SOL Value Declines as Major Investors Liquidate Futures Holdings

In a recent turn of events that has sent shockwaves through the cryptocurrency market, SOL, the native token of the Solana blockchain, has experienced a notable dip in its value. This downturn is attributed to significant futures holdings liquidations by major investors. Here’s a closer look at the factors contributing to the declining SOL prices and the potential implications for investors and the blockchain industry.

Origins and Overview of Solana

Solana is renowned for its high throughput capabilities, boasting one of the fastest transaction speeds in the blockchain sphere. It has emerged as an attractive platform for decentralized applications (dApps) and has often been touted as one of the most formidable competitors to Ethereum due to its lower costs and higher scalability.

Catalysts of the Current Price Dip

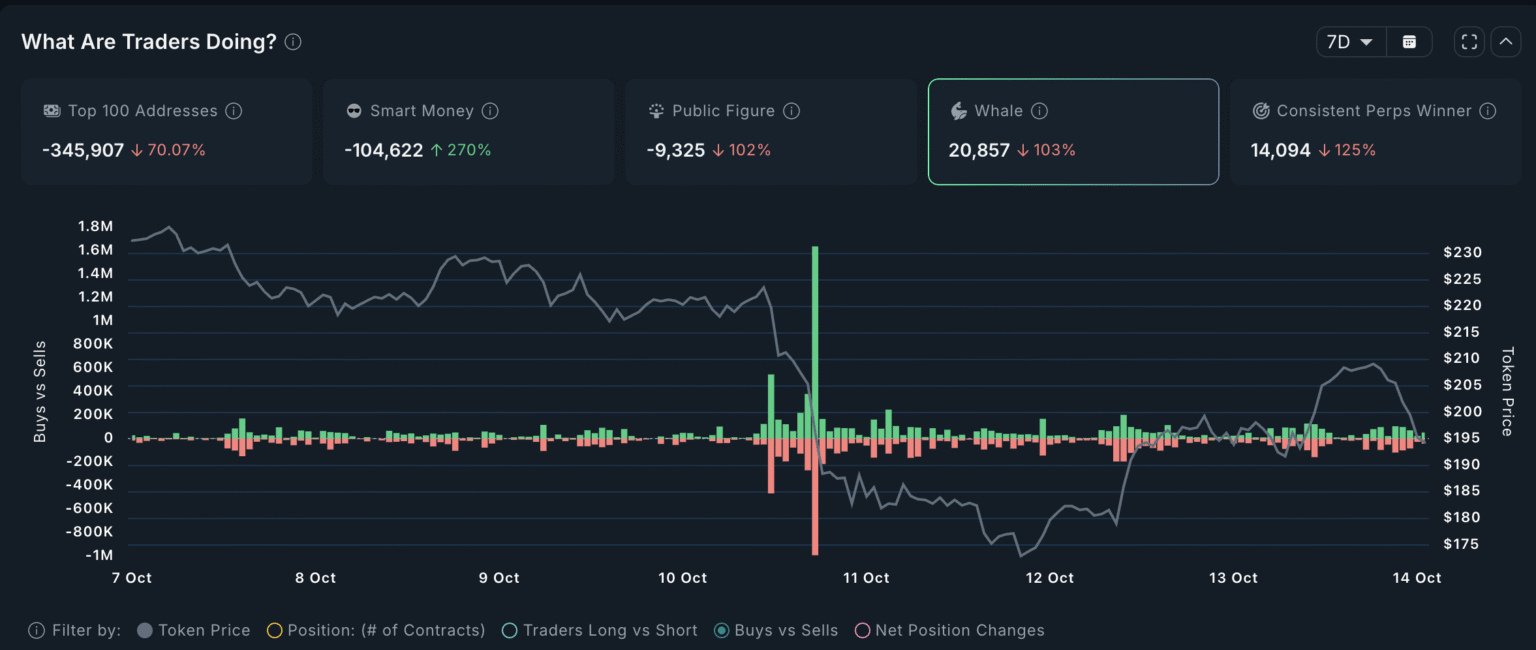

The recent downturn in SOL value is largely pinned down to the actions of several large-scale investors who have decided to liquidate their positions in SOL futures. Futures are financial contracts obligating the buyer to purchase an asset or the seller to sell an asset at a predetermined future date and price. The liquidation of such holdings often results in immediate and conspicuous consequences on the market, especially for assets with somewhat volatile prices such as SOL.

Insights from Market Analysts

Market analysts suggest that the sudden liquidation by these key players could be a result of multiple factors. Critical among them is the growing concern over potential regulatory crackdowns on cryptocurrencies, contributing to nervous market sentiments. Investors, particularly those exposed to high levels of risk, are opting to liquidate futures contracts to mitigate potential losses perceived on the horizon.

Adding to the ecosystem’s troubles, technical challenges and network outages in the past months have also marred Solana’s reliability and performance claims, thereby shaking investor confidence in the asset’s long-term viability.

Ripple Effects on the Market

This mass liquidation has not only impacted SOL’s price but has also had a broader effect on the cryptocurrency market. It leads to increased market volatility and can trigger subsequent selloffs as investors react to price movements and adjust their portfolios accordingly.

The decline also poses challenges for projects and dApps built on the Solana platform. Funding and operational scalability might become constrained, especially for those projects heavily reliant on the market valuation of SOL.

Looking Ahead

While the current situation might seem dire, it’s important to consider the wider context of cryptocurrency investment and innovation. Market corrections, while challenging, are not uncommon and can lead to important moments of recalibration and renewal.

For Solana, its capacity to address these immediate technical and market challenges will be critical in maintaining investor trust and demonstrating its claimed technological supremacy over other blockchains. Furthermore, this incident underscores the importance for investors to maintain a diversified and strategically balanced portfolio to mitigate risks associated with the volatility of cryptocurrency markets.

Finally, as the cryptocurrency landscape continues to evolve under increasing scrutiny from regulators and market watchers alike, the resilience and adaptability demonstrated by platforms like Solana will likely shape their paths forward in this complex and rapidly changing domain.

In conclusion, while the liquidation of SOL futures points toward a turbulent period for Solana, it also opens up dialogues about the future of decentralized finance and blockchain technology’s role in shaping modern finance. How Solana navigates this crisis could very well set critical precedents for similar technologies down the line.