S&P Global’s Integration with Chainlink Fails to Boost LINK’s Market Value

In an unexpected development in the cryptocurrency and blockchain industry, S&P Global’s recent decision to integrate with the decentralized oracle network, Chainlink, has not led to the anticipated boost in the market value of Chainlink’s native token, LINK. This development comes as a surprise to many investors and analysts who had high expectations from the collaboration, typically foreseeing a positive impact on LINK’s market performance.

Background on the Integration

S&P Global, a leading provider of transparent and independent ratings, benchmarks, analytics, and data to the capital and commodity markets worldwide, announced its integration with Chainlink earlier this year. The collaboration was intended to allow S&P Global to securely connect their data with decentralized finance (DeFi) applications, using Chainlink’s widespread and trusted oracle network. This partnership was seen as a significant endorsement of blockchain technology and a step forward in bridging traditional financial data with emerging decentralized platforms.

Expectations Vs. Reality

Historically, similar integrations and partnerships have led to increased trust and credibility of the blockchain projects involved, typically reflected through a rise in the market value of the associated tokens. However, in the case of Chainlink and S&P Global, the immediate financial outcomes did not align with the expectations.

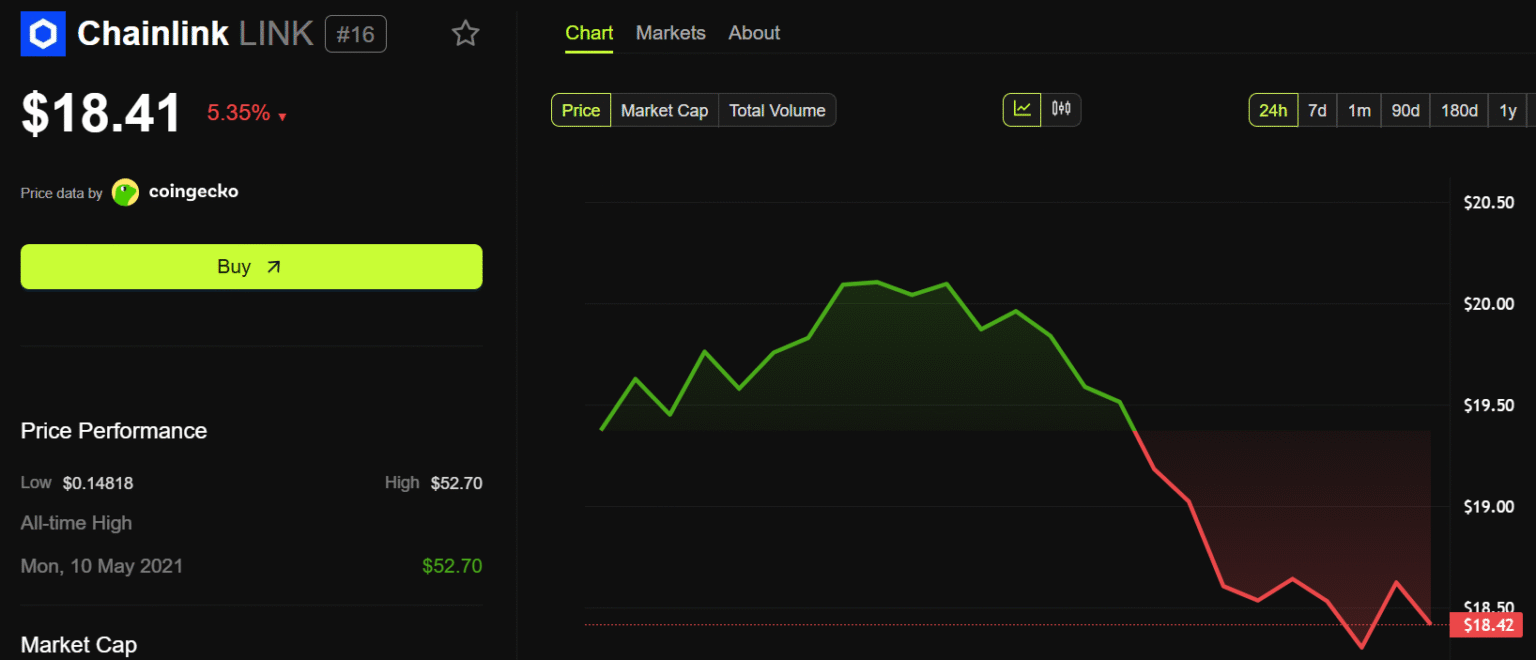

Despite S&P Global’s prestigious reputation and its potential to bring massive amounts of premium, real-time data into the blockchain ecosystem, the LINK token did not experience the projected increase in market value. As of the latest market checks, LINK has relatively remained stagnant, showing mild fluctuations that fall in line with general market trends.

Possible Reasons for the Stagnant Market Response

Several factors could be contributing to the less-than-stellar performance of LINK following the announcement. Firstly, the broader cryptocurrency market has been experiencing a period of volatility and uncertainty, possibly overshadowing individual token advancements and integrations. Moreover, the market might be showing signs of maturity, responding less dramatically to news and more on fundamental developments and long-term value creation.

Secondly, the details of the integration could have played a part. If the market perceives the collaboration as not substantial enough to change the fundamental valuation of the network, or sees the implementation timeline as too extended, the price of LINK might not have an immediate positive impact.

Additionally, there is the aspect of competition and innovation. With numerous DeFi projects and oracles coming up, Chainlink faces stiff competition in both the decentralized and centralized sectors of data handling and integration. As such, even a significant partnership like that with S&P Global may not suffice to generate significant market excitement.

Conclusion

While the integration of S&P Global with Chainlink does represent a forward leap in terms of technological and operational collaboration between traditional financial data providers and blockchain networks, its immediate impact on LINK’s market value has been surprisingly muted. This scenario serves as a reminder that in the volatile world of cryptocurrencies, not all partnerships result in quick gains, and fundamental value often takes precedence over short-term market movements.

Looking ahead, it will be crucial to monitor how this partnership develops and what tangible impacts it has on the Chainlink network, beyond token price alone. Could the real value of this partnership be realized in the strategic advancements and broader adoption of blockchain technology? Only time will tell. Meanwhile, investors and market watchers may need to adjust their expectations and focus more on long-term outcomes and integrations rather than immediate market reactions.