The recent surge in SOL price marks a significant milestone, as it has surpassed the 130 USDT threshold, currently sitting at 130.05 USDT with a 24-hour increase of 1.78%. This notable upward trend has injected optimism into the cryptocurrency market, sparking interest among investors and analysts alike. As we explore SOL market analysis and assess SOL trends, it’s clear that the dynamics influencing this price rise are critical to understanding its potential trajectory. This cryptocurrency update highlights not only the current surge but also sets the stage for discussions surrounding future projections, including SOL price January 2026. With the SOL USDT rise capturing attention, many are eager to find out what this means for their investments in the Solana ecosystem.

The recent uptick in the valuation of Solana’s cryptocurrency, referred to by its symbol SOL, has garnered significant attention among market watchers. As SOL trades above 130 USDT, analysts are diving deep into the implications of this bullish movement. Observing the recent trends and price fluctuations, it’s essential to conduct a thorough market analysis to gauge the factors driving this increase. Investors are particularly interested in whether this momentum will hold, especially as discussions around future valuations intensify. With an eye on the upcoming months, especially January 2026, the ongoing developments in the Solana market are crucial for anyone engaged in cryptocurrency trading.

| Key Point | Details |

|---|---|

| Current SOL Price | 130.05 USDT |

| 24-Hour Change | +1.78% |

| Date Reported | 2026-01-23 17:30 |

| Source | Odaily Planet Daily / OKX |

Summary

The SOL price has recently surpassed 130 USDT, currently standing at 130.05 USDT with a 24-hour increase of 1.78%. This positive growth reflects increasing interest in SOL, and traders should keep an eye on any further fluctuations in this cryptocurrency’s value.

Understanding Current SOL Trends

As of January 2026, SOL has displayed an impressive resilience in the cryptocurrency market, breaking past the 130 USDT mark. This movement reflects a notable increase of 1.78% within a 24-hour period, showcasing the volatile yet potentially lucrative nature of blockchain assets. Current trends suggest a growing interest in SOL, supported by broader market dynamics and investor sentiment that are leaning towards optimism.

The recent market analysis indicates that SOL is gaining traction, especially in the context of the ongoing transformations within the crypto space. Investors and analysts alike are now keenly observing SOL trends, as the token seems poised to capitalize on the shifting tides of the cryptocurrency ecosystem. Furthermore, this upswing could be a precursor to larger investment movements as the cryptocurrency community continues to evaluate emerging trends and project advancements.

In-depth SOL Market Analysis

The latest SOL market analysis highlights significant factors influencing its current valuation. With SOL surpassing the 130 USDT mark, a deeper examination of trading patterns and market sentiments reveals a consistent upward trajectory for the token. This has resulted from favorable developments within the ecosystem and increased adoption rates among users, which have contributed to a bullish outlook for SOL.

Furthermore, understanding the constraints in the broader market and their impact on SOL is essential. While the cryptocurrency landscape can often be unpredictable, historical data and recent trends suggest a solid foundation for SOL’s future growth. As traders analyze SOL price movements, they are also considering external influences such as regulatory changes and technological advancements that could further enhance SOL’s standing in the market.

Impact of SOL Price on Cryptocurrency Investments

The SOL price surge above 130 USDT is influential, not just for individual traders but also for the cryptocurrency investment landscape as a whole. When a prominent token like SOL sees an upward movement, it often sets a precedence for other altcoins to follow suit. This correlation demonstrates the interconnectedness of cryptocurrency values, where gains in SOL can lead to increased investor confidence in the market.

Moreover, the SOL USDT rise serves as a focal point for both seasoned investors and newcomers attempting to navigate the evolving landscape of digital assets. As the cryptocurrency market continues to mature, understanding the implications of SOL’s price fluctuations becomes paramount for making informed investment decisions. Analysts suggest that monitoring SOL price in the coming weeks could provide predictive insights into market movements and potential trading opportunities.

Anticipating SOL Price in January 2026

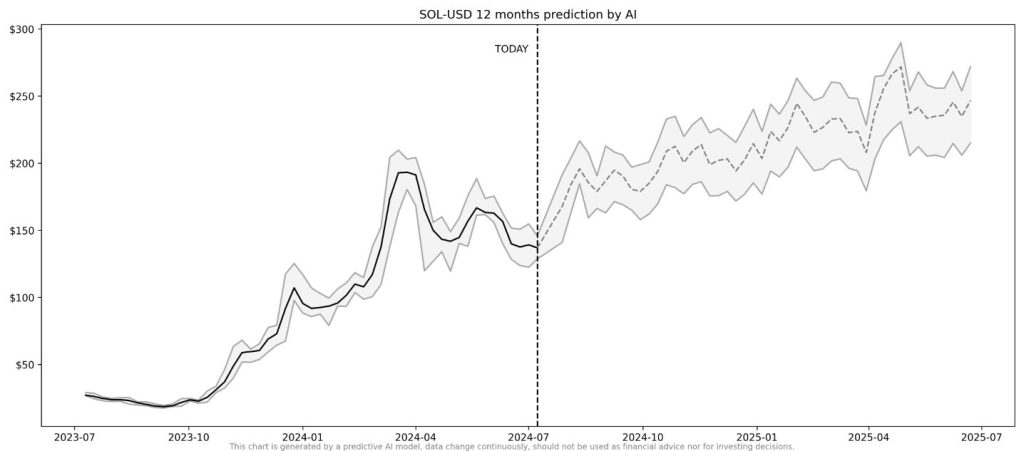

Looking ahead at the SOL price predictions for January 2026, market analysts are painting diverse scenarios based on technical analysis and market trends. Given the recent performance, where SOL managed to breach the 130 USDT threshold, many enthusiasts speculate that this momentum may continue. This speculative analysis is vital for traders aiming to leverage potential profit margins as the market evolves.

