In recent SOL trading news, the SOL price drop has captured the attention of cryptocurrency enthusiasts and investors alike. As reported by OKX market data, the Solana token has fallen below 130 USDT, currently standing at 129.98 USDT, marking a 24-hour drop of 1.78%. This decline has led many to reconsider their Solana price forecast and assess the potential impact on the broader market. With the fluctuating dynamics of the Solana market update, traders are keen to analyze the underlying reasons for this downturn. For those closely following the cryptocurrency news, understanding these shifts is crucial to making informed trading decisions.

The recent dip in the value of SOL has raised eyebrows among crypto investors, as the Solana blockchain continues to navigate challenging market conditions. This decrease, indicating a broader trend, is essential for anyone keeping tabs on the Solana ecosystem and its performance in the digital asset landscape. With the SOL USDT price fluctuating, many are analyzing current market trends to anticipate future movements. Insights into this volatility are beneficial not only for seasoned investors but also for newcomers engaged in the rapidly evolving world of cryptocurrencies. Overall, the situation underscores the importance of staying updated with ongoing Solana market dynamics.

Recent SOL Price Drop Below 130 USDT

In a significant market shift, SOL has recently fallen below the crucial threshold of 130 USDT, currently trading at approximately 129.98 USDT. This 24-hour drop of 1.78% reflects the ongoing volatility in the cryptocurrency market. Traders monitoring SOL trading news may be concerned about this decline, especially considering that Solana has been a favorite among investors due to its speed and scalability. Such price movements can trigger increased trading activity, as investors look to take advantage of perceived dips.

The dip below 130 USDT for SOL is not isolated; it corresponds to broader trends seen in the Solana market update. As market conditions fluctuate, various factors could influence SOL’s price trajectory, including investor sentiment, upcoming technology upgrades, and the overall performance of the cryptocurrency market. Those looking to engage in SOL trading should keep an eye on these developments while considering Solana price forecasts for their investment strategies.

Understanding Solana’s Current Market Dynamics

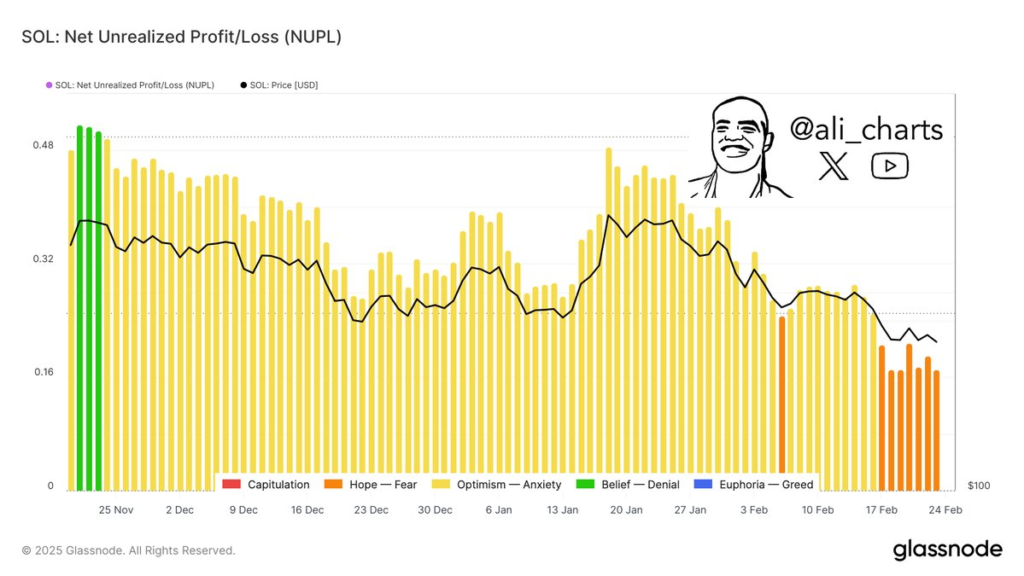

The current dynamics in Solana’s market pose intriguing questions for traders and investors alike. The recent SOL price drop serves as a reminder of the inherent volatility that characterizes cryptocurrencies. While some may view the recent dip in SOL USDT price as a potential buying opportunity, others might adopt a more cautious approach, anticipating further declines. The balance of fear and greed often dictates market fluctuations, emphasizing the need for astute investor analysis.

