In recent weeks, spot gold has seen a significant decline, dipping to a low of $4315.28 per ounce, prompting discussions across the precious metal market. Investors are reacting to the latest reports of a gold price drop, which is raising concerns about the overall stability of the gold value decline. With current gold prices fluctuating, many are questioning the future trajectory of this traditionally safe haven asset. Spot gold news indicates that this downward trend may continue as market sentiments shift. As traders navigate these changes, understanding the implications of this decline on investment strategies becomes increasingly crucial.

The recent downturn in the gold market has raised eyebrows, as the value of gold has experienced a downward shift, causing ripples throughout the investment community. This precious metal’s current woes reflect broader market trends that investors should pay attention to. As experts analyze the ongoing decreases in gold’s worth, alternative terminology such as gold value drop or precious metal downturn captures the challenges facing investors today. These developments not only affect the current gold prices but also signal potential changes in the precious metals landscape. Keeping abreast of such fluctuations is vital for anyone involved in the precious metals sector.

Introduction to the Spot Gold Decline

The recent decline in spot gold prices has captured the attention of investors and analysts alike. With values dropping to a low of $4315.28 per ounce, many are questioning the factors contributing to this downturn in the precious metal market. As we examine the current gold prices and market dynamics, it becomes clear that various external influences are at play, leading to a depreciation in gold value.

Understanding the intricate details of the spot gold decline is crucial for making informed investment decisions. Factors such as inflation, interest rates, and geopolitical tensions often dictate the performance of gold in the market. As a result, it is essential to analyze these elements closely to grasp how they impact the current gold prices and the greater framework of gold value fluctuation.

Factors Contributing to the Gold Price Drop

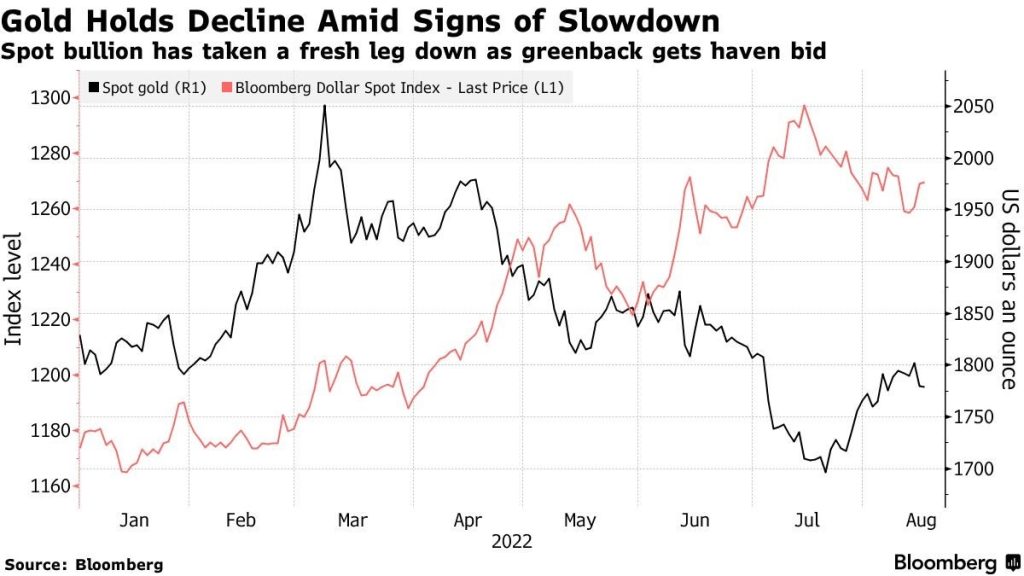

Several factors can explain the recent gold price drop, including economic indicators and global events. For instance, fluctuations in the U.S. dollar and changes in interest rates can significantly affect gold’s appeal as a safe-haven asset. When the dollar strengthens, gold prices often weaken, leading to a noticeable decline in demand and subsequently the market value of gold.

Moreover, investor sentiment plays a pivotal role in determining gold’s market dynamics. In times of economic uncertainty, many turn to precious metals as a store of value. However, when confidence in the economy returns, as seen in recent market trends, the demand for gold may diminish, further contributing to the gold value decline.

Impact of Spot Gold News on Investors

Recent spot gold news has indeed impacted investor behavior significantly, with the current decline prompting a reevaluation of investment strategies. Investors need to stay updated on price movements and market analyses to mitigate risks associated with the volatile nature of precious metals. Understanding how news events correlate with price actions can aid investors in making timely decisions.

Additionally, the response to spot gold news is often a key indicator of market sentiment. As traders react to headlines regarding economic reports or geopolitical tensions, the prices reflect this dynamic nature. Therefore, keeping track of accurate and timely information sources is crucial for those looking to navigate the intricate realm of gold investments successfully.

Evaluating the Long-Term Outlook for Gold

Despite the recent setback, many investors remain optimistic about the long-term outlook for gold. History has shown that while spot gold may experience short-term declines, it often rebounds when market conditions shift. Trends in inflation rates, currency valuations, and global economic stability can contribute to future price increases, making gold an attractive investment in the long run.

Moreover, as more investors seek alternative investments amidst increasing economic uncertainty, demand for gold could rise again. Analysts suggest that even though current gold prices reflect a decline, the fundamental value of gold as a hedge against inflation and a safeguard during market volatility remains steadfast. Investors should consider these long-term trends when evaluating their position in the precious metal market.

The Role of Geopolitical Events on Gold Prices

Geopolitical events possess a profound influence on the performance of gold in the market. Any instability or conflict can lead to increased demand for gold as a safe-haven asset, as investors seek to protect their wealth from potential losses in uncertain times. Thus, monitoring such events can provide insights into potential price rebounds, countering the current gold value decline.

