s essential to understand the broader cryptocurrency trends influencing this movement, as market dynamics can heavily impact XLM’s performance.

Additionally, the influence of Bitcoin on altcoins remains a vital factor in Stellar’s price forecast. As Bitcoin attempts to stabilize near its support, the sentiment trickles down to altcoins like XLM. If Bitcoin fails to rally and consolidates lower, it could instigate a similar response in Stellar. Keeping a close eye on both Bitcoin’s performance and the established support levels for XLM will provide valuable insights for investors navigating this volatile market.

XLM’s Support Levels and Price Predictions

Investors need to be aware of the key support levels in XLM’s trading history to formulate a sound price prediction. The immediate support at $0.20 has historically functioned as a bullish zone, where buyers have previously stepped in to defend against declines. However, with current market trends pointing towards growing bearish sentiments, this level could be tested in the coming days. Understanding these XLM support levels is crucial, as any breakdown could indicate further weakness in the altcoin.

Moreover, with the current market atmosphere favoring bears, analysts emphasize the importance of observing buy/sell volumes. If XLM cannot bounce back above $0.22, it may suggest ongoing bearish pressure, pushing prices lower. Conversely, positive developments in the cryptocurrency space or a surge in institutional interest could revive bullish sentiments and may propel XLM toward its previous highs, resulting in a more optimistic price prediction.

Understanding Bitcoin’s Impact on Altcoins and XLM

The relationship between Bitcoin and altcoins is pivotal in determining the latter’s market performance. The current bearish phase experienced by Bitcoin has replicated feelings of uncertainty across the cryptocurrency landscape, affecting coins like XLM. When Bitcoin undergoes significant fluctuations, such as recent dips towards its support levels, altcoins typically follow suit. This correlation becomes critical for analysts attempting to predict XLM’s price actions based on Bitcoin’s movements.

In light of this correlation, investors must remain vigilant about Bitcoin’s price trends, as these can signal upcoming movements in XLM and other altcoins. If Bitcoin manages to reclaim a foothold and rise beyond recent resistance, it’s likely that XLM may also reflect positive gains. Conversely, if Bitcoin’s bearish trends persist, the pressure on Stellar may result in increased volatility, leading to more substantial declines towards critical support zones.

Stellar Price Analysis and Technical Indicators

Examining Stellar’s price performance through a technical lens reveals a concerning landscape for XLM. Currently, with prices trading below essential moving averages, investor confidence wanes as bearish signals dominate the charts. The failure to maintain critical moving averages, specifically the 50-day and 200-day, raises alarm bells and prompts traders to reassess their positions. If these technical indicators don’t show signs of recovery, further decline toward multi-year lows remains a possibility.

In contrast, examining various indicators beyond moving averages can provide additional context for Stellar’s price trajectory. For instance, the Relative Strength Index (RSI) has recently dipped, suggesting that the asset could be oversold. While short-term dips could lead to buying opportunities, the prevailing sentiment indicates that caution is paramount. Traders may consider setting strategic entry points or protective stops to mitigate risk in light of XLM’s current bearish outlook.

Future Outlook for XLM Amid Overall Market Sentiment

As market sentiment fluctuates, the future outlook for XLM appears clouded. Many industry experts expect that if global cryptocurrency trends do not shift towards recovery, XLM and other altcoins will likely follow in decline. The bearish sentiment that dominates currently is compounded by macroeconomic uncertainties that also affect Bitcoin. Those involved with Stellar need to stay informed about these broader market conditions to better gauge potential price movements.

However, the broader market can also create opportunities. If a turnaround occurs in market sentiment, especially if Bitcoin rebounds decisively, XLM could see a corresponding increase in value. Investors should keep an eye on market catalysts that could propel prices upward, such as regulatory developments or institutional investment trends, as these factors may significantly influence future price levels for XLM.

How Market Psychology Influences Stellar’s Price Movements

The psychological aspect of trading often plays a pivotal role in the movements of Stellar’s price. Fear and greed heavily influence market sentiment, driving traders to make decisions that often lead to rapid price fluctuations. A market engulfed in fear, particularly with XLM crashing below $0.22, may lead to panic selling, further driving the price down, especially if the $0.20 support level fails. Understanding this psychological impact is essential for investors looking to navigate the current trading environment.