Investors are also closely tracking advancements in Solana’s technological infrastructure that might impact SOL price. With a focus on scalability and efficiency, any improvements or partnerships announced could further bolster investor confidence. Thus, understanding what drives SOL price movements in January will be crucial for stakeholders looking to navigate the cryptocurrency landscape successfully.

SOL Cryptocurrency Update: Recent Developments

In the latest SOL cryptocurrency update, the token’s performance is indicative of a larger narrative within the blockchain space. The recent metrics concerning SOL show a surge in trading activity and investor engagement, aligning with increased public interest in decentralized finance (DeFi) applications associated with Solana. This development has provided a conducive environment for the SOL price to hold steady as trading volumes spike.

Additionally, keeping abreast of SOL’s cryptocurrency updates allows investors to make timely decisions. The rise in market discussion on platforms like social media and crypto forums reflects a growing community around SOL, which can significantly affect its trading dynamics. As updates continue to roll in, traders are encouraged to analyze these changes closely to remain competitive.

Future SOL Trends to Watch

As we progress through January 2026, it is vital for crypto enthusiasts to keep an eye on future SOL trends that may emerge. The token’s recent performance above 130 USDT sets a dynamic stage for potential future movements, suggesting that traders should remain vigilant. Trends in trading volume, price volatility surrounding SOL, and broader market influences will play critical roles in shaping expectations.

Understanding future SOL trends also involves analyzing external factors that could affect prices, such as government regulations and investor sentiment in macroeconomic contexts. By observing these elements, traders can develop sound strategies that may maximize their investment potential in the ever-evolving landscape of cryptocurrencies.

Evaluating SOL USDT Performance

Evaluating the SOL USDT performance offers insights into trading effectiveness and market positioning. As SOL surpasses the 130 USDT mark, the dynamics between SOL and USDT have become increasingly pertinent for traders. The fluctuation in SOL’s liquidity against USDT not only illustrates its market strength but also highlights the trading patterns that may emerge as market conditions evolve.

Traders and analysts need to closely monitor the performance metrics of SOL in relation to USDT to identify potential buy or sell signals. The correlation between the two allows for better forecasting of SOL price movements, offering valuable tools for informed trading decisions. As the cryptocurrency market matures, such evaluations will remain critical for active participants.

Analyzing SOL in the Broader Crypto Marketplace

Analyzing SOL in the broader crypto marketplace brings understanding to its unique position among other cryptocurrencies. With its recent breakthrough of the 130 USDT resistance level, SOL is carving its niche as one of the leading tokens in the space. Market analysts frequently draw comparisons with other altcoins to gauge SOL’s performance and market health indicators.

Additionally, as SOL continues to gain recognition, investors are finding value in comparing its growth patterns against bellwethers like Bitcoin and Ethereum. This comparative analysis allows for a more nuanced perspective on SOL’s market dynamics, potentially illuminating future price trajectories that could benefit strategic investors. Keeping abreast of how SOL interacts with the greater crypto ecosystem will be vital as trends continue to unfold.

Key Insights for Investing in SOL

Investing in SOL requires understanding key insights that could determine future success. The recent performance indicates a bullish trend that many beginners and seasoned investors may seek to capitalize on. Awareness of market sentiment and trading behaviors surrounding SOL is crucial in crafting an effective investment strategy.

Moreover, potential investors should also pay attention to broader macroeconomic factors and their impact on SOL pricing. Researching past performance alongside current trends—such as SOL’s breakthrough above 130 USDT—will equip investors with the necessary knowledge to navigate the cryptocurrency landscape confidently. In this context, establishing a balanced portfolio with insight into SOL could lead to enhanced investment outcomes.

Frequently Asked Questions

What is the SOL price forecast for January 2026?

The SOL price forecast for January 2026 suggests a target that could exceed the current levels, as recent trends indicate an upward trajectory. Analysts suggest monitoring the SOL market analysis for insights into potential price movements.

How has the SOL price changed recently?

Recently, the SOL price has shown positive momentum, breaking through 130 USDT with a 24-hour increase of 1.78%. This upward trend may indicate stronger market confidence in SOL’s future.

What influences SOL price trends?

SOL price trends are influenced by various factors such as market demand, overall cryptocurrency updates, and investor sentiment. Keeping up with SOL market analysis can provide insights into these driving forces.

Is the recent rise in SOL USDT significant?

Yes, the recent rise of SOL to 130.05 USDT is significant as it marks a notable increase of 1.78% over the past 24 hours, indicating potential bullish trends in the market.

Where can I find updates on the SOL price?

For the latest updates on SOL price, you can check cryptocurrency news platforms and market analysis websites that provide real-time data and insights regarding SOL and other cryptocurrencies.