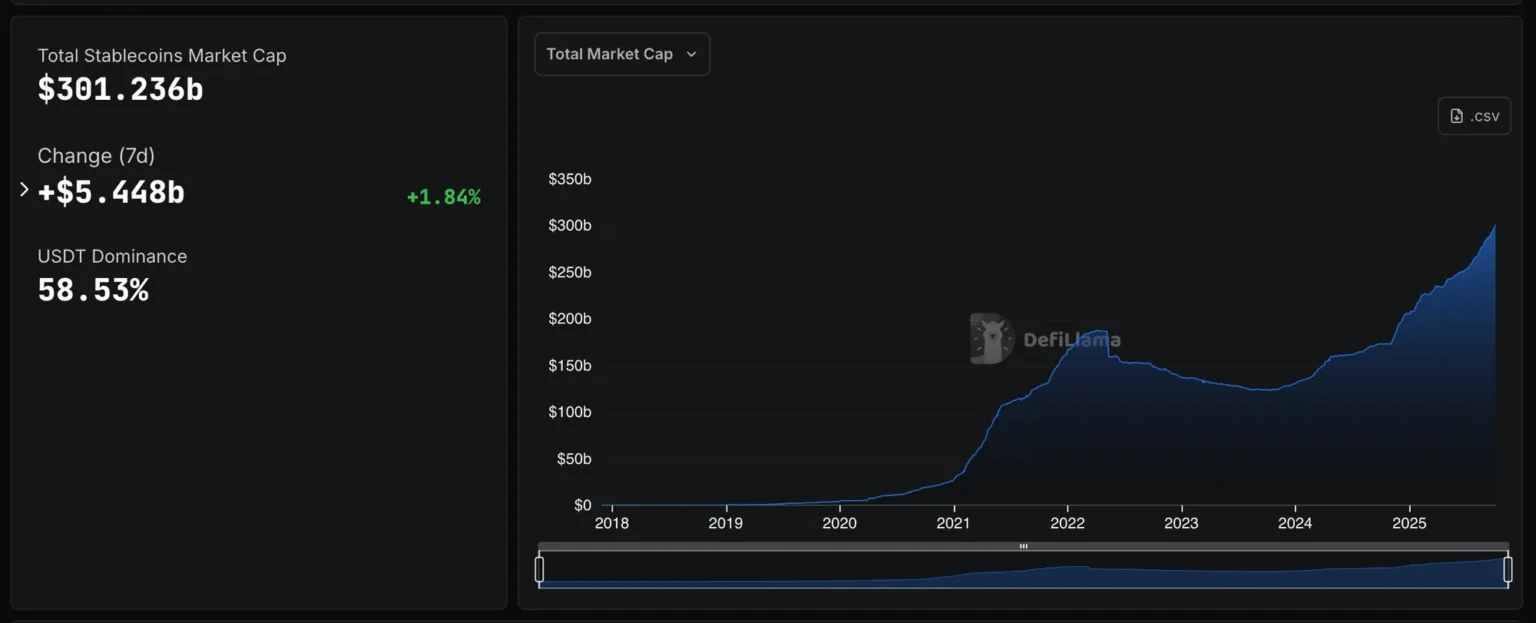

In a significant milestone for the cryptocurrency market, the total market capitalization of stablecoins has surpassed $300 billion, marking an all-time high. This surge reflects the growing acceptance and integration of stablecoins within the broader financial ecosystem, as they provide a stable alternative to the volatility often associated with traditional cryptocurrencies like Bitcoin and Ethereum.

Stablecoins are digital currencies pegged to stable assets, typically fiat currencies like the US dollar. This peg allows them to maintain a consistent value, making them an attractive option for investors and traders looking to mitigate risk. The recent increase in market cap can be attributed to several factors, including the rising demand for decentralized finance (DeFi) applications, increased institutional adoption, and the overall growth of the cryptocurrency market.

As more users turn to stablecoins for transactions, savings, and trading, their utility continues to expand. Major players in the stablecoin space, such as Tether (USDT), USD Coin (USDC), and Binance USD (BUSD), have seen significant growth in their issuance and usage, contributing to the overall market cap increase. This trend indicates a shift in how digital assets are perceived, with stablecoins becoming a cornerstone of the cryptocurrency landscape.

The implications of this growth are profound, as stablecoins not only facilitate smoother transactions but also enhance liquidity in the market. As the stablecoin market continues to evolve, it will be interesting to see how regulatory frameworks adapt to this burgeoning sector and what innovations will emerge in the coming years.