In recent times, Solana on-chain trading volume has surged to an impressive $1.6 trillion, making it a formidable player in the cryptocurrency landscape. This milestone not only highlights Solana’s growing importance but also showcases a significant shift in cryptocurrency trading trends, as more traders embrace decentralized platforms over traditional methods. The rise of Solana’s trading volume reflects a broader transition in the market, where centralized exchanges, including Binance, have seen a notable decline in market share. With this rapid increase in on-chain trading, Solana has emerged as a competitor, outperforming notable players like Coinbase and Bybit. As cryptocurrency enthusiasts continue to seek efficiency and lower fees, Solana’s on-chain solutions are poised to reshape the future of digital asset exchanges.

Exploring the landscape of digital asset transactions, Solana’s impressive on-chain transaction volume stands out at a remarkable $1.6 trillion. This figure not only positions Solana as a leader in decentralized finance but also signals a broader migration of cryptocurrency traders away from centralized platforms. As users increasingly adopt on-chain trading mechanisms, Solana showcases a shift in how assets are traded, challenging conventional exchanges like Binance and other major players. The dynamic nature of cryptocurrency trading trends is evident, with Solana’s market influence rising sharply since 2022. This evolving framework emphasizes the prominence of direct transactions on blockchain networks, redefining the future of trading in the digital asset realm.

Solana’s On-Chain Trading Volume Breaks Records in 2025

In a remarkable turn of events, December 2025 saw Solana’s on-chain trading volume soar to an astonishing $1.6 trillion. This figure positions Solana as a dominant player in the cryptocurrency market, outpacing all major centralized exchanges except for Binance. The rapid growth of Solana’s trading activity emphasizes a broader trend where cryptocurrency traders are increasingly opting for on-chain platforms over traditional centralized exchanges. This shift not only highlights consumer preferences for decentralization but also underscores the efficiency and flexibility that on-chain trading offers.

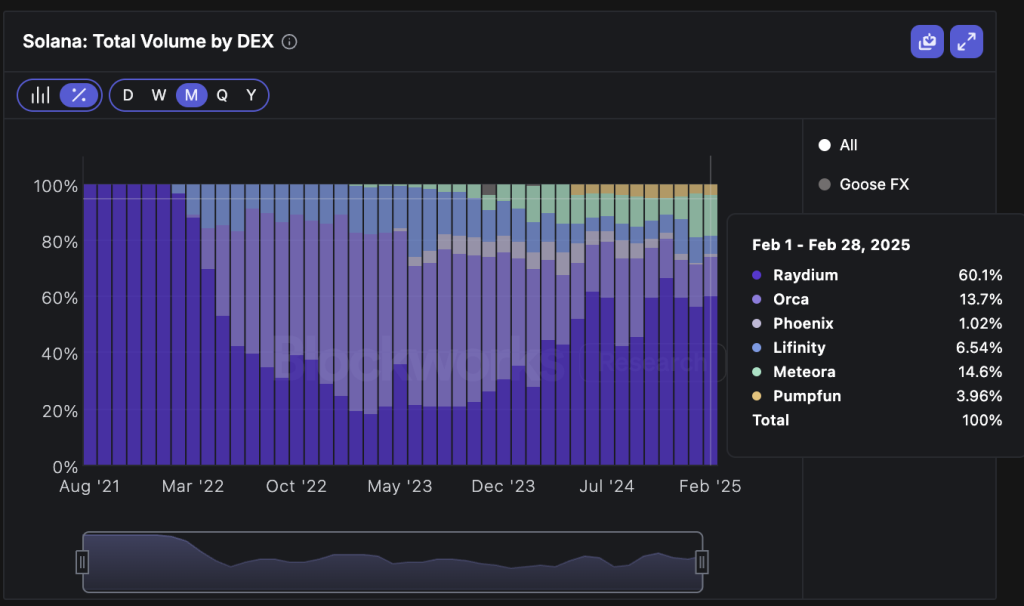

The data released by JupiterExchange further illustrates the phenomenal rise of Solana’s trading volume, which expanded from a mere 1% of the total trading activity in 2022 to an impressive 12% by December 2025. This growth reflects a significant change in trading behaviors, where users are gravitating toward on-chain solutions due to their transparency and security benefits. As the market evolves, it’s clear that Solana is strategically positioned to capitalize on this shift, making it a focal point in discussions concerning the future of cryptocurrency trading.

Shifts in Cryptocurrency Trading Trends: Solana vs. Centralized Exchanges

The cryptocurrency landscape is undergoing profound changes as traders begin to favor decentralized platforms. Centralized exchanges like Binance, once the dominant players in market share, are experiencing a decline—evident in their drop from an 80% market share in 2022 to just 55% in 2025. As traders recognize the risks associated with centralized platforms, such as lack of transparency and higher fees, there is a clear transition toward more robust on-chain trading options provided by networks like Solana.

