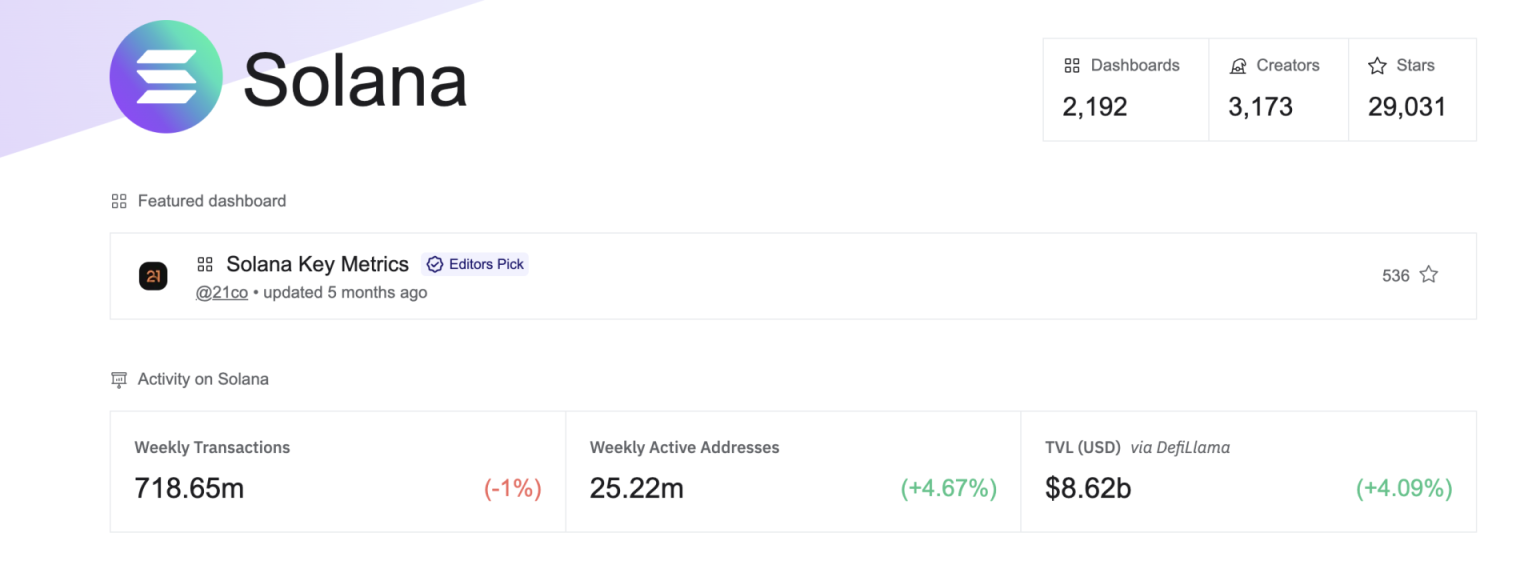

The Solana price outlook has been a topic of keen interest in the cryptocurrency community, especially considering the recent downturn that saw SOL drop to $90 amid significant market liquidations. As the bears test this crucial support level, analysts are exploring Solana price prediction trends in light of current cryptocurrency market dynamics. With Bitcoin and Ethereum also experiencing declines, the overall crypto market sentiment remains bearish, intensifying the focus on SOL price analysis. The wave of liquidations, particularly in leveraged positions, has impacted not only Solana but various leading altcoins, leaving traders wary of potential further losses. Nevertheless, with projections from Standard Chartered anticipating a rally to $250 by 2026 and $2,000 by 2030, the future of Solana may hold promising possibilities despite its struggles in the current climate.

Examining the future of Solana through alternative lenses, the SOL price forecast is heavily influenced by recent market activities, particularly the fallout from the extensive liquidations transpiring within the broader crypto landscape. The ongoing cryptocurrency trends have led many investors to keep a close watch on Solana’s performance, as its recent price movements demonstrate a distinct connection to general market sentiment. Furthermore, significant shifts in the liquidation rates of SOL positions have highlighted the risks associated with high leverage during volatile periods. As Sentiment remains predominantly negative, traders are increasingly intrigued by potential recovery levels, making Solana a point of interest for both cautious investors and seasoned market participants alike. Amidst these fluctuations, comprehensive SOL price assessments remain vital for understanding the altcoin’s place within the ever-evolving digital currency market.

| Key Points |

|---|

| Solana price fell to $90 due to massive liquidations in the crypto market. |

| Bitcoin and Ethereum also dropped sharply, impacting market sentiment. |

| Standard Chartered predicts Solana will reach $250 by 2026 and $2,000 by 2030. |

| In the last 24 hours, Solana saw a drastic 10% drop, indicating high market volatility. |

| There have been significant liquidations in Solana-based platforms, totaling over $70 million. |

| The bearish market trend has resulted in excessive leverage among traders being cleared out. |

| Current technical indicators suggest a bearish outlook for Solana, trading below its 50-day moving average. |

| Standard Chartered’s bullish prediction contrasts with the current bearish market sentiment. |

Summary

The Solana price outlook indicates a challenging phase for the cryptocurrency, particularly as it tests the $90 support level amid large-scale liquidations. Despite the significant downturn entailing a 10% drop and a bearish sentiment throughout the crypto market, optimistic forecasts from institutions like Standard Chartered offer a glimmer of hope. They project potential recovery, with Solana possibly reaching $250 by 2026, reflecting resilience in the face of current adversities. However, the market’s volatility and the looming threats of further declines under the psychological threshold of $100 warrant cautious optimism.

