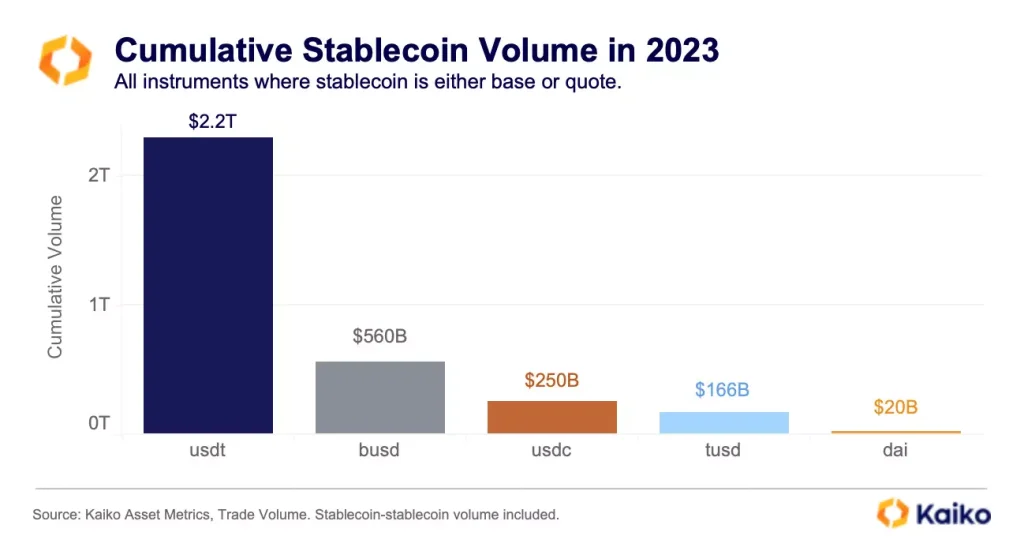

In 2025, stablecoin trading volume reached a staggering $33 trillion, setting a new historical record that reflects the explosive growth of digital currencies. According to a report by Bloomberg, the global trading volume for these cryptocurrencies surged by 72% year-on-year, fueled by a pro-crypto policy environment that has facilitated greater adoption. Leading the charge, USDC, issued by Circle, topped the charts with a trading volume of $18.3 trillion, while Tether’s USDT maintained a strong presence at $13.3 trillion. Together, these two stablecoins dominated the landscape, accounting for the vast majority of trading activity. This remarkable achievement highlights not only the rising importance of stablecoins in the global financial system but also emphasizes the need for further regulatory developments as we approach the 2025 stablecoin market.

The phenomenal rise in the liquidity and acceptance of crypto-backed currencies, often referred to as stablecoins, has garnered substantial attention recently. With alternative digital tokens like the USD Coin (USDC) and Tether (USDT) leading the way, the overall market is witnessing unprecedented patterns in digital asset trading. The increase in stablecoin trading volume results from various factors, including supportive legislation and heightened interest from institutional investors seeking a more stable crypto alternative. As these digital currencies become woven into the fabric of global finance, they are poised to change the traditional dynamics of monetary transactions. Analysts note that the continued trend in stablecoin growth is shaping a new era for digital economies, warranting close examination of how emerging crypto policies will influence their future.

The Rise of Stablecoin Trading Volume in 2025

In 2025, stablecoin trading volume reached a staggering $33 trillion, marking a monumental shift in the cryptocurrency landscape. This record-breaking volume reflects the growing acceptance and integration of stablecoins within the broader financial ecosystem. Such an uptick can be attributed to several factors, including increased consumer adoption and advancements in blockchain technology, enhancing the usability and stability of these digital currencies.

An astounding 72% year-on-year increase highlights not only the significant demand for stablecoins but also their role as a fundamental component in various financial applications. The shift towards tangible financial instruments has seen stablecoins like USDC and USDT gain traction as alternatives to traditional fiat currencies, particularly for cross-border transactions.

USDC and Tether: Leaders in Stablecoin Trading

Of the $33 trillion in stablecoin trading volume, USDC issued by Circle led the pack with a monumental trading volume of $18.3 trillion. This growth can be attributed to its strong backing by cash and cash equivalents, assuring users of its stability and reliability. With a focus on compliance and transparency, USDC has positioned itself as a preferred choice for investors and businesses alike in an increasingly volatile market.