Moreover, the surrounding cryptocurrency news suggests that factors such as regulatory updates, technological advancements, and macroeconomic shifts play a pivotal role in shaping Solana’s price. Analyzing SOL trading news can provide crucial insights into market sentiment, while following Solana price forecasts can assist traders in making informed decisions. As the market evolves, successful navigation will increasingly depend on understanding these complex interactions.

Impact of Market Factors on SOL Prices

The decline in SOL’s price underscores the substantial impact of market factors on Solana’s cryptocurrency performance. Recent SOL trading news has highlighted not only the price movements but also investor behavior that reacts to potential regulatory changes and competitive pressures within the broader blockchain ecosystem. Daily trading volumes and market sentiment can dramatically shift based on news cycles, making continuous monitoring essential for traders.

As we consider the broader landscape, SOL’s drop below 130 USDT can also be attributed to factors such as market liquidity and trader psychology. An understanding of these elements, compounded by comprehensive market analysis, can provide critical insights into future trends. Those engaged in Solana trading should be prepared to adjust their strategies in response to ongoing fluctuations, leveraging data from Solana market updates to inform their decisions.

Future Prospects for Solana (SOL)

Looking ahead, the future of Solana (SOL) hangs delicately in the balance, particularly following its current price drop. Investors and analysts alike are keenly observing potential drivers that could induce a price recovery, such as technological advancements and partnerships. The Solana ecosystem remains robust, with continuous innovation aimed at enhancing performance and user engagement, which could eventually rebound its price.

Additionally, keeping an eye on Solana price forecasts will be vital as they provide a framework for understanding potential growth trajectories. Positive news on developments or integrations in the Solana network could provide the catalyst needed for a significant price rebound, making it an exciting asset to watch for those engaged in cryptocurrency trading.

Analyzing SOL Trading News for Insights

To effectively navigate the complexities of the cryptocurrency landscape, analyzing SOL trading news is essential. This news often highlights critical market shifts, upcoming launches, or regulatory changes affecting Solana’s price dynamics. Each piece of news can substantially impact trader sentiment and, consequently, price movements. Being well-informed allows traders to anticipate market reactions and position themselves for potential gains.

Recent coverage of SOL’s performance emphasizes the necessity for traders to remain adaptable and informed. The ability to synthesize multiple sources of information, including cryptocurrency news, can provide a more comprehensive understanding of market momentum and investor psychology. This analytical approach is key for those looking to gain an edge in Solana trading.

The Role of Cryptocurrency News in Price Movements

Cryptocurrency news plays a pivotal role in influencing SOL price movements, as seen in the recent drop below 130 USDT. Articles and reports stemming from the broader crypto market can create ripples of reaction across individual assets, particularly those as prominent as Solana. Keeping an ear to the ground can give traders a heads-up about trends and shifts that might not be immediately apparent in price charts.

Moreover, the significance of timely and relevant news cannot be understated. Daily updates surrounding SOL can affect investor sentiment and provoke swift trading responses. Understanding the intersection between news events and market performance is crucial for anyone involved in cryptocurrency trading, particularly for those focused on short-term opportunities.

Market Reactions to SOL Price Forecasts

Market reactions to SOL price forecasts often dictate trading strategies within the community, especially following significant price changes such as the recent drop below 130 USDT. Traders closely monitor expert predictions to gauge potential market directions. Bullish forecasts may lead to increased buying activity, while bearish sentiments could prompt selling.