Additionally, how governments and financial markets respond to geopolitical tensions often dictates the direction of gold prices. For example, tensions that lead to sanctions or military conflict can push investors toward gold, resulting in a price surge. Consequently, understanding these relationships equips investors with the necessary knowledge to anticipate potential changes in the context of spot gold price movements.

Market Analysis: Current Trends in Precious Metals

Current trends in the precious metal market are being shaped by various economic indicators and consumer behavior. The recent spot gold decline is a reflection of broader market conditions, driven by shifts in investor confidence and changing economic policies. Close examination of market data reveals essential patterns that indicate where the gold price may be headed.

Furthermore, analysts often utilize technical analysis tools to predict future price movements. By interpreting charts and market patterns, they attempt to forecast whether the gold decline will continue or if a reversal is in sight. These analytical approaches are vital for investors seeking to navigate the complexities of current gold prices and make informed decisions about their investment portfolios.

Understanding Investor Sentiment in Gold Markets

Investor sentiment significantly impacts gold market dynamics, influencing the fluctuations in current gold prices. When investor confidence wanes due to economic or political instability, demand for gold tends to rise, leading to price increases. Conversely, when optimism returns, as seen in recent market behaviors, gold prices may plummet, demonstrating the delicate balance between sentiment and market value.

Furthermore, understanding the complexities of investor psychology can provide valuable insights into potential future movements. Monitoring sentiment indicators and engagement in gold-related forums can help investors gauge market sentiments effectively, positioning themselves advantageously in anticipation of gold price adjustments.

Short Selling Strategies Amid Gold Price Decline

In light of the current gold price decline, some investors may employ short-selling strategies as a means to capitalize on the downward trends. This trading method involves selling gold futures or ETFs with the intention to buy at lower prices later. By understanding market conditions and timing their trades effectively, investors can potentially profit from short positions during periods of gold value decline.

However, engaging in short-selling carries inherent risks, particularly in a volatile market. Therefore, comprehensive knowledge of the precious metal landscape, along with precise execution and risk management strategies, is essential for investors opting for this approach. Analyzing market trends, as well as balancing short positions with long-term investments, can create a more robust trading strategy.

Incorporating Gold into Diversified Investment Portfolios

Despite the recent dip in spot gold prices, incorporating gold into diversified investment portfolios remains a strategic decision for many investors. Precious metals often provide a hedge against market volatility and inflation, making them a valuable component of a well-rounded investment strategy. As gold often moves independently of stocks and bonds, it can help mitigate overall portfolio risk.

Moreover, the unpredictability in the precious metal market means that fluctuations like the current gold value decline can be viewed as an opportunity for strategic purchasing. Investors aiming to maintain a diversified portfolio should consider allocation percentages for gold, balancing it with other asset types to achieve financial resilience during economic fluctuations and uncertainty.

Conclusion: The Future of Gold Investment

In conclusion, while the spot gold decline has caused many to reasses their investment strategies, it’s essential to consider the broader context of gold investing. Historical data suggests that gold often recovers from downturns, making it a timeless asset for strategic investors. Keeping an eye on macroeconomic indicators will provide insights into potential resurgences in gold value.

Investors are encouraged to adopt a long-term perspective in the precious metal market. By monitoring trends, understanding the factors influencing current gold prices, and re-evaluating their strategies accordingly, they can better navigate the complexities of gold investing and capitalize on future opportunities as market conditions evolve.

Frequently Asked Questions

What factors have contributed to the recent spot gold decline?

The recent spot gold decline can be attributed to several factors including fluctuations in interest rates, changes in investor sentiment, and shifts in the precious metal market. Economic indicators showing strength in other asset classes have also led to diminished demand for gold, resulting in a drop in current gold prices.

How does the current gold prices reflect the spot gold decline?

Current gold prices that show a spot gold decline indicate a significant drop in value, with spot gold recently hitting a low of $4315.28 per ounce. This decline reflects market reactions to economic conditions, investor behavior, and demand for gold as a safe-haven asset.

What does the gold value decline mean for investors?

The gold value decline signals potential opportunities and risks for investors. As spot gold prices decrease, it could attract bargain hunters seeking to invest at lower levels. However, it also raises concerns about the overall health of the precious metal market and might indicate a fundamental shift in market dynamics.

Are there predictions for the future of spot gold following this decline?

Predictions for the future of spot gold post-decline are cautiously optimistic among analysts, who suggest that if economic conditions stabilize or geopolitical tensions rise, we may see a rebound in gold prices. Monitoring spot gold news will be crucial for any changes in this trend.

How do global economic conditions impact the spot gold decline?

Global economic conditions significantly impact the spot gold decline. Economic growth can lead to a preference for equities over gold, decreasing demand for precious metals. Additionally, rising interest rates generally strengthen the dollar, which inversely affects gold value, thereby causing a decline in spot gold prices.

What can investors do in response to the current decline in spot gold prices?

In response to the current decline in spot gold prices, investors may consider diversifying their portfolios by incorporating a mix of assets. Monitoring market trends and expert advice could also help in making informed decisions about when to buy or sell in the precious metal market.

| Key Point | Details |

|---|---|

| Current Spot Gold Price | $4315.28 per ounce |

| Market Trend | Turning to decline |

| Date of Report | January 2, 2026 |

| Source | Odaily Planet Daily News |

Summary

The recent spot gold decline is marked by a significant drop in price, reaching a low of $4315.28 per ounce. This downturn reflects the ongoing adjustments in the precious metals market, signaling potential concerns among investors. Factors influencing this trend may include economic indicators, shifts in demand, and investment sentiment towards gold as a safe haven asset.

Related: More from Market Analysis | Earnings season is wrapping up with a mixed bag of results across | Polymarket Bet Fails to Catch Insider Traders