Solana Struggles to Regain Ground After $130 Million Sell-Off: What’s Next for the Blockchain Platform?

In the volatile world of cryptocurrencies, significant sell-offs can lead to drastic drops in value and shaken investor confidence. Solana, a prominent blockchain platform known for its high-speed transactions and scalability, is currently grappling with this challenge. Following a $130 million sell-off, the price of Solana’s native cryptocurrency, SOL, has struggled to hold above the $200 mark, raising concerns and speculations about its short and long-term future.

The Sell-Off: Causes and Consequences

The recent $130 million sell-off in Solana can be attributed to a mix of factors. Experts point to macroeconomic pressures such as rising interest rates, inflation concerns, and the ongoing geopolitical tensions that have created a risky environment for all kinds of investments, including cryptocurrencies. Additionally, some investors have expressed concerns over technical issues within the Solana network, including network outages in the past, which have spurred moments of volatility and unease among the community.

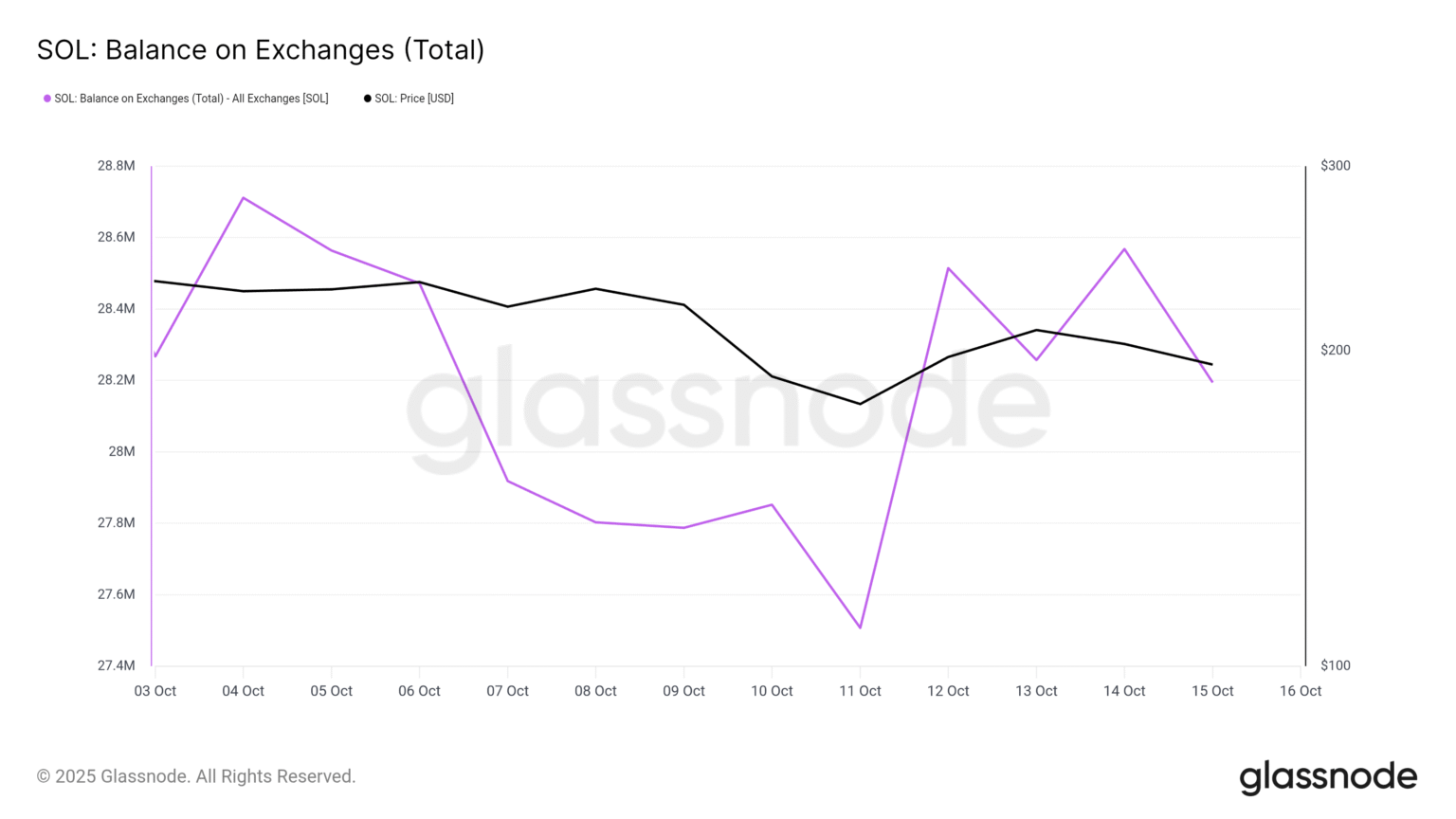

When large amounts of SOL were sold off, it not only pushed the price below the psychological barrier of $200 but also raised liquidity issues and heightened fears of further depreciation. This price point is crucial as it is considered a stabilizing level where Solana had previously found strong support during upward and downward trends.

Market Reaction and Investor Sentiment

The market’s reaction to Solana’s recent sell-off has been mixed. While some investors see this as a buying opportunity, betting on Solana’s strong fundamentals and potential for recovery, others remain cautious, adopting a wait-and-see approach. The apparent loss of confidence, for now, is evident in trading volumes and the hesitant behavior of market participants.

Cryptocurrency enthusiasts and analysts are closely watching key indicators and sentiment analysis to gauge the next moves. If Solana continues to struggle below $200, it could trigger further sell-offs, compounding the challenges it faces. Conversely, a strong rebound could restore confidence and attract new investments to the network.

Technical Insights and Future Prospects

From a technical standpoint, Solana’s infrastructure still holds promise. Known for its ability to process thousands of transactions per second (TPS) at a lower energy cost compared to competitors like Ethereum, Solana remains an attractive proposition for developers and users seeking efficiency and scalability in decentralized applications (dApps).

Looking to the future, the Solana Foundation has outlined several updates and projects aimed at addressing the network’s robustness and attracting more users. This includes enhancements in network stability, security measures, and partnerships that could broaden its use cases beyond the typical decentralized finance (DeFi) applications.

Moreover, as the overall cryptocurrency market continues to mature, networks like Solana may benefit from increased adoption and a better regulatory landscape. How well Solana can leverage its technological advantages while overcoming current challenges will be crucial in determining its place in the competitive cryptocurrency sphere.

Conclusion

The recent $130 million sell-off has undoubtedly put Solana in a challenging position. As it hovers below the $200 level, the path forward is uncertain but not devoid of opportunity. Whether Solana can quickly restore confidence among investors and users and capitalize on its technological potential will be key to its recovery and future growth. In the highly unpredictable and dynamic world of cryptocurrencies, resilience and adaptability are indispensable, and how Solana responds to these challenges will be closely watched by stakeholders across the board.