On the other hand, positive news or speculative trading can create momentum, causing a shift in sentiment that might support Stellar’s rebound. Investors attentive to changes in market psychology can better position themselves in such volatile conditions, whether that means taking profit on existing positions or instating stops to minimize losses in particularly unfavorable situations. Both psychological analysis and technical indicators contribute to a well-rounded understanding of Stellar’s potential price futures.

The Role of Institutional Investors in Stellar’s Market Performance

The growing interest from institutional investors has become a notable trend in recent years, impacting Stellar’s market performance significantly. As institutional players enter the cryptocurrency space, they bring substantial capital and contribute to price stabilization and upward momentum. This influx of investment could shield XLM from typical market dips driven by retail sentiment alone. Consequently, keeping watch over institutional involvement will be essential in determining the future trajectory of Stellar’s price.

However, the presence of institutional investors also comes with its challenges; their trading actions can introduce volatility. For instance, if significant sell-offs occur from these entities during bearish trends, they can further exacerbate price declines for XLM. Therefore, monitoring the behavior of institutional investors, alongside market conditions, will be necessary for creating informed predictions about Stellar’s price direction moving forward.

Technical Breakdowns Reveal Fundamental Strengths and Weaknesses

Technical analysis plays an essential role in uncovering the underlying strengths and weaknesses of Stellar in the cryptocurrency market. The recent technical breakdowns have showcased weaknesses, prompting concern that XLM may continue to struggle in an environment increasingly dominated by bearish sentiment. Analysts often look for signs of recovery or strong support levels to identify potential buying opportunities amidst the volatility, using these technical aspects to guide their approach.

Furthermore, understanding these technical signals allows investors to grasp market psychology better. The prevalence of bearish trends can often lead to market overreactions, where prices drop more substantially than warranted by fundamentals. Thus, trading decisions based on technical analysis have the potential to yield profitable outcomes, especially if investors capitalize on subsequent recoveries following extensive corrections.

Navigating Stellar’s Future: Investment Strategies in Uncertain Markets

As the market navigates uncertain waters, developing robust investment strategies for trading Stellar is imperative. Given the current sentiment, traders may look towards employing risk management techniques, like setting stop-loss orders to safeguard against further declines below critical support levels. Holding a diversified portfolio that includes both XLM and other cryptocurrencies can also mitigate risks associated with individual asset volatility. Strategic allocation of funds will be essential for maintaining resilience in the face of unpredictable market movements.

In addition to risk management, having a plan for potential market upswings will be vital for leveraging opportunities when they arise. Observing key resistance levels, such as $0.23 for XLM, can provide better exit points for those looking to capitalize on profitable positions. The ability to adapt to changing market landscapes and maintain flexibility in investment strategies will be crucial as Stellar navigates its future amidst prevailing uncertainties.

Frequently Asked Questions

What are the key support levels in the Stellar price forecast for XLM?

In the current Stellar price forecast, key support levels for XLM are identified at $0.22 and $0.20. A drop below these levels could signify greater bearish pressure, potentially leading to a decline towards multi-year lows at $0.18 and $0.14.

How does Bitcoin’s performance impact the Stellar price analysis for XLM?

Bitcoin’s performance heavily influences the overall cryptocurrency market, including Stellar price analysis. Current trends suggest that as Bitcoin approaches its support levels, altcoins like XLM also face downward pressure, contributing to a bearish outlook in the Stellar price forecast.

What factors are currently influencing the cryptocurrency trends affecting XLM?

Current cryptocurrency trends affecting XLM include increased selling pressure in the market, bearish sentiment from traders, and a notable decrease in open interest on derivatives. These factors are central to the current Stellar price forecast, indicating potential challenges for a bullish recovery.

What is the XLM price prediction if it breaches the $0.20 support level?

If XLM breaches the critical $0.20 support level, the price prediction leans towards further declines, potentially targeting multi-year lows around $0.18 and $0.14. This scenario is reinforced by growing bearish sentiment and ongoing technical sell signals.

How can the technical indicators be interpreted in the Stellar price forecast for XLM?

Technical indicators in the Stellar price forecast show that XLM is trading below its 50-day and 200-day moving averages, indicating a bearish structure. The rejection at previous support levels suggests resistance at $0.22 and $0.25, contributing to an anticipated downward trend if the price fails to hold above $0.20.