The SOL price fluctuation is a critical factor in the dynamics of the cryptocurrency market, particularly impacting the liquidation of leveraged positions. As the price of SOL sees its ups and downs, it influences approximately $400 million in open trades across the market. Recent analysis reveals that a mere 10% change in SOL’s price can trigger significant liquidation events, making traders acutely aware of the risks involved. For instance, a 10% increase could lead to the forced liquidation of short positions valued at about $217 million, while a decline could threaten long positions worth $183 million. Understanding these price movements, alongside SOL market trends, is essential for anyone involved in crypto price analysis to effectively navigate liquidation risks and optimize their trading strategies.

When discussing the volatility of SOL, it is crucial to explore the variability in its market pricing and how it affects trading positions. Referred to as SOL price movement, such fluctuations can significantly impact various trading strategies, particularly those involving leveraged positions. Traders must remain vigilant, especially when considering the potential liquidation of high-stakes positions during rapid price changes. This delicate balance is further complicated by overarching market trends and investor sentiment within the cryptocurrency space. Ultimately, keeping a close watch on SOL pricing and leveraging insights from thorough financial analysis can help mitigate risks amid fluctuating market conditions.

Understanding SOL Price Fluctuation and Its Impact on Liquidation

The recent fluctuations in the price of SOL, particularly the reported 10% volatility, have significant implications for the liquidation of leveraged positions in the crypto market. As highlighted in recent analyses, a rise of 10% could trigger liquidations of short positions amounting to $217 million, while a corresponding drop could place long positions worth $183 million at risk. This showcases the high stakes involved in leveraged trading, where even minor price movements can lead to massive repercussions for traders.

In a market characterized by such price volatility, traders need to remain vigilant and proactive. With SOL trading around the $132 mark, many market participants must carefully evaluate their positions, especially given the densely packed long and short leveraged positions. Understanding the triggers for SOL price fluctuations is essential, as it not only affects individual traders but also shapes the broader landscape of crypto market trends.

Frequently Asked Questions

What are the implications of SOL price fluctuation on leveraged positions?

SOL price fluctuation can significantly affect leveraged positions due to liquidation risks. A 10% price change in SOL, currently around $132, could lead to the liquidation of $217 million in short positions if the price rises and $183 million in long positions if the price drops.

How does SOL liquidation impact market trends?

SOL liquidation events can drive market trends since large liquidation amounts, such as those from leveraged positions worth $400 million, can exacerbate price volatility. Observing SOL price fluctuations can help traders anticipate these potential market impacts.

What should traders consider regarding SOL price fluctuation and liquidation risks?

Traders should closely monitor SOL price fluctuations, especially when using leveraged positions. With significant liquidation risks linked to price movements, understanding SOL price dynamics is crucial to managing potential losses effectively.

Can crypto price analysis predict SOL liquidation events?

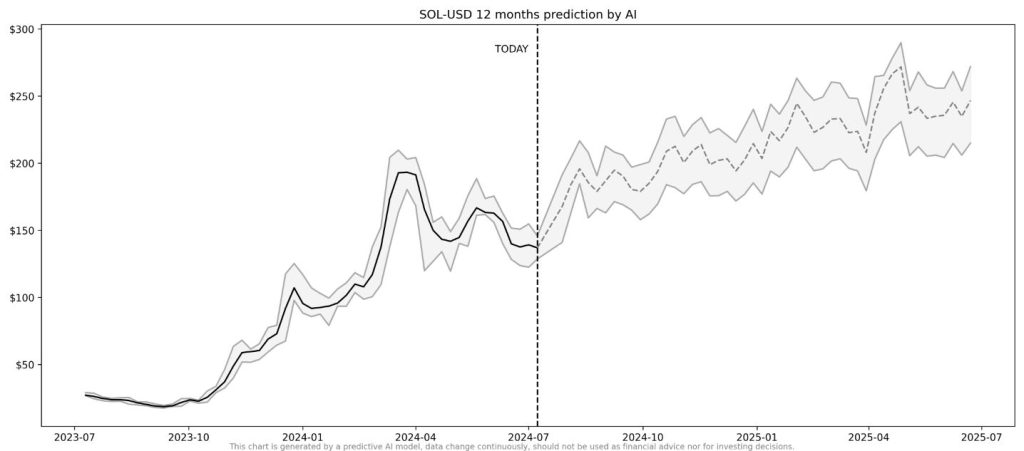

Yes, thorough crypto price analysis can help predict potential SOL liquidation events. By analyzing current trends and historical data, traders can identify patterns and assess risks associated with SOL price fluctuations.

Why are SOL market trends important for investors?

SOL market trends are essential for investors as they reveal potential price movements influenced by liquidation risks. Knowing how SOL price fluctuations can affect leveraged positions helps investors make informed decisions and strategize accordingly.

| Price Movement | Impact on Liquidation | Position Type | Value ($ million) |

|---|---|---|---|

| Increase +10% | Liquidation Risk | Short Positions | 217 million $ (liquidated) |

| Decrease -10% | Liquidation Risk | Long Positions | 183 million $ (liquidated) |

Summary

SOL price fluctuation is critical for investors as it directly affects the potential liquidation of leveraged positions. A 10% change in the price of SOL can lead to significant risks, with up to $217 million at stake in short positions if prices rise and $183 million in long positions if prices drop. Understanding these dynamics is essential for anyone engaging with SOL.