Tether’s USDT, with a trading volume of $13.3 trillion, also played a critical role in the stablecoin market, maintaining its reputation as the most widely used stablecoin globally. As these leading stablecoins capture the vast majority of trading activity, they continue to establish themselves as essential tools for trading, payments, and liquidity management in the crypto markets.

Impact of Crypto Policy on Stablecoin Growth

The pro-crypto policy environment announced by the Trump administration significantly boosted the use of stablecoins in 2025. By signaling a more welcoming attitude towards cryptocurrencies, these policies fostered innovation and encouraged a broader base of financial market participants to engage with stablecoins. This influx of interest from both retail and institutional investors transformed the way stablecoins were utilized in trading and payments.

The positive policy stance not only bolstered trading volumes but also instilled confidence among users regarding regulatory frameworks surrounding stablecoins. This growing stability and compliance with emerging regulations have positioned stablecoins as a cornerstone of modern finance, paving the way for their increased utility in everyday transactions.

Future Projections for the Stablecoin Market by 2025

Looking ahead, the stablecoin market is projected to continue its robust growth trajectory. Analysts predict that by 2025, the trading volume of stablecoins will further expand, fueled by increasing demand for digital transactions and the continuous evolution of regulatory frameworks. The integration of stablecoins into payment systems, financial services, and even decentralized finance (DeFi) platforms will likely enhance their adoption and usage.

Furthermore, with innovations in technology and finance, the stablecoin landscape might see the introduction of new players entering the market. This influx of competition could drive improvements in terms of efficiency, costs, and even features offered by stablecoins, ultimately benefitting users and investors alike.

Stablecoins as Core Infrastructure for Crypto Transactions

Stablecoins have clearly emerged as a key infrastructure within the cryptocurrency ecosystem, facilitating seamless transactions across various financial platforms. Their inherent low volatility has made them ideal for trading pairs on exchanges and for settling transactions without the typical fluctuations associated with more traditional cryptocurrencies. As such, they have become indispensable for both trading settlements and cross-border capital flows.

This pivotal role underscores the utility of stablecoins beyond mere price stability; they are enabling a new era of financial services characterized by speed and efficiency. As businesses increasingly recognize the advantages of using stablecoins, their integration into payment systems and supply chains is set to redefine traditional financial paradigms.

The Role of Stablecoins in Cross-Border Transactions

Stablecoins are revolutionizing cross-border transactions by providing a stable currency alternative that mitigates exchange rate risks. Their inherent properties enable swift and cost-effective exchanges across borders, especially in regions with unstable fiat currencies or high remittance costs. As such, they serve as a beacon of financial inclusion for underserved populations who rely on remittances.

As we move toward a more interconnected global economy, the importance of stablecoins in facilitating these transactions cannot be overstated. With their ability to enhance liquidity and reduce transaction costs, stablecoins are likely to play an increasingly prominent role in global commerce by 2025.

Key Statistics of Tether USDT in 2025

Tether (USDT) remains a dominant force in the stablecoin market, primarily due to its widespread adoption and extensive trading volume, which reached $13.3 trillion in 2025. These impressive statistics highlight USDT’s significance not only as a liquidity provider but also as a trusted stablecoin among traders and investors.

As Tether continues to maintain its lead, it is essential to monitor evolving statistics that can provide insights into market trends and user behavior. By analyzing trading data and overall usage metrics, stakeholders can better understand the dynamics driving the stablecoin market and inform their strategies in the evolving crypto landscape.

The Connection Between Stablecoins and Financial Stability

The rise of stablecoins has sparked discussions around financial stability, particularly concerning their role in mitigating volatility within cryptocurrency markets. As stablecoins offer a reliable value reference amid unpredictable market conditions, their integration into trading environments has provided traders with much-needed stability. This characteristic is especially crucial during periods of high volatility, where traders seek refuge in less volatile assets.