This cyclical analysis of price forecasts versus actual performance creates a dynamic environment for SOL trading. Traders who can anticipate market mood shifts based on forecasts stand a better chance of capitalizing on volatility, enhancing their overall investment strategy. As the market evolves, staying informed about the latest forecasts and their potential implications becomes integral to successful trading.

Volatility in the Solana Market

The cryptocurrency market is notorious for its volatility, and the recent SOL price drop is a testament to this reality. With SOL trading now below 130 USDT, it’s clear that rapid price fluctuations can be both an opportunity and a risk for traders. Volatility can provide short-term trading opportunities for skilled investors, but it also necessitates a cautiously strategic approach.

Understanding the causes of such volatility—be it market sentiment, technological developments, or regulatory changes—is crucial for anyone involved in trading Solana. The past price trends show that while SOL can experience swift ascents, dips are equally common, and recognizing the cycles of volatility can be key to maintaining profitability.

Preparing for Upcoming Solana Developments

As Solana embarks on new developments, traders must prepare for their potential impact on SOL prices. With initiatives like the upcoming airdrop for the mobile token SKR and ongoing improvements to the Solana network, traders should assess how these developments could influence SOL’s market position. The anticipation and hype surrounding these events often provoke trading surges.

Understanding the timing and expected benefits of new releases can provide traders with a competitive advantage. Engaging with community discussions and staying updated on Solana’s progress will equip traders with the insights necessary to make informed decisions in an ever-changing market landscape.

Frequently Asked Questions

What caused the recent SOL price drop below 130 USDT?

The recent SOL price drop below 130 USDT can be attributed to a combination of broader market trends and specific selling pressures within the Solana ecosystem. As of now, SOL is trading at approximately 129.98 USDT, facing a 24-hour decline of 1.78%. Market sentiments in cryptocurrency news suggest volatility across various altcoins, impacting investor confidence.

How is the current Solana market update affecting SOL prices?

The latest Solana market update reveals a downturn in its price, pushing SOL below 130 USDT. This decline is consistent with recent trading news, where SOL has recorded a 1.78% drop over the last 24 hours. Market analysts suggest keeping an eye on external factors such as regulatory changes and new technological developments that could influence future SOL price forecasts.

What should I know about SOL USDT price trends after the recent drop?

Following the recent drop of SOL falling below 130 USDT, it is crucial to analyze the SOL USDT price trends to understand potential future movements. With a current trading price of 129.98 USDT, market analysts are forecasting that continued monitoring of cryptocurrency news and trading patterns will provide insights into whether this price level can hold or lead to further declines.

Is the SOL price drop a sign of a longer-term downtrend in Solana?

While the recent SOL price drop below 130 USDT, with a 24-hour decrease of 1.78%, may raise concerns about a longer-term downtrend in Solana, analysts urge caution before jumping to conclusions. It’s essential to consider technical indicators, market sentiment, and upcoming events in the cryptocurrency landscape. Keeping up with Solana price forecasts can offer clearer insights into its future trajectory.

What impact will the SOL drop have on future Solana price forecasts?

The impact of the recent SOL drop below 130 USDT on future Solana price forecasts remains uncertain. Market fluctuations often provide volatility, which can present buying opportunities. Observers of cryptocurrency news will be keen to follow upcoming events and technological advancements within the Solana network that may affect SOL’s market position and price recovery.

| Date | SOL Price (USDT) | 24-Hour Price Drop (%) | Source |

|---|---|---|---|

| 2025-12-07 22:07 | 129.98 | 1.78% | OKX Market Data |

Summary

The SOL price drop is a significant market event as it has now fallen below 130 USDT, currently sitting at 129.98 USDT with a decline of 1.78% over the last 24 hours. This drop highlights the volatility present in the cryptocurrency market, and investors should remain vigilant. Understanding the factors influencing these price changes can better prepare traders for future fluctuations.