Current Solana Price Outlook

The current price outlook for Solana (SOL) paints a concerning picture as it recently dipped below the psychologically important threshold of $100, hitting lows around $90. This dramatic drop aligns with broader cryptocurrency trends, where we have seen significant sell-offs in major digital assets like Bitcoin and Ethereum, dragging the price of numerous altcoins down. Such liquidations have reached unprecedented levels, with Solana itself witnessing over $70 million in forced selling, primarily from long positions. The dramatic volatility showcases a bearish sentiment pervasive in the market, impacting both small individual investors and large treasury companies investing in Solana.

Traders and analysts are closely monitoring this price action, as the psychological impact of dropping below $100 may further demoralize bullish sentiment in the market. The accompanying trend of liquidity contractions indicates ongoing challenges for Solana’s recovery, especially in light of the excessive leveraging seen across the crypto landscape. While some forecasts suggest potential recovery due to future market dynamics, the immediate sentiment and technical indicators point towards heightened caution among Solana traders.

Impact of Massive Liquidations on Cryptocurrency Markets

The wave of liquidations sweeping through the cryptocurrency markets has had a profound impact on trading sentiment and price stability. As Solana faced massive liquidations amounting to over $70 million, the broader cryptocurrency market experienced similar pressures with Bitcoin and Ethereum also falling to multi-month lows. With a market environment characterized by excessive leverage, this mass forced selling has magnified price declines, further contributing to investor uncertainty. The historical performance of assets during periods of liquidation serves as a reminder of the inherent risks associated with highly leveraged positions.

These events not only affect individual asset prices but also shape overall market dynamics, creating a ripple effect across the crypto ecosystem. High-profile investors witnessing significant unrealized losses are reevaluating their strategies and investment positions, amplifying a negative feedback loop. Consequently, savvy traders are now looking for indications of stability, hoping for a return of bullish trends in assets like Solana despite the overwhelming bearish narrative prominently evident in the market.

Solana Price Prediction for 2026 and Beyond

In light of the recent market downturn, Solana price predictions have evolved significantly, yet there is still a mix of bullish and bearish outlooks for the future. Analysts from Standard Chartered have revised their 2026 price forecast for SOL down to $250, citing the impact of macroeconomic conditions and liquidation fallout as contributing factors to this adjustment. Despite the short-term volatility depicted in SOL’s price action, the longer-term forecast remains optimistic, with predictions of the asset reaching levels as high as $2,000 by 2030, contingent upon market recovery and renewed investor interest.

Key aspects influencing Solana’s potential recovery include shifts from speculative investments back to solid altcoins, alongside increased adoption for decentralized applications (dApps) powered by the Solana blockchain. As the crypto market evolves, shifts in investor sentiment and behavior may strategically position Solana to benefit from the next wave of growth. Traders are encouraged to stay vigilant and continuously analyze market trends and indicators, especially in times of relative instability, to maximize their positioning as the landscape unfolds.

Understanding Crypto Market Sentiment

Crypto market sentiment plays a crucial role in determining price movements, especially for highly volatile assets like Solana. Recent data showcase an overwhelmingly bearish sentiment as investors react to the rapid liquidations and severe price adjustments seen across major cryptocurrencies. The collective view on market dynamics, influenced by factors such as market news, investor psychology, and evolving trends, can drastically alter how traders approach their positions in Solana and other altcoins. As such, grasping the underlying sentiment is essential for forecasting future price movements.

Utilizing sentiment analysis tools can provide traders with insight into the prevailing attitudes towards Solana, helping them to make more informed decisions. With significant price drops amidst shifting sentiments, the importance of understanding not just technical factors but also market psychology cannot be overstated. This rounded view allows investors to gauge when it might be prudent to enter or exit positions, especially in environments characterized by rapid price changes and heightened volatility.

Key Trends Influencing Solana’s Future

Several key trends are shaping Solana’s future trajectory within the cryptocurrency landscape. Firstly, the increasing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs) has highlighted Solana’s potential as a scalable blockchain capable of handling high transaction speeds and low fees. This capability places Solana in a favorable position to capture significant market share as more users migrate from slower or fee-crippled networks, potentially countering the recent bearish trends observed in price movements.

Additionally, the influence of macroeconomic factors cannot be ignored. As traditional financial markets grapple with inflation and interest rate fluctuations, the behavior of institutional investors towards cryptocurrencies like Solana is likely to evolve. There is a consensus that the contrasting dynamics of traditional finance against the backdrop of a rapidly maturing cryptocurrency market can spark new interest in Solana, enabling it to reclaim some of its losses and initiate a bullish trend as users seek alternatives in challenging times.

