The recent SOL price drop has sent shockwaves through the cryptocurrency market as the popular SOL cryptocurrency plummeted below 70 USDT. Currently trading at 69.93 USDT, this marked a significant 24H decline of 24.03%, reflecting the volatile nature of the crypto environment. Analysts are closely monitoring this rapid change, providing in-depth SOL market analysis to understand the factors driving this downturn. As traders adjust their strategies in response to the drop, concerns over broader crypto price decline trends continue to rise. For the latest insights, our SOL news update will keep you informed on the evolving situation and USDT trading activities.

In the realm of digital currencies, the recent downturn in SOL values has garnered considerable attention, particularly due to its abrupt descent below the 70 USDT threshold. This significant decrease, quantified at 24.03% over a 24-hour window, serves as a stark reminder of the inherent volatility associated with cryptocurrencies. Market participants are dissecting the implications of this event in their trading decisions, reflecting the ongoing SOL price fluctuations that affect investor sentiment. As discussions around fluctuating token values intensify, critical analyses of SOL market behaviors and pricing dynamics will become increasingly relevant. This provides a vital backdrop for understanding the evolving landscape of cryptocurrency investments.

| Date | Current Price (USDT) | 24H Decline (%) | Source |

|---|---|---|---|

| 2026-02-06 | 69.93 | 24.03% | Odaily Planet Daily |

Summary

The recent SOL price drop below 70 USDT highlights a significant decline in the cryptocurrency’s value, marked by a notable 24.03% drop over the last 24 hours. As investors react to market fluctuations and economic conditions, this price movement may prompt further analysis of SOL’s performance and potential recovery strategies.

Understanding the Recent SOL Price Drop

Recently, the SOL cryptocurrency has faced a significant price drop, falling below the 70 USDT mark. This decline was recorded at 24.03%, raising concerns among investors and traders in the crypto market. With SOL currently trading at approximately 69.93 USDT, market analysts are scrambling to determine the root causes behind this steep decline. Understanding the factors influencing SOL’s price can provide insights for prospective investors looking for entry points or for those already invested who are concerned about market volatility.

Several elements could potentially explain this drop in the SOL market. External factors such as global economic trends, regulatory news, and competition from other cryptocurrencies might have contributed to this recent downturn. Additionally, market sentiment and investor reaction can often lead to fluctuations in price, as observed in this stark drop. Monitoring SOL news updates and broader market analysis can help investors anticipate future movements and make informed trading decisions.

Analyzing SOL Market Conditions

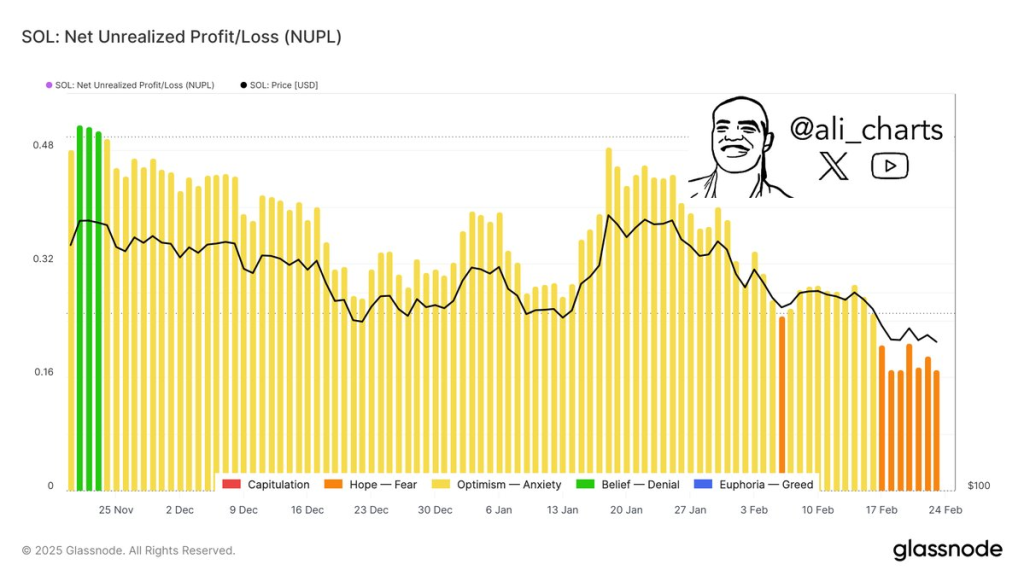

In light of the recent SOL price drop, it’s essential to conduct a thorough market analysis to understand the current trading conditions. The overall cryptocurrency market experiences fluctuations due to various influences including technological developments, market hype, and significant trades with USDT. As SOL’s market performance fluctuates, investors must analyze trends and utilize statistical tools to make educated predictions about the cryptocurrency’s future trajectory.

Market analysts suggest that ongoing reviews of SOL trading behaviors in relation to USDT, along with other cryptocurrencies, can reveal potential recovery signs or further decline. Understanding these market dynamics not only aids in establishing a robust trading strategy but ensures that investors remain well-informed, especially in light of the current price volatility. Keeping up with SOL news updates will help traders react promptly to market shifts.

Impact of SOL’s Decline on Cryptocurrency Investment Strategies

The recent drop in SOL prices has significant implications for cryptocurrency investment strategies. Investors who hold SOL may need to reconsider their positions and decide whether to hold, sell, or buy additional assets during this period of uncertainty. A price decline like this can evoke emotional responses that might lead to hasty decision-making, so it is crucial for investors to base their actions on solid market analysis and not merely on current sentiments.