This shift indicates a growing confidence in decentralized finance (DeFi) solutions, where users can engage in trading with minimal intermediaries. Solana, thanks to its technological advantages, capitalizes on this trend, allowing for rapid and efficient transactions that appeal to a new generation of traders. With its expanding market share in on-chain trading, Solana is redefining the standards of cryptocurrency trading, providing a vivid example of how user preferences can reshape the market narrative.

The Decline of Binance and the Rise of Solana

Binance has long been viewed as the king of cryptocurrency exchanges, but its market dominance is being challenged as platforms like Solana rise to prominence. The data reporting a dramatic drop in Binance’s market share from 80% to 55% underscores the changing dynamics in the cryptocurrency ecosystem. Traders are increasingly seeking alternatives that offer not only lower fees but also enhanced security and transparency, qualities that Solana’s on-chain trading solutions provide.

As traders flock to Solana, it’s evident that the market is embracing a new era where decentralization plays a critical role in the appeal of crypto platforms. The influx of users into Solana has bolstered its on-chain trading volume significantly, surpassing not just Binance but also other centralized exchanges like Bybit and Coinbase. This shift highlights the potential for decentralized systems to disrupt established norms in the cryptocurrency sector, paving the way for innovative approaches to trading.

Understanding On-Chain Trading and Its Benefits

On-chain trading refers to transactions carried out directly on a blockchain, offering a number of advantages over traditional centralized exchanges. One of the primary benefits is the high degree of transparency, as all trades are visible on the blockchain, allowing users to independently verify transactions. This transparency is crucial for building trust within the community, especially in an environment where scams and hacks have previously undermined user confidence in centralized platforms.

Moreover, on-chain trading typically involves lower fees compared to centralized exchanges, as it reduces the need for intermediaries to facilitate trades. This can significantly enhance profitability for traders, making platforms like Solana increasingly attractive in today’s market. With its streamlined and cost-effective trading solutions, Solana has become a go-to destination for investors looking to maximize returns in the rapidly evolving cryptocurrency landscape.

The Future of Cryptocurrency Trading: What Lies Ahead?

As Solana continues to expand its on-chain trading capabilities, the future of cryptocurrency trading looks promising. The growth in Solana’s trading volume, which reached $1.6 trillion, signals a shift toward decentralized trading models that prioritize user autonomy. With increasing awareness of the disadvantages of centralized exchanges, traders are likely to continue exploring on-chain solutions that provide the necessary tools for safe and efficient trading.

Looking ahead, the landscape may evolve with further innovations in blockchain technology, which could address existing challenges and enhance the functionality of on-chain trading platforms. As more traders recognize the benefits of engaging with platforms such as Solana, we might witness a broader market transformation that favors decentralized finance, reshaping the way individuals approach cryptocurrency transactions.

The Role of JupiterExchange in Tracking Solana’s Growth

JupiterExchange has been instrumental in providing crucial data regarding Solana’s on-chain trading volume. Their analysis reveals how Solana’s market presence has expanded dramatically in recent years, from a 1% share of total trading volume to an impressive 12% in 2025. Such data not only highlights Solana’s growth trajectory but also serves as a benchmark for traders looking to assess potential opportunities within the market.

By tracking various metrics related to trading volume and market share, JupiterExchange effectively underscores the shifting patterns of interest within the cryptocurrency ecosystem. This information enables traders and analysts to make informed decisions based on comprehensive market insights, thereby fostering an environment where data-driven investing flourishes. The continued analysis from platforms like JupiterExchange will be vital as Solana’s position in the market continues to evolve.

Identifying Key Trends in Cryptocurrency Trading

Identifying key trends in cryptocurrency trading is pivotal for investors seeking to navigate the volatile market landscape. As Solana’s on-chain trading volume spikes, it illustrates a significant trend toward decentralized trading solutions that enhance user trust and reduce transactional costs. Observing these patterns allows traders to adapt to shifting dynamics and capitalize on emerging opportunities that deviate from traditional centralized exchanges.

Moreover, current trends indicate that as decentralized platforms gain traction, the demand for centralized exchanges will likely diminish. Investors looking to stay ahead of the curve must be attuned to these developments and understand the implications they may have on their trading strategies. By leveraging insights gained from observing trends within Solana’s growing on-chain trading framework, traders can make more strategic decisions aligned with the future of the cryptocurrency market.