Analyzing Solana’s Technical Indicators

Technical analysis offers critical insights into Solana’s current and prospective price movements. Currently, Solana trades under its 50-day moving average, which suggests a weak trend and reinforces the bearish outlook among traders. Indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) depict oversold conditions, hinting that a potential reversal could be on the horizon if buying pressure returns, although caution is advised given the current high leverage environment.

Monitoring these technical indicators is essential for traders aiming to capitalize on potential price rebounds. By keeping an eye on support and resistance levels, coupled with broader market sentiments, traders can better position themselves. Solana’s price action could signal entry points for those looking to take advantage of any recovery and could be used as a guide for setting stop-loss orders to manage risks effectively in these volatile conditions.

The Role of Liquidations in Cryptocurrency Trading

Liquidations have emerged as a significant force in the cryptocurrency trading landscape, particularly during periods of extreme volatility. In Solana’s recent case, the $70 million in liquidations have had severe repercussions, serving as a stark reminder of the precarious nature of high-leverage trading. Such liquidations occur when the value of margin positions falls below required maintenance levels, forcing automatic sell-offs that can exacerbate price declines, leading to more liquidations in a cascading effect.

This mechanism not only affects individual traders but also contributes to wider market instability, making it crucial for participants to remain aware of their leverage and position management. By understanding how liquidation events function, traders can better navigate the complexities of the cryptocurrency market, implementing more stringent risk management protocols to protect themselves from forced selling during extreme price swings.

Market Dynamics Surrounding Solana’s Trading Position

The market dynamics currently surrounding Solana’s trading position reveal a particularly turbulent atmosphere, where rapid shifts can occur within hours. The interplay between bullish and bearish sentiments plays a pivotal role in defining price trajectories, especially when deep liquidations drive emotions in trading. When Solana dropped to $90 amid significant sell-offs, it highlighted the fragility of market confidence, raising concerns about sustainability for future price stability.

Understanding these dynamics allows traders to identify possible tipping points where bullish sentiment could recoup losses or further declines could materialize. As Solana navigates market pressures, ongoing analysis of market forces, coupled with informed sentiment readings, can equip traders with a strategic advantage to navigate through uncertainty and capitalize on favorable shifts.

Investor Strategies During Bear Markets

In the face of current bear market conditions, savvy investors are re-evaluating their approaches. The recent downturn in Solana’s price offers strategic lessons on effective risk management and diversified investment strategies. Investors should consider adopting a defensive posture, focusing on asset allocation that balances risk and reward. This could involve holding cash reserves or stablecoins to capitalize on lower entry points in the future when bullish sentiment resurfaces.

Additionally, employing dollar-cost averaging in buying Solana or other cryptocurrencies could mitigate the impact of volatility. This approach allows investors to gradually accumulate positions rather than risking significant capital based on short-term price speculation. By embracing these strategies, traders can position themselves for long-term success while navigating the inherent risks presented by current market conditions.

Frequently Asked Questions

What is the current Solana price outlook amid recent market trends?

The current Solana price outlook reflects a bearish sentiment in the cryptocurrency market, with SOL dropping to around $90 amid massive liquidations. This decline is in alignment with broader market pressures impacting Bitcoin and Ethereum, further indicating a challenging environment for altcoins.

How do recent liquidations affect Solana price predictions?

Recent liquidations significantly impact Solana price predictions, as over $70 million in liquidations were noted within 24 hours. This forced selling has intensified the downward pressure on the price of Solana, causing it to trend lower and leading to forecasts anticipating a potential drop to around $70 if market conditions worsen.

What are the factors influencing the Solana price outlook for 2026 and beyond?

Several factors influence the Solana price outlook for 2026 and beyond, including macroeconomic conditions, capital flows, and shifts in crypto market sentiment. Standard Chartered forecasts SOL may rally to $250 by 2026 and even reach $2,000 by 2030, contingent on recovery in market stability and the adoption of stablecoins.

How can Solana overcome its current price challenges?

To overcome current price challenges, Solana must stabilize above the critical $90 level. This requires clearing excessive leverage, reducing liquidation pressures, and attracting bullish sentiment back to the cryptocurrency market. A recovery trend could be supported by improved market sentiment and capital inflows into Solana.

What does the technical analysis indicate for Solana’s future price movements?

Technical analysis shows Solana trading below its 50-day moving average, which supports a bearish outlook. The RSI and MACD indicators also reflect negative trends. To improve its price outlook, SOL needs to break above these technical resistance levels and regain investor confidence in a recovery phase.

What is the impact of overall crypto market sentiment on Solana’s price outlook?

The overall crypto market sentiment has a profound impact on Solana’s price outlook. Currently, bearish sentiment has led to substantial price declines across the board, including SOL’s recent drop. Positive shifts in market sentiment could reverse the current trends and provide a more favorable outlook for Solana’s price.