Moreover, the drop in SOL’s price also prompts potential new investors to reevaluate entry points. With SOL now below 70 USDT, opportunities arise for those considering investing in cryptocurrencies. However, they need to be mindful of the risks associated with price volatility and market instability, which can be exacerbated by trends like the SOL price drop. Ultimately, a strategic approach grounded in thorough market research and diligent monitoring of SOL and other market signals is essential.

Investigating the Causes Behind the Crypto Price Decline

Understanding the wider implications of the crypto price decline, particularly with regard to SOL, requires a careful assessment of the elements at play in the cryptocurrency space. Factors such as market overcorrection, changes in investor appetite, or negative news can severely impact prices. Notably, SOL’s substantial fall to below 70 USDT is a symptom of broader market dynamics and investor confidence levels.

To gain a comprehensive understanding, one must analyze historical price behavior and its correlation with significant market news. This type of analysis can unveil patterns that might predict future price behavior. Engaging in discussions about SOL with fellow crypto enthusiasts can yield valuable insights and unique perspectives which may aid in navigating the complexities of the current market landscape.

The Role of Technical Analysis in Trading SOL

Technical analysis plays a crucial role in navigating the crypto markets, especially in light of recent fluctuations in the SOL price. By studying price actions and chart patterns, traders can develop strategies to maximize profit while minimizing risk. Tools such as moving averages, trend analysis, and trading volume comparisons are essential for traders looking to understand the mechanics of SOL’s current position in the market.

As SOL continues to experience instability, traders who rely on technical indicators can make informed predictions regarding future movements. This expert analysis helps in determining optimal entry and exit points in the market, especially in volatile conditions. Thus, staying abreast of SOL news updates and utilizing these technical tools can empower traders to optimize their trading strategies effectively.

Future Predictions for SOL After the Price Dip

The recent drop in SOL’s price raises questions about its future potential in the cryptocurrency market. Analysts often use historical data and market sentiment to forecast price recoveries and further declines. Understanding where SOL might head following this downturn is crucial for anyone involved in the crypto space. Investors are keenly observing market trends, and predicting the future of SOL requires a careful synthesis of technical data and market news.

Optimistic predictions may stem from potential recovery phases or new developments within the SOL ecosystem that could boost investor confidence. Conversely, market pessimism and potential continued declines might lead to cautious strategies among investors. Regular updates and analyses focused on SOL and the surrounding market environment can provide necessary insights to navigate the ambiguous conditions following such a significant price drop.

Keeping Up with SOL News Updates

For investors and traders in SOL cryptocurrency, staying updated with the latest news is paramount. Market movements are often influenced by announcements, technological advancements, and regulatory changes that can occur rapidly. By consistently tracking news updates related to SOL, investors can react promptly to events that might affect prices, thus minimizing losses or capitalizing on gains.

Additionally, news updates often provide a narrative that shapes market sentiment. Investors who grasp these narratives can better understand the reasons behind SOL’s price movements. In a volatile market, insights from news updates regarding SOL developments can significantly enhance trading strategies, enabling traders to make informed decisions.

The Importance of Market Sentiment in Crypto Trading

Market sentiment plays a vital role in the fluctuating prices of cryptocurrencies, including SOL. A sharp price drop often reflects a broader emotional reaction from investors, influenced by news events, social media discussions, and market rumors. Understanding the sentiment surrounding SOL can help traders gauge potential price movements and adopt appropriate strategies in light of the prevailing atmosphere.

Moreover, recognizing shifts in sentiment can be an early warning sign for market traders. By monitoring changes in public perception and investor confidence regarding SOL, traders can better position themselves in the market. As sentiment can turn quickly, remaining adaptable and continuously assessing emotional triggers in the market can assist in capitalizing on both bullish and bearish trends.

Evaluating SOL’s Position in the Competitive Cryptocurrency Market

With SOL dropping significantly within a short span, it is essential to evaluate its standing in comparison with other cryptocurrencies. The competitive landscape of digital assets is dynamic, and SOL’s recent price drop might influence how it is perceived against rival tokens. Monitoring competitor developments and news updates will help contextualize SOL’s performance in terms of market share and technological relevance.

Additionally, assessing SOL’s adoption within various sectors and its usability as a form of payment or development platform can provide insights into its long-term sustainability. As traders analyze SOL’s ecosystem amid recent price actions, understanding its competitive edge or limitations will become increasingly critical in strategizing approaches towards investment or trading.

Frequently Asked Questions

What caused the recent SOL price drop below 70 USDT?

The recent SOL cryptocurrency price drop below 70 USDT has been attributed to market fluctuations and increased selling pressure. A decline of 24.03% in the last 24 hours indicates a significant bearish sentiment in the SOL market.

How does the SOL price drop impact USDT trading?

The SOL price drop can influence USDT trading as traders seek to reposition their portfolios. With SOL currently under 70 USDT, many may be looking to trade SOL against USDT to capitalize on price volatility.

What is the current trend in SOL market analysis following the price drop?

Current SOL market analysis suggests a downturn, as reflected by the recent drop of 24.03%. Analysts are closely monitoring potential support levels and the overall trend to understand if this decline might be temporary or indicative of a larger market trend.

Where can I find the latest SOL news updates regarding the price drop?

To stay updated on SOL news, including the recent price drop below 70 USDT, you can follow cryptocurrency news platforms, market analysis websites, and official SOL social media channels for real-time information.

What are the potential recovery strategies for SOL after this price decline?

Following the SOL price drop, potential recovery strategies may include increasing investor confidence through positive news updates, enhancing market engagement, and ensuring strong community support for SOL development.