Strategies for Maximizing Gains in the On-Chain Market

Maximizing gains in the on-chain market requires a well-crafted strategy tailored to the unique characteristics of decentralized trading platforms like Solana. One important approach is to stay informed about market trends and the evolving trading environment. Understanding how Solana’s trading volume evolves and how it compares to other exchanges can provide valuable insights for discerning potential entry points or optimal times to execute trades.

Additionally, utilizing data from analytics platforms can significantly enhance trading strategies. Platforms like JupiterExchange can help traders identify volume spikes and market sentiment shifts, allowing them to make informed decisions quickly. Embracing a strategic framework that incorporates timely data analysis and trend observation is essential for traders looking to thrive in the increasingly competitive on-chain trading landscape.

The Impact of Regulatory Changes on On-Chain Trading

Regulatory changes can significantly impact on-chain trading practices, especially as decentralized platforms like Solana gain popularity. As governments and regulatory bodies work to establish clearer guidelines for cryptocurrency trading, market participants must remain aware of these developments. Regulations can shape how on-chain trading operates, influencing everything from the types of assets traded to compliance requirements that platforms must adhere to.

Understanding the regulatory landscape is crucial for traders engaged in on-chain transactions. As new laws come into effect, they may alter the trading environment in ways that directly affect profitability and accessibility. Keeping abreast of these changes allows traders to adjust their strategies to mitigate potential risks associated with regulatory shifts, ensuring they remain competitive and compliant in their trading activities.

Frequently Asked Questions

What is Solana’s on-chain trading volume as of 2025?

As of 2025, Solana’s on-chain trading volume reached an impressive $1.6 trillion, making it the second largest trading platform after Binance.

How does Solana’s trading volume compare to centralized exchanges?

In 2025, Solana’s on-chain trading volume surpassed that of all centralized exchanges except Binance, indicating a significant shift in cryptocurrency trading trends.

What percentage of total trading volume does Solana account for?

Solana’s on-chain trading volume increased its share from 1% in 2022 to 12% of the total trading volume by 2025.

Which exchanges did Solana surpass in trading volume?

Solana’s total trading volume officially exceeded that of prominent exchanges such as Bybit, Coinbase Global, and Bitget in 2025.

What are the implications of Solana’s rising trading volume?

The rise in Solana’s on-chain trading volume highlights a broader trend where cryptocurrency activities are increasingly moving from centralized exchanges to on-chain platforms.

How has Binance’s market share changed in relation to Solana’s trading volume?

Since 2022, Binance’s market share has decreased from 80% to 55%, while Solana’s on-chain trading volume has significantly increased.

What role does on-chain trading play in the cryptocurrency market?

On-chain trading is becoming pivotal in the cryptocurrency market, as seen with Solana’s growth, allowing for greater transparency and decentralization compared to centralized exchanges.

What influences Solana’s on-chain trading volume growth?

Factors influencing Solana’s on-chain trading volume growth include increased user adoption, scalability of the Solana blockchain, and a shift in preference towards decentralized trading solutions.

How does Solana’s performance signal changes in cryptocurrency trading trends?

Solana’s substantial on-chain trading volume signals a significant transition away from centralized platforms, showcasing the increasing acceptance of decentralized trading environments in the cryptocurrency space.

What does Solana’s trading volume indicate about future cryptocurrency trends?

The significant growth in Solana’s trading volume suggests that the future of cryptocurrency trading may lean more towards on-chain solutions, emphasizing decentralization and reduced reliance on centralized exchanges.

| Key Point | Details |

|---|---|

| Solana’s Trading Volume in 2025 | Officially reached $1.6 trillion, surpassing all centralized exchanges except Binance. |

| Growth in On-Chain Trading Volume | Solana’s share of on-chain trading volume grew from 1% in 2022 to 12% in 2025. |

| Competitor Analysis | Surpassed trading volumes of Bybit, Coinbase Global, and Bitget. |

| Binance’s Market Share Decline | Binance’s market share decreased from 80% to 55% between 2022 and 2025. |

| Shift in Cryptocurrency Activities | Cryptocurrency activities are increasingly moving on-chain. |

Summary

Solana on-chain trading volume officially reached $1.6 trillion in 2025, demonstrating significant growth in the cryptocurrency market. This remarkable achievement has positioned Solana as a leading player, overtaking major exchanges such as Bybit, Coinbase Global, and Bitget. Additionally, the data indicates an impressive increase in its market share from 1% to 12% since 2022, signifying a rapid shift of trading activities from centralized platforms to on-chain solutions. As Binance sees a decline in its market dominance, it is clear that Solana’s on-chain trading volume is influencing the overall landscape of cryptocurrency trading.