Moreover, the adoption of stablecoins can potentially reduce systemic risks associated with traditional banking systems. By offering a decentralized alternative to traditional banking products, stablecoins enable users to maintain liquidity without needing to rely on traditional fiat currency mechanisms.

Regulatory Perspectives on Stablecoin Use

The regulatory landscape surrounding stablecoins is rapidly evolving, and with it, the need for clear guidelines becomes increasingly urgent. As governments and financial authorities seek to establish frameworks that address the unique attributes of stablecoins, compliance with these new regulations will be critical for their sustained growth and adoption.

Emerging regulations will likely focus on issues like reserve backing, consumer protection, and anti-money laundering measures. Stablecoin issuers who proactively adapt to these guidelines will not only foster consumer trust but may also find themselves at a competitive advantage in the burgeoning market as 2025 approaches.

Influence of Market Trends on Stablecoin Demand

Market trends play a vital role in shaping the demand for stablecoins, especially during tumultuous times in the crypto ecosystem. Increased volatility and uncertainty in cryptocurrency prices can lead traders to seek stability offered by stablecoins, boosting their trading volumes significantly. This propensity toward stability reinforces the necessity of stablecoins as a financial tool in times of market distress.

Additionally, as adoption grows in sectors such as e-commerce and decentralized finance, the demand for stablecoins is expected to surge. These trends indicate that stablecoins are likely to remain a prominent feature in the financial markets, enhancing their utility and reinforcing their position as necessary instruments in modern transactions.

Frequently Asked Questions

What was the stablecoin trading volume in 2025?

In 2025, the stablecoin trading volume reached an impressive $33 trillion, marking a historic milestone in the cryptocurrency market.

What factors contributed to the rapid growth of stablecoin trading volume in 2025?

The remarkable 72% year-on-year increase in stablecoin trading volume in 2025 was primarily fueled by a pro-crypto policy environment that fostered greater adoption and utility of stablecoins.

How did USDC and USDT perform in terms of trading volume in 2025?

In 2025, USDC, issued by Circle, achieved a trading volume of $18.3 trillion, while Tether’s USDT recorded a trading volume of $13.3 trillion, together dominating the stablecoin trading landscape.

What impact does crypto policy have on stablecoin trading volume?

Favorable crypto policies have a significant impact on stablecoin trading volume, as seen in 2025 when the shift towards a more supportive regulatory environment greatly enhanced the use of stablecoins in various financial transactions.

Why are stablecoins considered vital for the future of the crypto market?

Stablecoins, especially with their soaring trading volumes, are increasingly viewed as essential components of the crypto market infrastructure, facilitating payments and trading settlements, and contributing to the overall stability of the financial system.

What insights do analysts provide regarding the stablecoin market’s growth and future regulations?

Analysts note that the explosive trading volumes of stablecoins in 2025 highlight their growing importance in the global financial ecosystem, prompting increased scrutiny regarding future regulatory frameworks and policy directions.

What trends were observed in the usage of stablecoins during 2025?

The usage of stablecoins surged in 2025, particularly in payments, trading settlements, and cross-border transactions, driven by favorable policy changes that enhanced their adoption and integration into the global economy.

| Key Points |

|---|

| In 2025, stablecoin trading volume reached an all-time high of $33 trillion. |

| Trading volume surged by 72% year-on-year due to favorable pro-crypto policies. |

| USDC by Circle led with $18.3 trillion in trading volume, followed by Tether’s USDT at $13.3 trillion. |

| Stablecoins have become vital for payments, trade settlements, and cross-border transactions. |

| The growth in stablecoin trading volumes highlights their increasing significance in the financial landscape. |

Summary

Stablecoin trading volume reached unprecedented heights in 2025, totaling $33 trillion, which signifies a major evolution in the cryptocurrency market. The surge can be attributed to a supportive regulatory framework that has enhanced the confidence and usability of stablecoins globally. With leading stablecoins like USDC and USDT dominating the landscape, their roles in various financial transactions have become indispensable. As the crypto ecosystem continues to grow, stablecoins are increasingly recognized as pivotal players, prompting discussions on future regulatory considerations.

Related: More from DeFi & Stablecoins | Alchemy USDC Payment for Autonomous AI Agents | Yen